According to Kitco, gold prices increased sharply as investors stepped up their risk-off gold purchases before the three-day holiday. Silver prices also edged up. June gold contract increased by 45.9 USD to 3,340.9 USD/ounce. July delivery silver price increased by 0.051 USD, to 33.27 USD/ounce.

The US stock market became unstable again on Friday morning after a number of posts on social media by President Donald Trump. This is actively supporting gold prices.

A post said that the iPhone will be subject to a 25% tax if not manufactured in the US. Another article said that US-EU trade negotiations are at a standstill and the US will impose a 50% tariff on the EU from June 1.

Asian and European stock markets traded in opposite directions overnight. US stock indexes are expected to open sharply down in New York after moving sideways in the overnight session.

The world financial market today recorded a slight decrease in the USD index. Crude oil prices are trading near 61.25 USD/barrel. The yield on the 10-year US Treasury note was 4.519%.

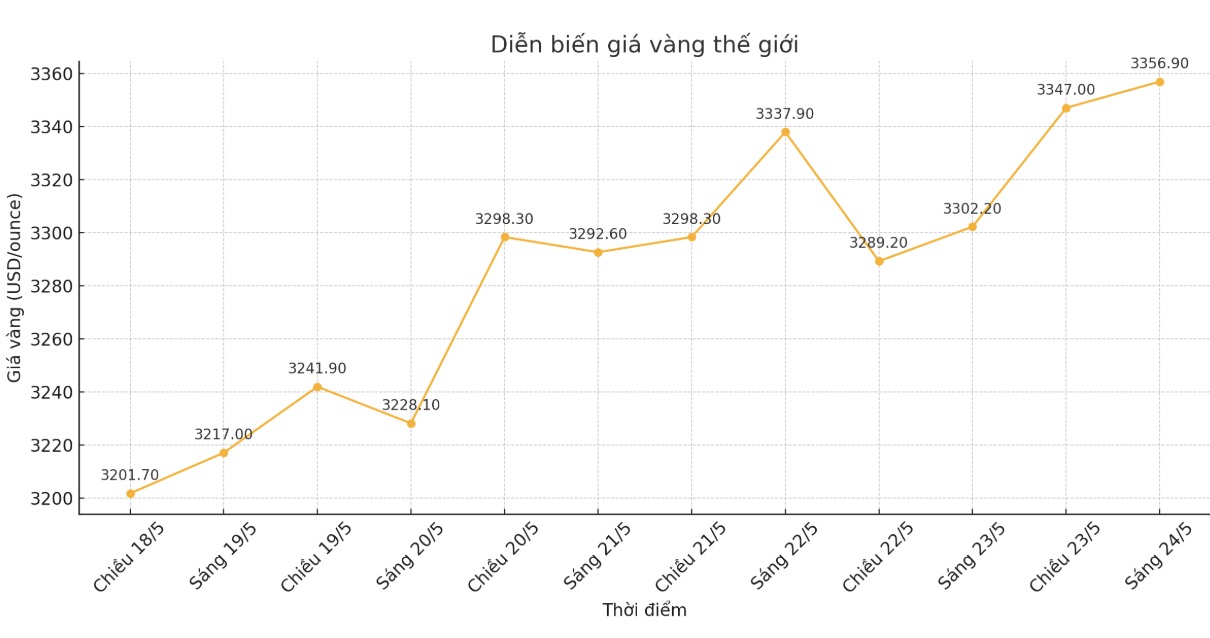

Technically, buyers are dominating the June gold contract. The next target is to close above the resistance level of $3,400/ounce. On the contrary, the sellers are aiming to push prices below the important support level at the bottom of May at 3,123.3 USD/ounce.

The most recent resistance level was the weekly peak at $3,346.8/ounce, followed by $3,375/ounce. The most recent support was $3,300/ounce and then the night low was $3,285.5/ounce.