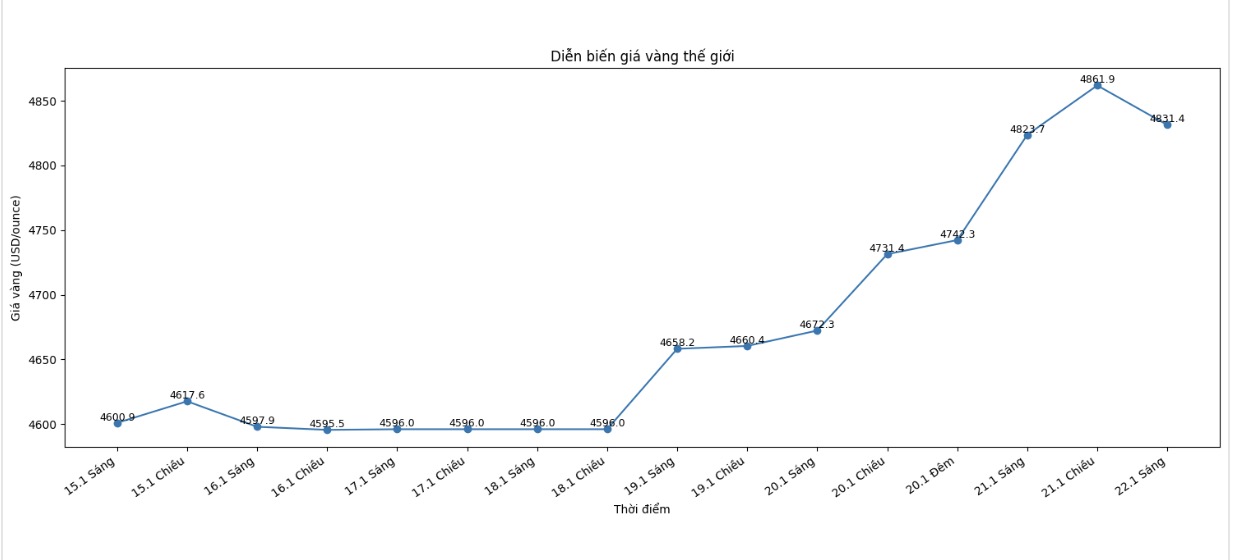

At 9:26 am on January 22 (Vietnam time), world gold prices were listed around the threshold of 4,790.4 USD/ounce, down 33.3 USD compared to the previous day.

Gold is under downward pressure as cash flow tends to return to riskier investment channels, amid improved market sentiment. The global stock market recovered after reports that the US withdrew its plan to impose tariffs on some countries related to the Greenland issue, and reached preliminary agreements with the North Atlantic Treaty Organization on the future of this region.

Mr. Bob Haberkorn - senior market strategist at RJO Futures - said that information related to tariffs has helped stocks increase, thereby reducing the upward momentum of gold and creating adjustment pressure on the precious metal market. However, he emphasized that the long-term upward trend of gold has not been reversed.

In the context of economic and geopolitical instability, gold continues to be seen as a safe haven. This precious metal has increased by 64% in 2025 and continued to increase by 11% from the beginning of 2026 to date.

At the same time, the US Supreme Court expressed a cautious stance on a proposal related to personnel at the US Federal Reserve (Fed), in the context of the central bank's independence being concerned.

According to a Reuters survey, most economists believe that the Fed is likely to keep key interest rates unchanged this quarter and may extend until President Jerome Powell's term ends in May. Maintaining low interest rates is often beneficial for gold – an asset that does not yield yields.

On other precious metals markets, spot silver prices fell sharply last night by 3.6% to 91.17 USD/ounce, after setting a record high of 95.87 USD/ounce in the previous session. According to Ms. Soni Kumari - commodity analyst at ANZ, silver prices are fully capable of reaching the 100 USD/ounce mark thanks to strong upward momentum, but this process may come with adjustments and major fluctuations.

Platinum prices fell slightly by 0.1%, to 2,460.20 USD/ounce, after reaching a record high of 2,543.99 USD/ounce earlier in the day. Meanwhile, palladium prices fell 2.1% to 1,825.85 USD/ounce.

Domestic gold price movements

As of 9:15 am, domestic gold prices recorded mixed movements between SJC gold bars and gold rings, in the context that the buying-selling price difference still maintained at a high level.

For SJC gold bars, DOJI Group listed at 166.7 - 168.7 million VND/tael (buying - selling), down 500,000 VND/tael in both directions compared to the previous session. The buying - selling difference is maintained at about 2 million VND/tael.

At the same price, Bao Tin Minh Chau also adjusted down by 500,000 VND/tael in both directions, with a buying - selling difference of 2 million VND/tael. Meanwhile, Phu Quy Jewelry Group listed SJC gold bar prices at 166 - 168.7 million VND/tael, down 500,000 VND/tael in each direction, the buying - selling difference reached about 2.7 million VND/tael.

In the 9999 gold ring segment, prices tend to increase again. DOJI listed the price of gold rings at 164.5 - 167.5 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions compared to the previous day, with a buying - selling difference of about 3 million VND/tael. Phu Quy listed the price of gold rings at 164.7 - 167.7 million VND/tael, an increase of 200,000 VND/tael in both directions, the buying - selling difference remained around 3 million VND/tael. Meanwhile, Bao Tin Minh Chau listed the price of gold rings at 166 - 169 million VND/tael, with a buying - selling difference also at 3 million VND/tael.

Notably, the buying-selling price difference between gold bars and gold rings is currently common in the range of 2 - 3 million VND/tael. This high difference is assessed as potentially risky, causing short-term investors to face the risk of losses if gold prices fluctuate strongly in the short term.