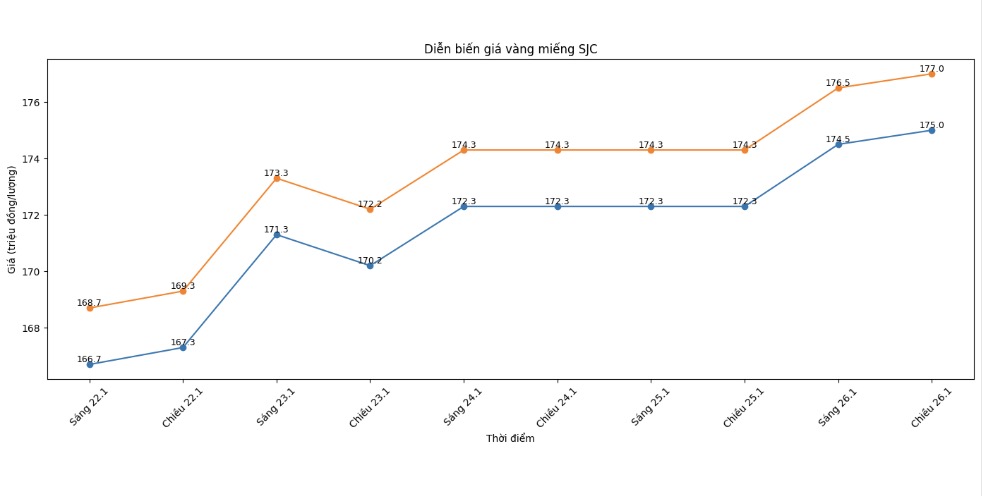

SJC gold bar price

As of 6:00 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 175-177 million VND/tael (buying - selling), an increase of 2.7 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 174.5-176.5 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at the threshold of 174.5-177 million VND/tael (buying - selling), an increase of 3 million VND/tael on the buying side and an increase of 2.7 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

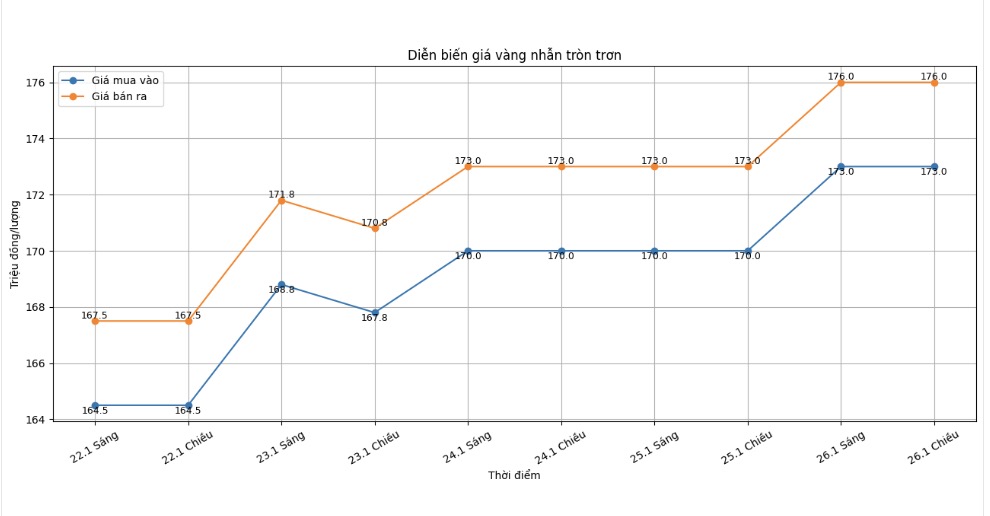

9999 gold ring price

As of 6:00 PM, DOJI Group listed the price of gold rings at 173-176 million VND/tael (buying - selling), an increase of 3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), an increase of 3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

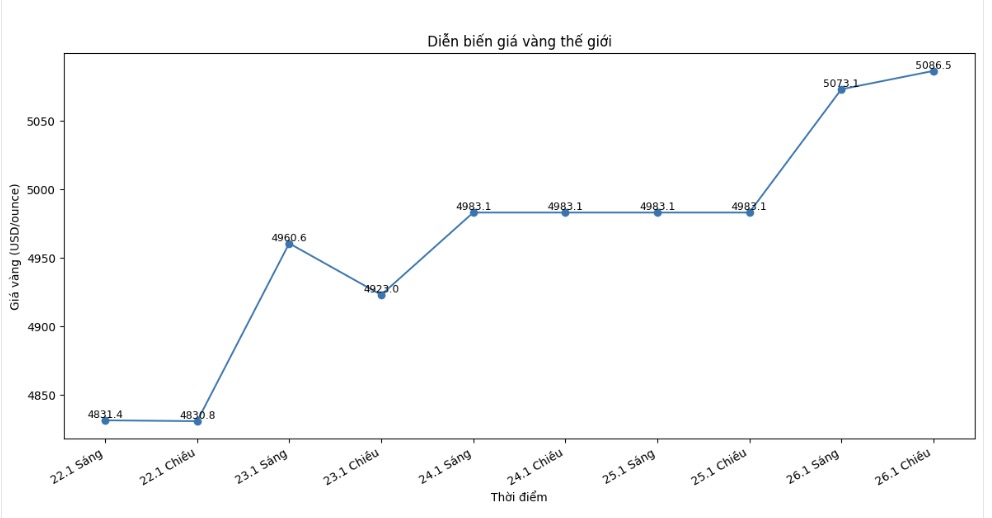

World gold price

At 6:50 PM, world gold prices were listed around the threshold of 5,086.5 USD/ounce, up 103.4 USD compared to the previous day.

Gold price forecast

The strong increase in gold prices in recent times shows that this precious metal is entering a special stage, when many supporting factors converge at the same time. In the international market, gold prices not only set new peaks but also maintained a stable state in the highlands, reflecting that demand is still clearly dominant.

According to experts, the global gold market currently operates in parallel through two main valuation mechanisms: the spot market and the futures contract market. In which, near-term gold contracts, especially contracts with a delivery time at the end of the year, are attracting great attention from investors due to increased demand for book closing and risk hedging. High liquidity in the futures contract market shows that both speculative and defensive cash flows are focusing on gold.

Trao doi voi Kitco News, ong Kevin Grady - Chu tich Phoenix Futures and Options, nhan dinh thi truong kim loai quy hien nay dang o trong trang thai rat hiem gap. Theo ong, vang duong nhu khong con van dong theo moi quan he truyen thong voi chung khoan hay cac tai san rui ro khac. “Du thi truong co phieu tang hay giam, vang van thu hut dong tien. Dieu nay cho thay nguoi mua chua co y dinh rut lui, trong khi nguoi ban cung khong man ma voi viec chot loi”, ong Grady danh gia. Vi chuyen gia nay cho rang moc 5.000 USD/ounce da tro thanh muc tieu mang tinh dong thuan cua thi truong trong boi canh hien nay.

From a technical perspective, senior analyst Jim Wyckoff of Kitco believes that the main trend of gold prices is still upward, thanks to the combination of safe shelter demand and buying power based on graph signals. According to Mr. Wyckoff, the buying side is clearly dominant as prices continuously hold firm in important support zones. Although it is not excluded the possibility of short-term corrections when prices approach strong psychological levels, this is considered necessary for the market to consolidate its upward momentum.

Summarizing the factors shows that, in the context of prolonged global economic and geopolitical instability, along with the unpredictable developments of monetary policy and exchange rates, gold is likely to continue to be prioritized as a safe haven. The upward trend is assessed to still play a dominant role, although investors need to be cautious of short-term fluctuations that may occur during the market's upward trend.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...