Updated SJC gold price

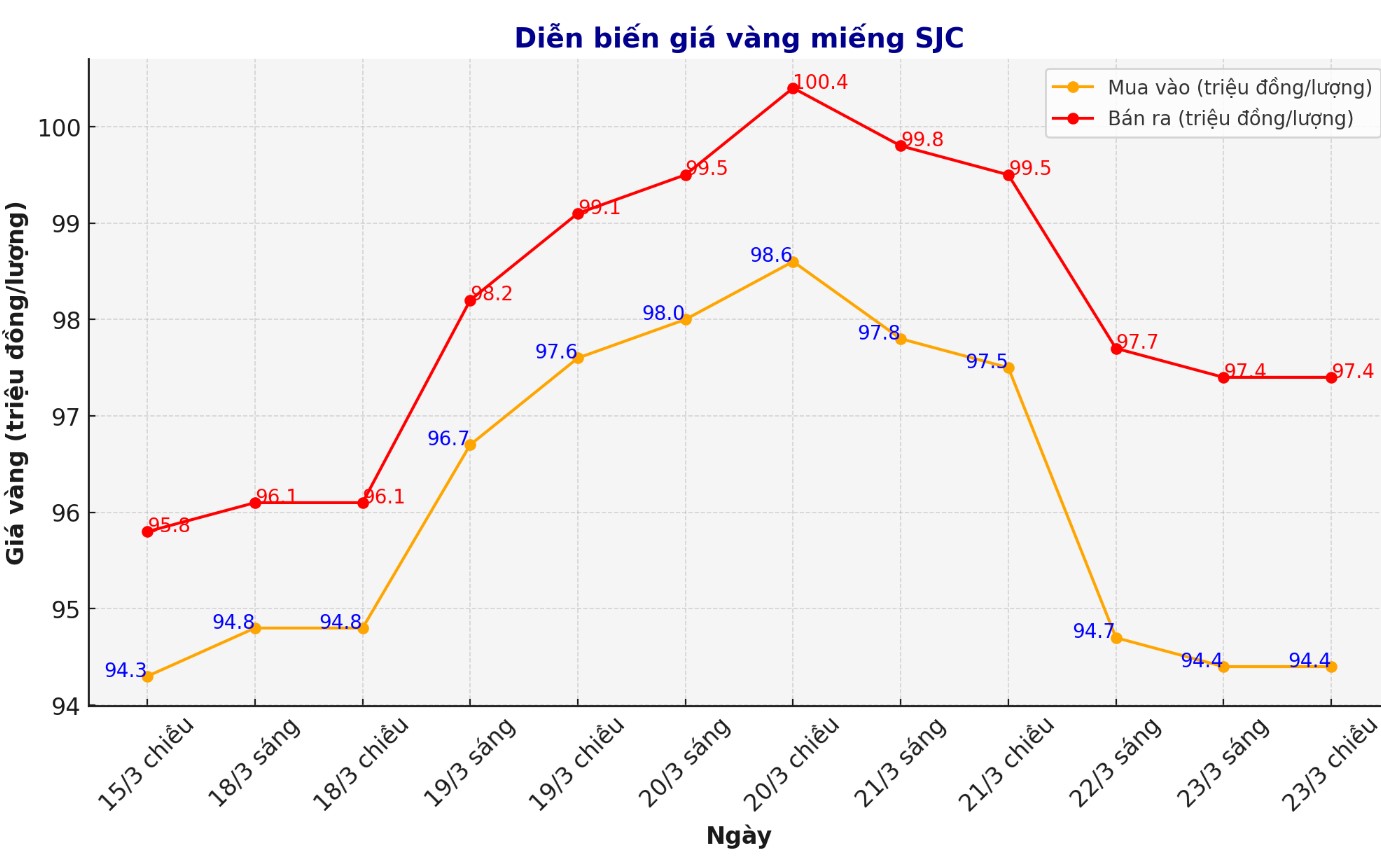

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at VND94.4-97.4 million/tael (buy in - sell out).

Compared to the closing price of last week's trading session (March 16, 2025), the price of SJC gold bars at DOJI increased by VND100,000/tael for buying and VND1.6 million/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group increased from 1.5 million to 3 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at VND94.4-97.4 million/tael (buy in - sell out).

Compared to the closing price of last week's trading session (March 16, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by VND100,000/tael for buying and VND1.6 million/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company Group SJC also increased from 1.5 million to 3 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of March 16 and selling it in today's session (March 23), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both lose 1.4 million VND/tael.

9999 round gold ring price

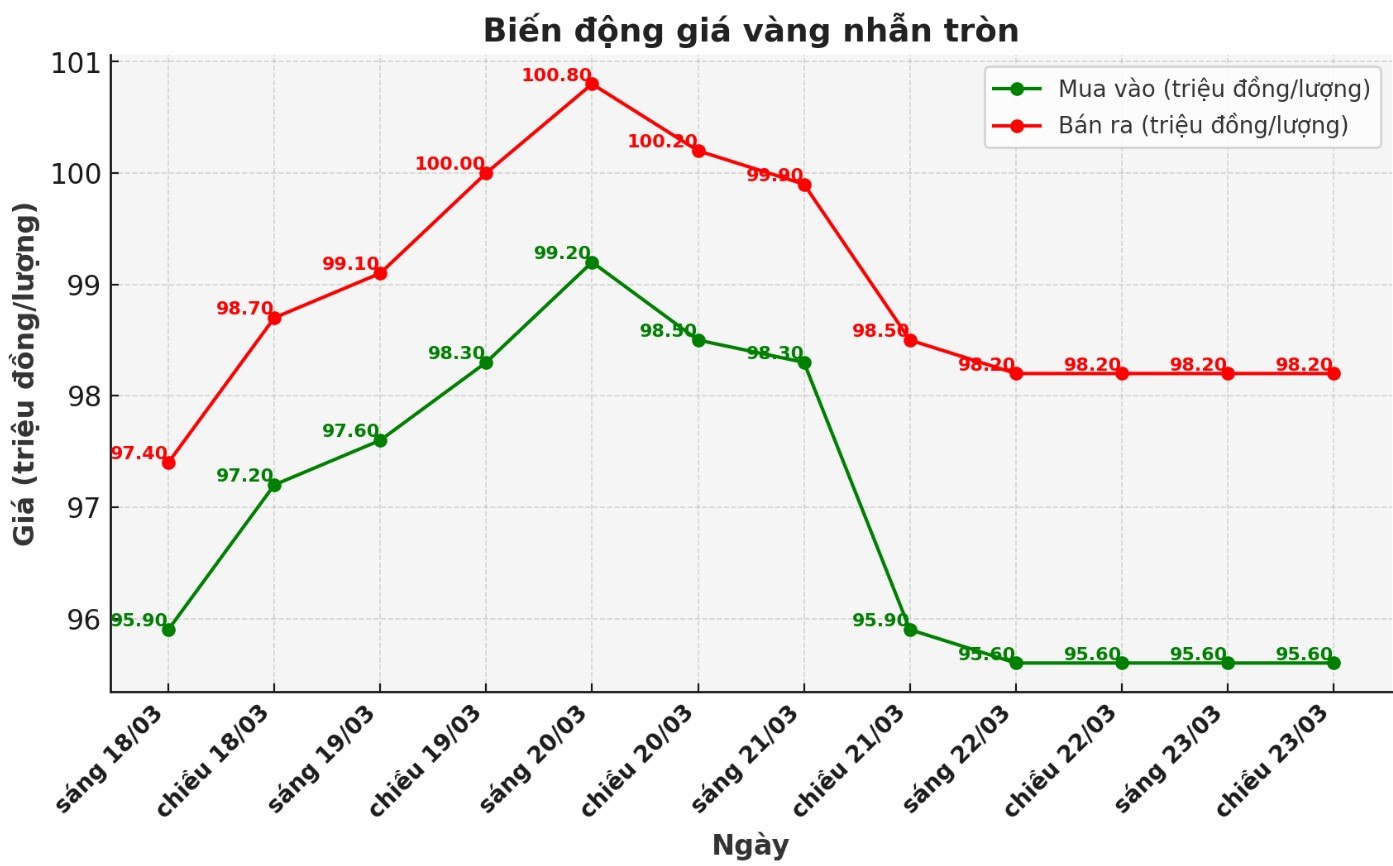

At the same time, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 95.6-98.2 million VND/tael (buy - sell); an increase of 700,000 VND/tael for buying and an increase of 1.9 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 96.1-98.6 million VND/tael (buy - sell); an increase of 1.1 million VND/tael for both buying and an increase of 2 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 2.5 million VND/tael.

If buying gold rings in the session of March 16 and selling in today's session (March 23), buyers at DOJI will lose 700,000 VND/tael, while buyers at Bao Tin Minh Chau will lose 500,000 VND/tael.

World gold price

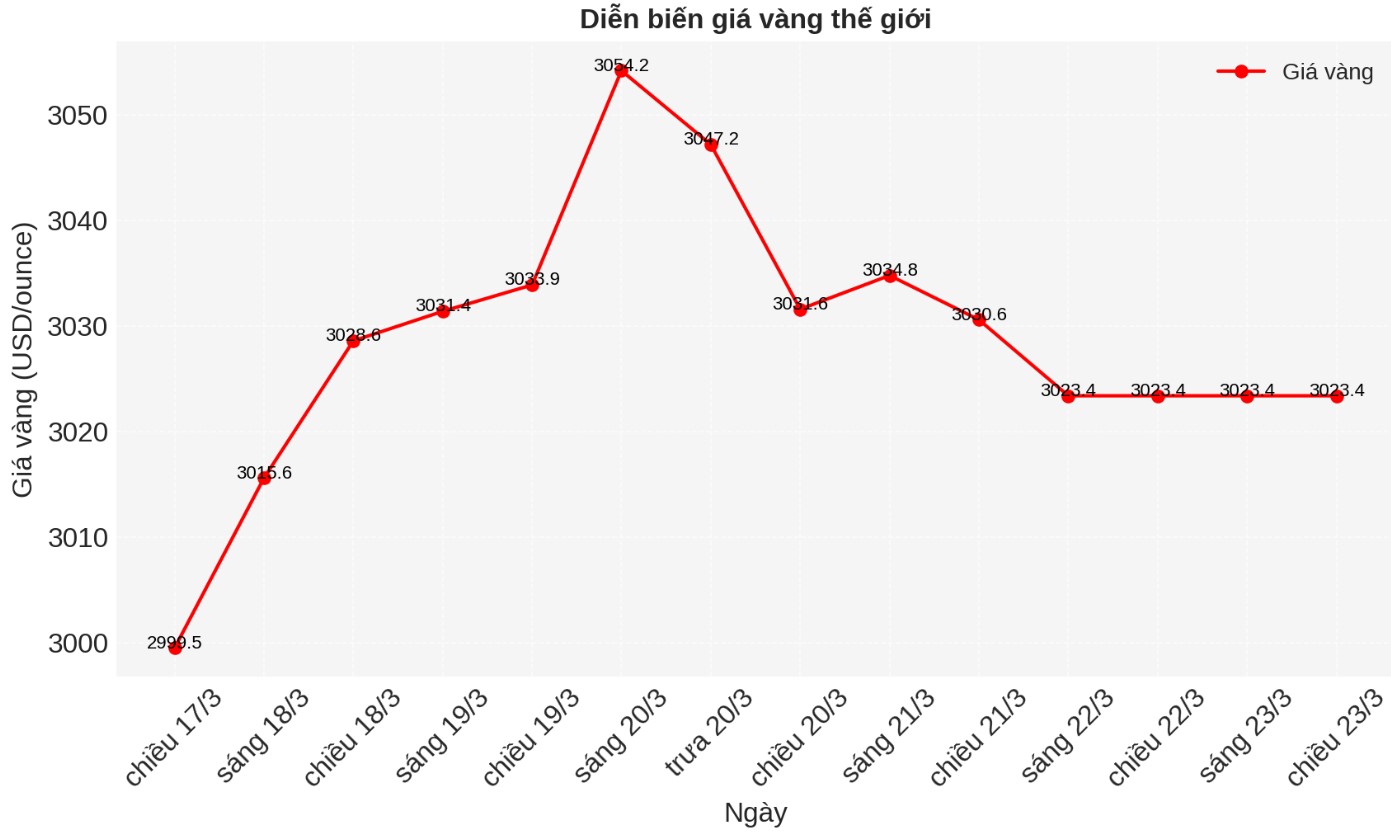

At the end of the trading session of the week, the world gold price listed on Kitco was at 3,023.4 USD/ounce, up 38.5 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

World gold prices fell at the end of the week as the USD increased. Recorded at 5:00 p.m. on March 23, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.740 points (up 0.24%).

Neil Welsh, head of metals at Britannia Global Markets, also gave a positive view on gold: In general, the current gold rally shows no signs of weakening. In fact, if someone bet on gold going down at this time, it would be a rather risky decision.

Basic market factors still support gold, and there is no change in the momentum to boost gold prices in the near future. In particular, factors such as the monetary policy of the US Federal Reserve (FED), global political instability, and trade negotiations are all factors that favor gold as a safe asset".

Alex Kuptsikevich, a market analyst at FxPro, also has a very optimistic view: Gold has been in an uptrend since the beginning of March and I see this uptrend as likely to continue. If the market continues to increase, I expect gold to reach $3,180/ounce, a fairly high price compared to the present. I believe this rally could continue for the next few months, especially as gold is seeing a lot of support from current economic and political factors."

Finally, Michael Moor - founder of Moor Analytics, also predicted a positive trend for gold: "I still maintain a positive view on gold in the long term. The upward momentum of gold since 2015 is still very strong, and I think gold will continue to maintain this upward trend. The recent strong rally in gold prices is only part of a long-term uptrend, and I believe there will be further uptrend in the coming period."

Rich Checkan from Asset Strategies International also predicted a price drop in the coming period: I predict that gold will fall below $3,000 at least once next week. This could be an opportunity for the market to re-check the support level before continuing to increase. However, I believe that gold will hold firm in the long term and the short-term decline is only temporary."

Economic data to watch next week

Monday: US manufacturing and services PMI (S&P Global).

Tuesday: American consumer confidence, new home sales in the US.

Wednesday: Orders for durable US goods.

Thursday: Waiting for home sales, US Q4 GDP.

Friday: US core PCE, US personal income and expenses.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...