Talking to Kitco News, Mr. Kevin Grady - Chairman of Phoenix Futures and Options said that the precious metal market today is almost unstoppable.

When the stock market decreases, gold increases. When stocks increase, gold also increases" - Mr. Grady said, arguing that gold is moving independently of traditional risky assets.

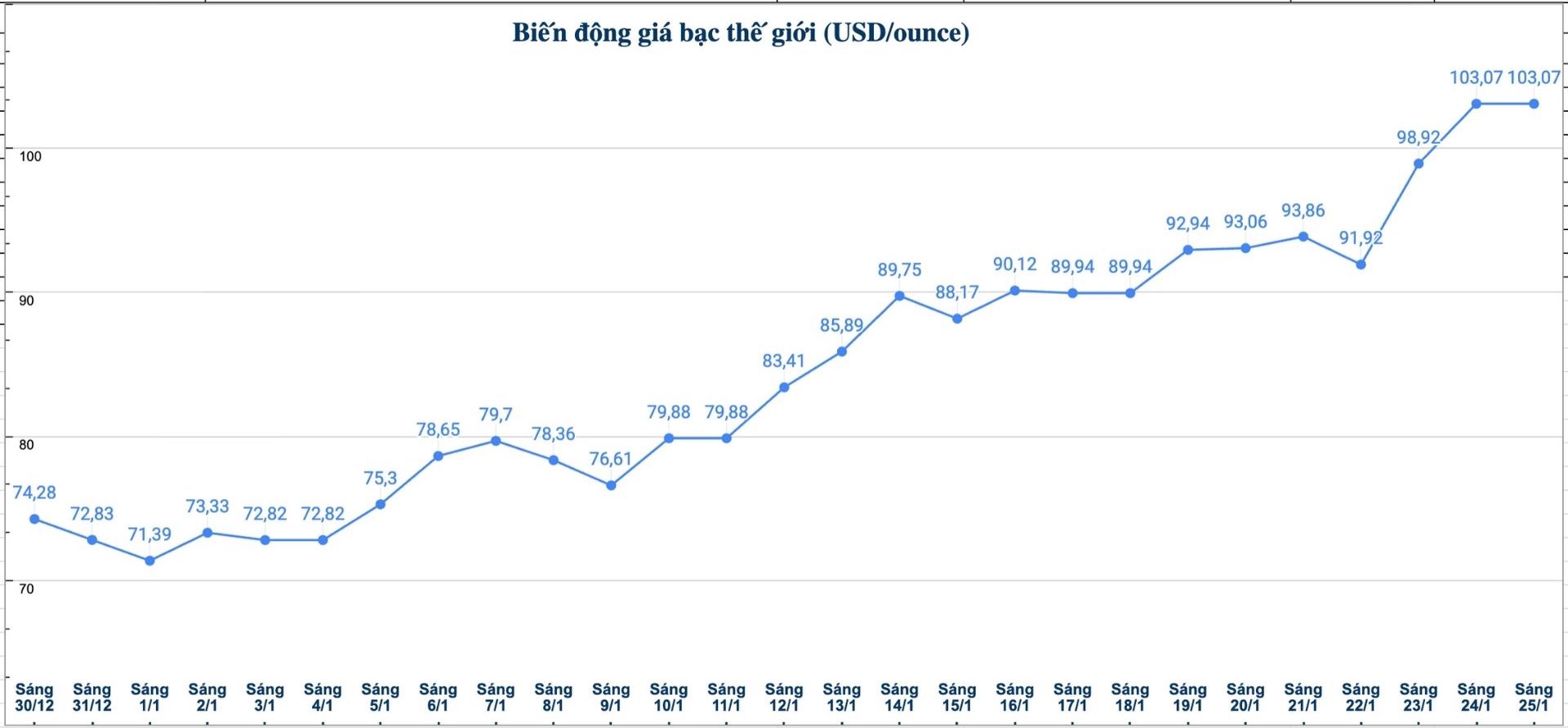

According to him, both gold and silver at this time "seem to have their own trajectory", reflecting a very rare state of the market. "This is one of the rare cases where buyers naturally do not want to withdraw, while sellers do not want to sell" - he analyzed.

Mr. Grady said that gold producers are currently not enthusiastic about selling or hedging futures. Meanwhile, trend investors have entered strongly, clearly shown by the rapid increase in open-ended interest rates in the market. "People are simply riding on this wave" - he said.

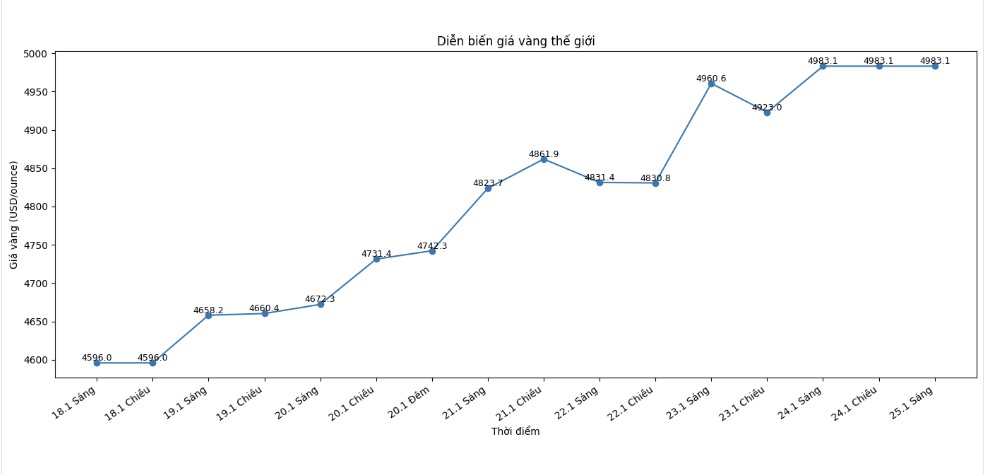

According to this expert, the $5,000/ounce mark has long been a market target. "I don't think any trader participating in the precious metals market would not believe that gold prices will reach the $5,000 mark in this region" - Mr. Grady said.

Although admitting that the number of buying positions is at a high level, he believes that this is a special case when the basic factors are still very solid. "Gold holds good prices, silver also holds good prices. There are reasonable reasons for prices to stand in this area. This is not only speculative activity, but also reflects the real driving forces of the market" - he emphasized.

Sharing the same positive view, senior analyst Jim Wyckoff of Kitco said that gold and silver prices are being strongly supported by safe shelter demand and buying power based on technical analysis.

“The need to find safe havens along with buying activities based on price charts in the context of technical signals maintaining a clear upward trend is continuing to push precious metal prices up” - Mr. Wyckoff said.

Technically, he believes that the buying side on the February gold futures market is clearly dominant. "The next upside target for the buying side is to close above the strong resistance zone at the 5,000 USD/ounce mark" - Mr. Wyckoff said.

In the opposite direction, the near-term target of the selling side is to pull gold prices below the important support zone around 4,539.1 USD/ounce. However, according to Mr. Wyckoff, this scenario is currently not dominant as buying pressure is still overwhelming.

Regarding specific technical milestones, Mr. Wyckoff said that the nearest resistance of gold prices was at a record high in the night session of 4,970 USD/ounce, followed by a psychological threshold of 5,000 USD/ounce. Meanwhile, important support zones were determined at 4,900 USD/ounce and 4,850 USD/ounce respectively.

According to experts, in the context of prolonged global economic and geopolitical instability, along with cash flow continuing to turn to safe assets, the main trend of the gold market is likely to still be upwards, although it is not excluded the possibility of short-term technical corrections.

See more news related to gold prices HERE...