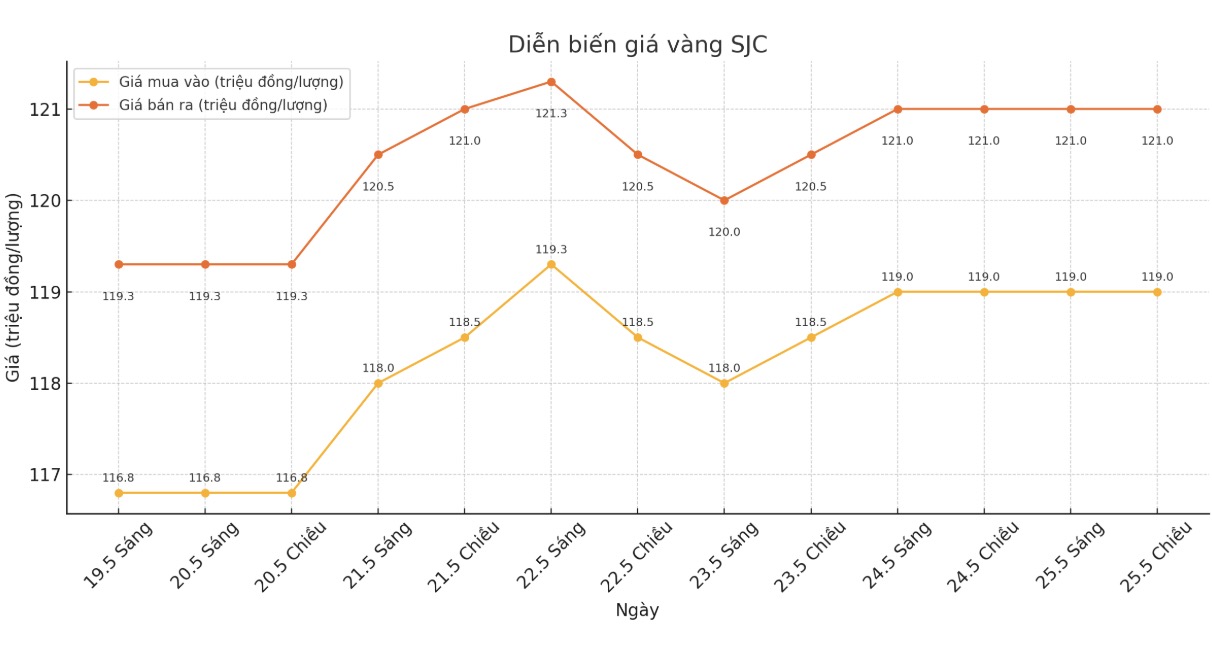

SJC gold bar price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at 119-121 million VND/tael (buy - sell).

Compared to the closing price of last week's trading session (May 18, 2025), the price of SJC gold bars at DOJI increased by 3.5 million VND/tael for buying and increased by 2.5 million VND/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 119-121 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (May 18, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 3.5 million VND/tael for buying and increased by 2.5 million VND/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of May 18 and selling it in today's session (May 25), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both make a profit of VND500,000/tael.

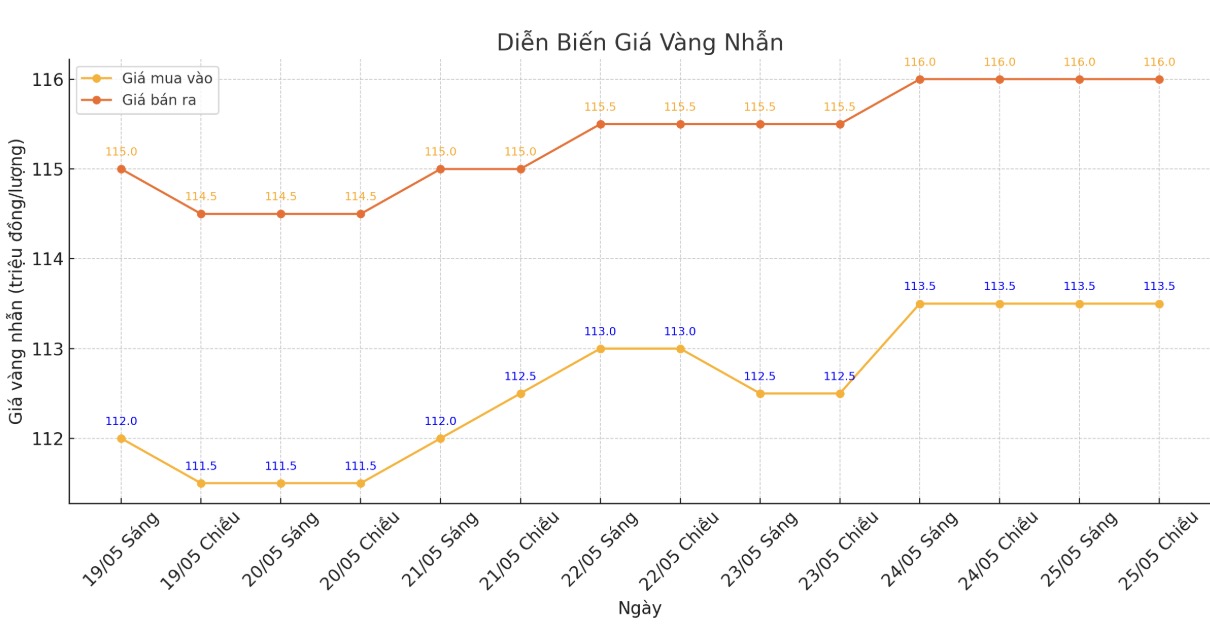

9999 gold ring price

The price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5-116 million VND/tael (buy - sell); an increase of 2.5 million VND/tael for buying and an increase of 2 million VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell); an increase of 1.5 million VND/tael in both directions compared to the closing price of the previous trading session. The difference between buying and selling is at 3 million VND/tael.

If buying gold rings in the session of May 18 and selling in today's session (May 25), buyers at DOJI will lose 500,000 VND/tael, while buyers at Bao Tin Minh Chau will lose 1.5 million VND/tael.

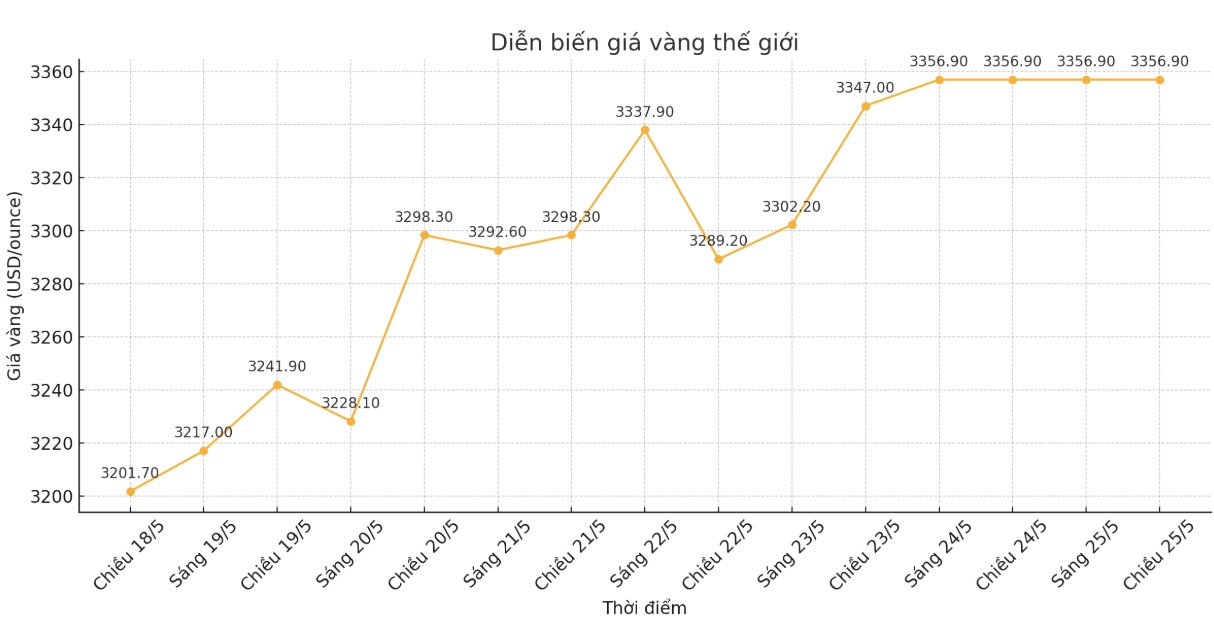

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 3,356.9 USD/ounce, a sharp increase of 155.2 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

A weekly survey by Kitco News shows that industry experts no longer have a downward view on next week. Meanwhile, individual investors also returned to the uptrend after gold had an outstanding performance.

This week, 16 experts participated in the Kitco News gold survey. Wall Street has completely abandoned negative views after a week of strong recovery in gold prices.

There are 13 experts, equivalent to 81%, predicting that gold prices will continue to increase next week, while the remaining 3 people (19%) believe that prices will remain flat. No one predicted gold prices would fall.

Meanwhile, Kitco's online poll recorded 245 votes. Investors returned to a mostly optimistic trend after the recent increase in gold.

155 individual investors (63%), or more, expect gold prices to continue to rise next week; 52 people (21%) see prices falling; the remaining 38 people (16%) see prices accumulating and moving sideways.

Rich Checkan - Chairman of financial solutions provider Asset Strategies International, predicted that gold prices will increase next week. Gold's rally was especially supported after Moody's downgraded the US government bond credit rating from Aaa to Aa1.

Colin Cieszynski - chief strategist at the investment management unit SIA Wealth Management, said that Donald Trump's new tough stance on tariffs, along with the lack of substantial trade deals in the past, has created conditions for gold to return to the role of "king" of defensive assets.

Economic calendar affecting gold prices next week

Next week will be a short trading week due to the US Memorial Day holiday on Monday, but traders will still have a lot of important information to watch when they return.

Tuesday will see a US durable goods orders report in April and a US consumer confidence index in May, along with the Reserve Bank of New Zealand's monetary policy decision in the evening.

By Wednesday afternoon, the market will receive the minutes of the Federal Open Market Committee (FOMC)'s May meeting, with expectations that the US Federal Reserve (FED) may be being more flexible in its rate cut stance.

Thursday will see data such as weekly jobless claims, preliminary estimates of US Q1 GDP and pending home transaction figures. The trading week will end on Friday with a report on the core PCE price index - the Fed's preferred inflation measure.

See more news related to gold prices HERE...