Many experts say positively

After a volatile week, many experts believe that gold prices will continue to grow next week. I think the gold market will continue to maintain its upward momentum in the coming time, said Darin Newsom, a market analyst. While $3,000 an ounce may have made buyers more cautious for some time, I have not seen any clear signs that the market is taking profits.

Therefore, I predict that gold prices will continue to increase in the short term, at least in the next few weeks. However, the fact that $3,000/ounce may reduce the short-term increase is not a cause for concern about the large decrease in gold prices at this time".

Sharing the same view, James Stanley from Forex.com affirmed: I still believe that gold speculators will continue to maintain their optimism in the coming time. Although the $3,000/ounce price may create some short-term barriers for investors to buy, I do not see any clear signs of strong profit-taking.

So I think we will continue to see growth in gold prices, especially in the short term. The $3,000/ounce price may make buyers a little hesitant, but I still expect a steady increase."

According to Adam Button from Forexlive.com, he commented that although he was not too worried about gold's price drop on Friday, he also noticed some notable new factors in the gold market: "One of the important factors is the weakness of the USD this year, which could increase gold prices more strongly.

In addition, political and commercial events could fuel a shift away from risky assets to gold, especially when there is no clarity on tariff issues. In general, I think gold will continue to increase in the coming time".

Experts predict a decrease

On the other hand, some experts believe that gold will face a short-term correction. Adrian Day, chairman of Adrian Day Asset Management, said: A break in golds strong rally is completely normal, and I think this will benefit the market in the long term.

While this adjustment could reduce gold prices in the short term, I believe it is just a short adjustment and will not last long. The gold market may continue to recover after a period of price increase suspension".

Mark Leibovit, founder of VR Metals/Resource Letter, shared a similar view: I think the gold market has been overbought and therefore, I predict there will be a short-term correction. Thats normal in bullish markets, and Im hoping gold will fall a bit before rallying back.

Neutral forecast

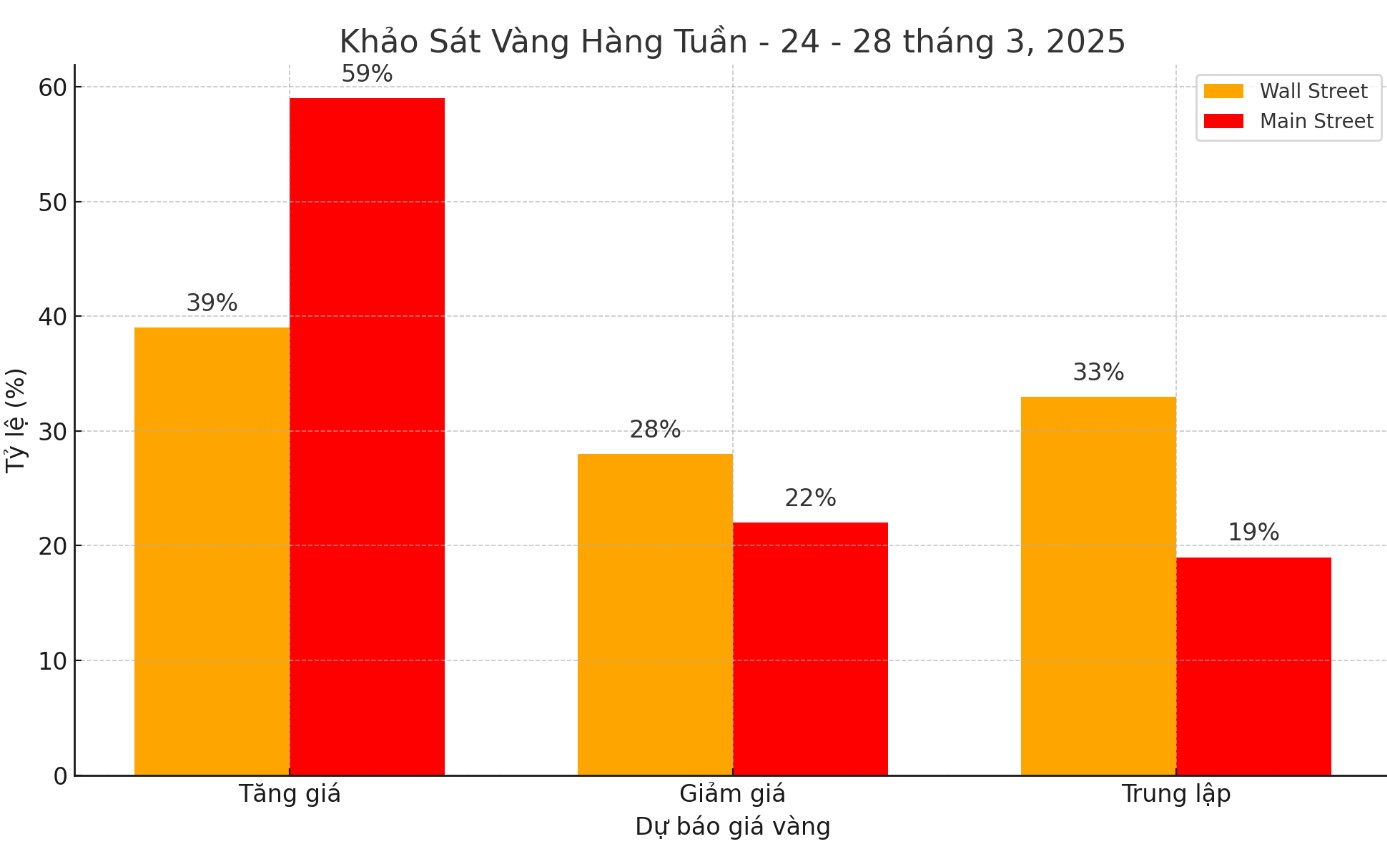

In addition to optimistic and negative comments, some experts have a neutral view on gold prices in the coming time. Results from the Kitco News survey show that about 33% of experts predict gold will move sideways and stably next week. This division shows that the gold market is facing mixed factors and cannot clearly determine the next trend.

I currently have a neutral view on gold for next week, said Colin Cieszynski, chief strategist at SIA Wealth Management. Gold may continue to consolidate at $3,000 until the end of the month, but I think that in early April, when the US began to make serious decisions on tariff issues, the gold market could become more vibrant. However, gold currently appears to be stable and there will be no strong price changes.

Everett Millman, a market analyst at Gainesville Coins, also believes that the gold market will be volatile but will remain stable in the long term: I dont see too many big changes in the gold market in the short term. Although there will be days of price adjustments, I think gold will continue to maintain a stable increase, although there may be a few weeks of slight adjustments.

We may see this volatility next spring, but I believe gold will not weaken and will continue to consolidate prices above $3,000/ounce.