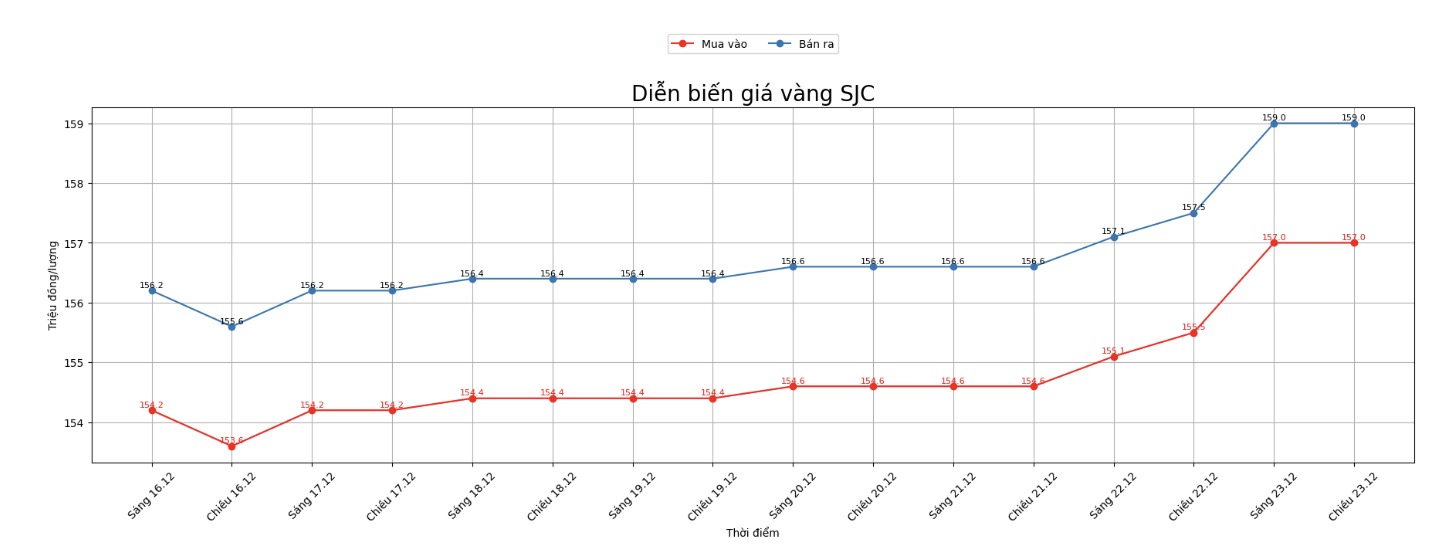

SJC gold bar price

As of 5:50 p.m., DOJI Group listed the price of SJC gold bars at 157-159 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 157-159 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 156-159 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

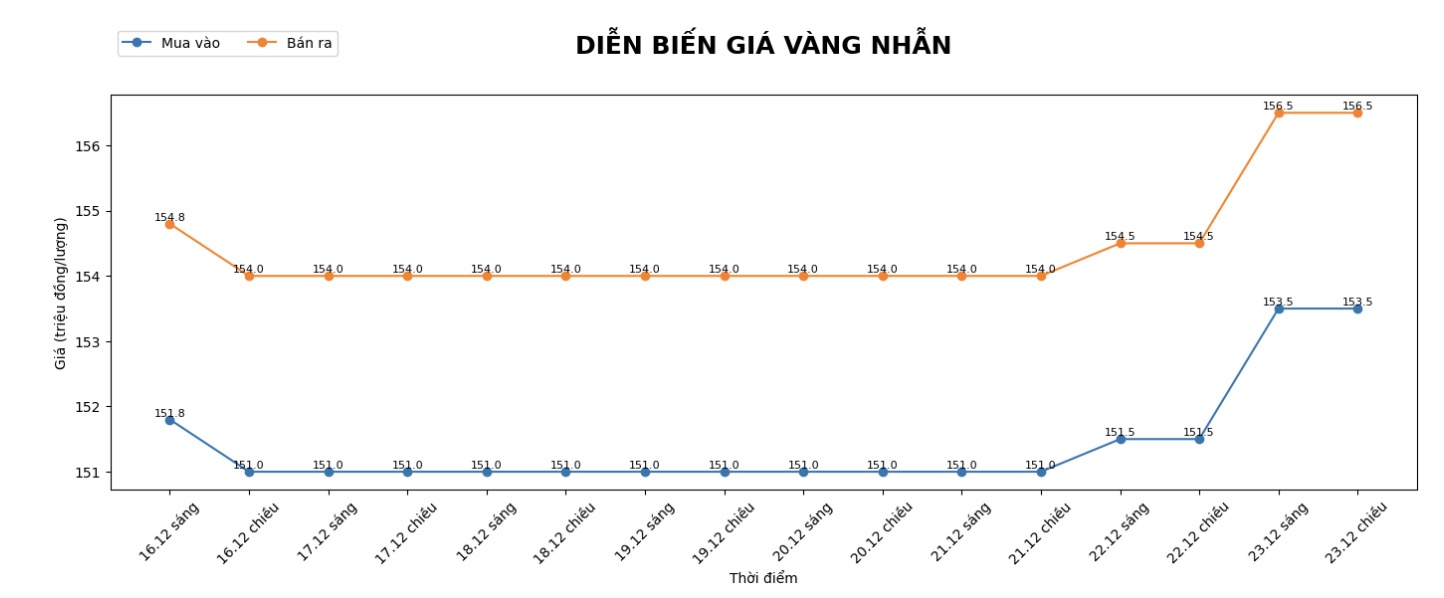

9999 gold ring price

As of 5:50 p.m., DOJI Group listed the price of gold rings at 153.5-156.5 million VND/tael (buy - sell), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 154.5-157.5 million VND/tael (buy - sell), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 153.8-156.8 million VND/tael (buy - sell), an increase of 1.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

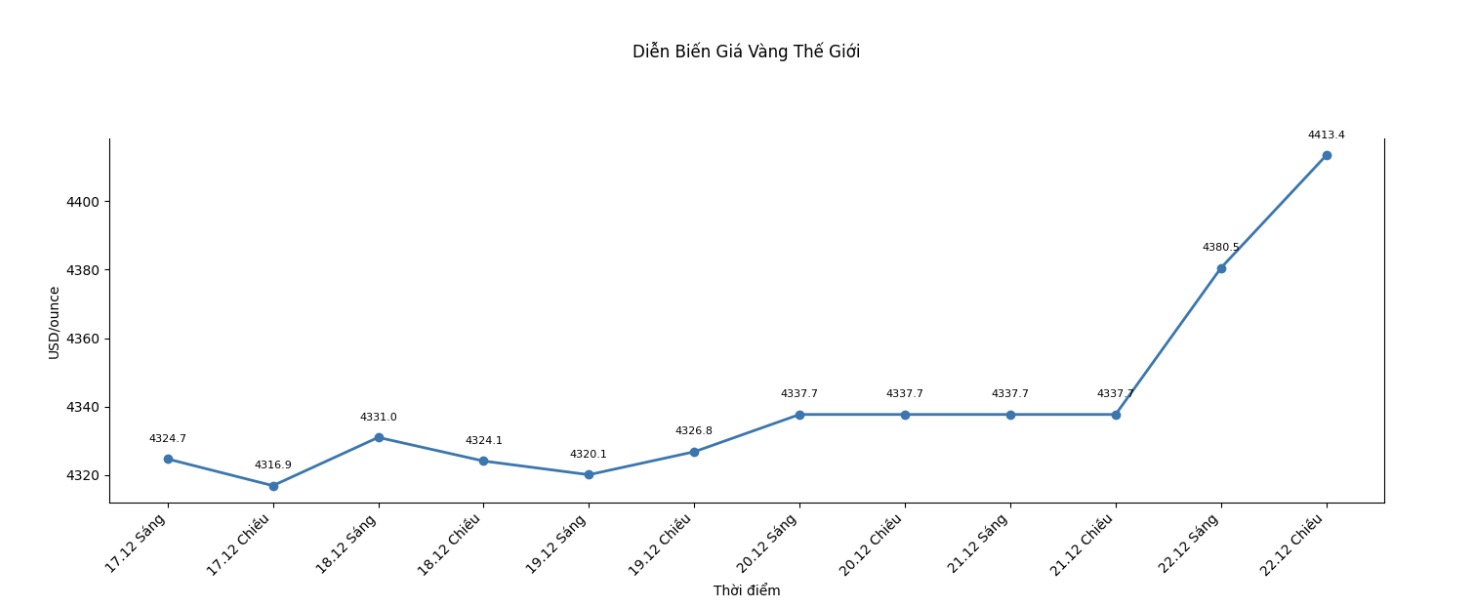

World gold price

The world gold price was listed at 5:50 p.m., at 4,483 USD/ounce, up 69.9 USD compared to a day ago.

Gold price forecast

Gold prices hit a record high in the trading session on Tuesday, just a short distance from the threshold of 4,500 USD/ounce. Silver prices also increased sharply.

Mr. Tim Waterer - Head of Market Analysis at KCM Trade - said that the US-Venezuela tensions are keeping gold in the spotlight of investors as a hedge against risk. He added that the sharp increase in gold prices this week is part of a broader shift in investment position, in the context of US interest rates forecast to continue to decrease.

According to Mr. Waterer, investors still consider precious metals an effective channel to diversify their portfolio and preserve asset value.

I dont think gold or silver have reached their peak, he said.

According to Reuters, last week, US President Donald Trump announced the imposition of " frights" on all oil tankers that are being sanctioned from entering and leaving Venezuela.

Gold prices are also supported by the news that Mr. Trump may appoint a new Chairman of the US Federal Reserve (Fed) in early January. The market is now betting on two interest rate cuts next year, in the context of expectations that monetary policy will be more dovish.

Gold prices increased thanks to a combination of factors such as geopolitical risks, expectations of interest rate cuts, central bank purchases, the trend of de-dollarization and capital flow back to ETFs.

Mr. Frank Walbaum - market analyst at Naga Trading and Investment Platform - said that as the end of the year approaches, thinner market liquidity can cause strong price fluctuations. According to him, gold will be particularly sensitive to geopolitical news as well as changes in interest rate expectations.

Meanwhile, spot silver prices rose 0.6%, to 69.44 USD/ounce, after hitting a record 69.98 USD/ounce. Since the beginning of the year, silver prices have increased by more than 141%, far exceeding the increase of gold, thanks to a shortage of supply, high industrial demand and strong investment capital flows.

Mr. Michael Brown - senior strategist at Pepperstone - said that the market may have an adjustment period during the holiday due to reduced liquidity. However, he believes that the increase will soon return when trading volume recovers, with the $5,000/ounce mark being a natural target for gold next year, while silver could head towards $75/ounce in the long term.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...