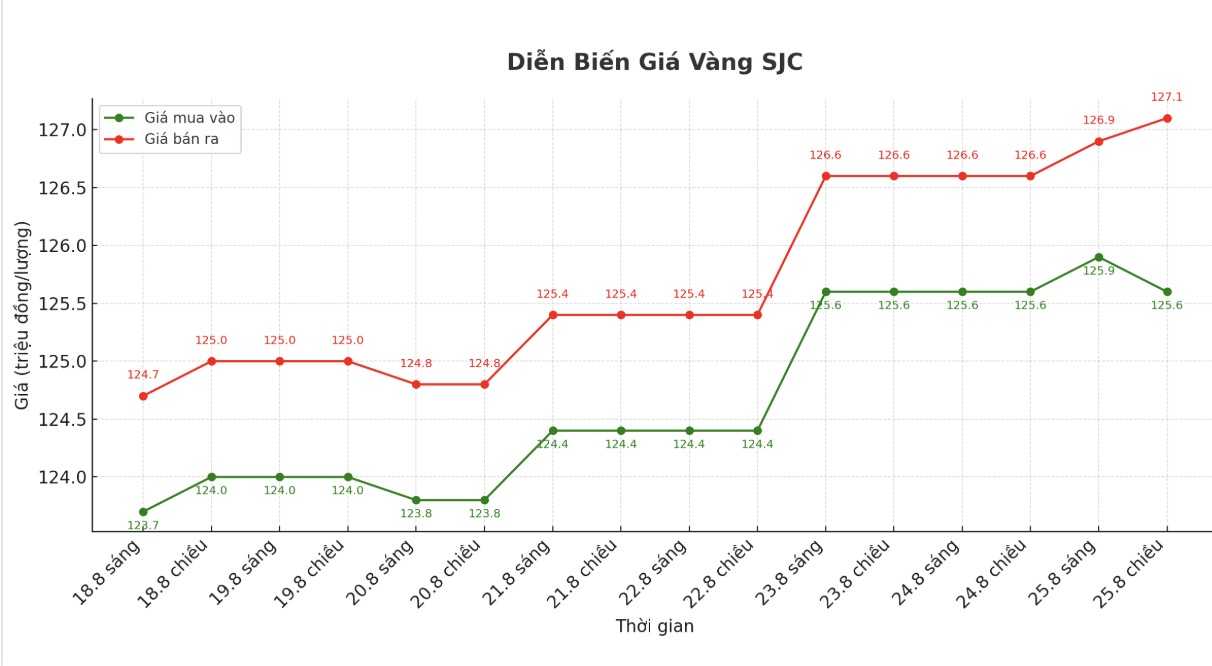

SJC gold bar price

As of 6:50 p.m., DOJI Group listed the price of SJC gold bars at VND125.6-127.1 million/tael (buy - sell), unchanged for buying but increased by VND500,000/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 125.6-127.1 million VND/tael (buy - sell), keeping the same for buying but increasing by 500,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 125.1-127.1 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

9999 gold ring price

As of 6:50 p.m., DOJI Group listed the price of gold rings at 118.8-121.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 119.2-122.2 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 118.8-121.8 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the gap between buying and selling domestic gold is being adjusted to increase, posing a potential risk of losses for investors.

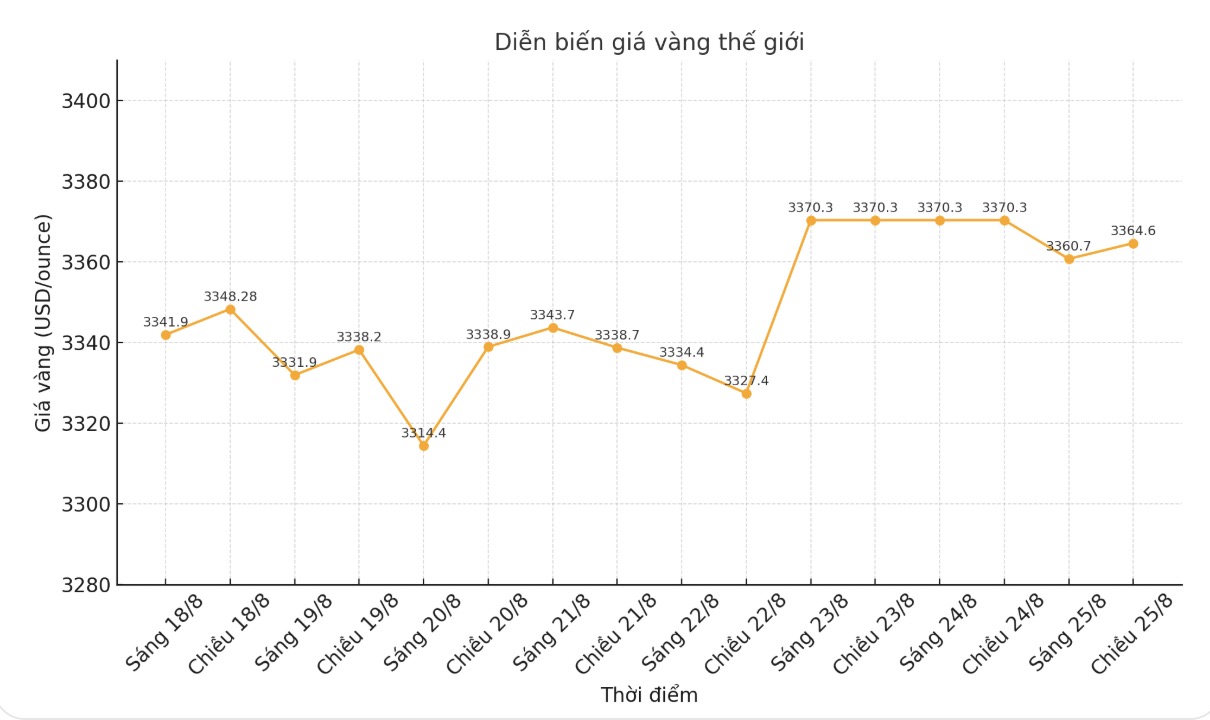

World gold price

The world gold price was listed at 7:50 p.m. at 3,370.3 USD/ounce.

Gold price forecast

Gold prices today have fallen from a two-week high. This price was achieved after Federal Reserve Chairman Jerome Powell commented to reinforce expectations of interest rate cuts.

USD Index increased by 0.2%, making gold more expensive for holders of other currencies.

Fed Chairman Jerome Powell signaled last Friday the possibility of a rate cut at the Fed's September meeting, saying that risks to the job market are increasing, while inflation is still a threat, while emphasizing that the decision has not been "backed".

UBS analyst Giovanni Staunovo commented: In my opinion, Mr. Powell only suggested a 25 basis point cut in September. Therefore, the market is adjusting expectations, which has supported the USD and put pressure on gold prices.

Currently, the market is pricing in an 87% chance that the Fed will cut interest rates by 0.25 percentage points at its September meeting, down slightly from nearly 90% after Powell's speech on Friday.

According to CME's FedWatch tool, investors also predict that the total cut will reach 48 basis points by the end of this year.

S stronger cuts also depend on upcoming US economic data, which needs to show clear signs of weakness. We expect gold to reach $3,700/ounce by mid-2026, Staunovo added.

Investors are now waiting for the US personal consumption expenditure (PCE) data released on Friday, which is expected to show core inflation increasing to its highest level since the end of 2023, reaching 2.9%.

Gold is often rising in a low-interest-rate environment due to the reduced opportunity cost of holding non-yielding assets.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...