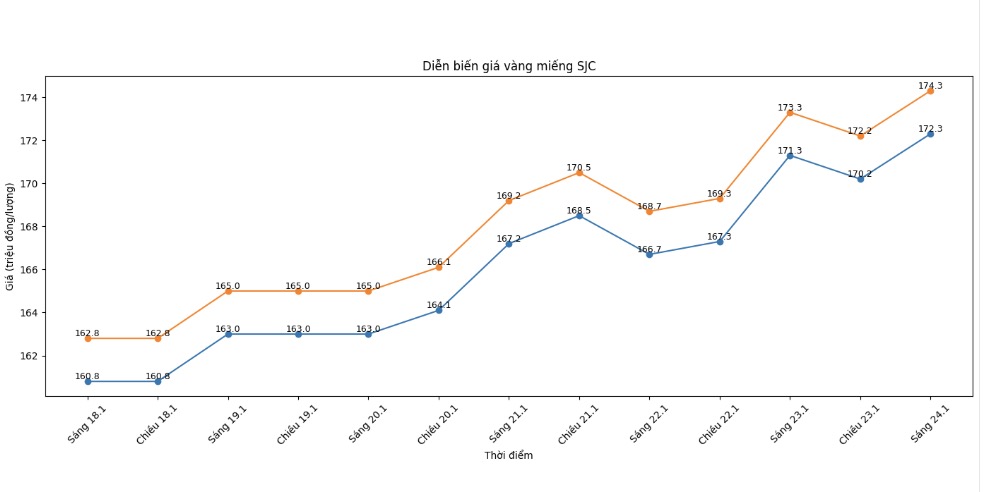

SJC gold bar price

As of 6:40 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 175.3-177.3 million VND/tael (buying - selling), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 173.5-176.5 million VND/tael (buying - selling), down 1 million VND/tael on the buying side and unchanged on the selling side. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 174.5-177 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

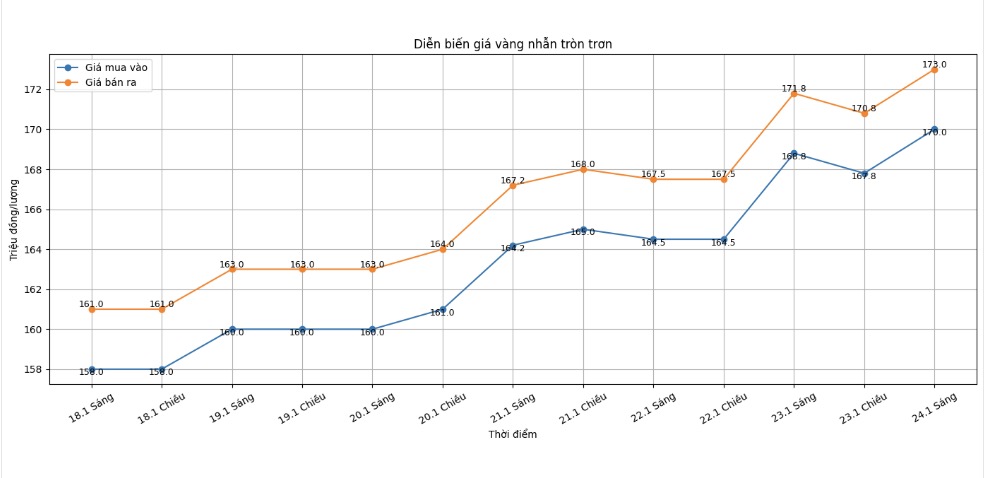

9999 gold ring price

As of 6:40 PM, DOJI Group listed the price of gold rings at the threshold of 173-176 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 173.5-176.5 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

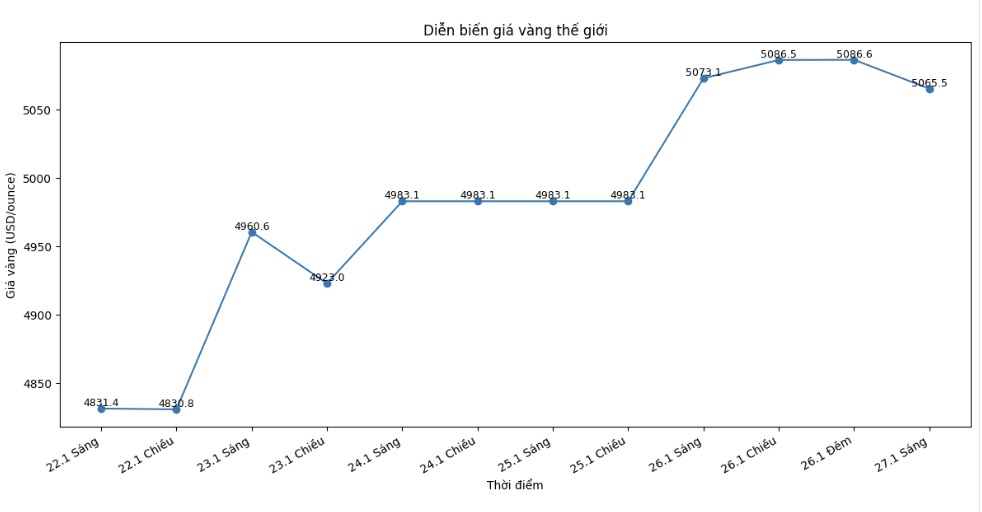

World gold price

At 6:40 PM, world gold prices were listed around the threshold of 5,087 USD/ounce; up 0.505 USD compared to the previous day.

Gold price forecast

World gold prices fluctuate just below the threshold of 5,100 USD/ounce - a price that was just broken for the first time in the previous trading session. Recently, the upward momentum of precious metals mainly came from the psychology of seeking safe haven assets, when the market faced many instabilities surrounding US President Donald Trump's policies.

According to Mr. Zain Vawda - an analyst at MarketPulse of OANDA, the fact that President Trump and the US administration are constantly changing their positions on tariffs, along with increasing concerns about the risk of military developments, is making it difficult for gold holding demand to cool down in the near future.

Since the beginning of 2026, gold prices have increased by about 18%, continuing the strong increase of 2025. The driving force for price increases comes from many factors, including the need for safe havens in the context of geopolitical and economic instability, expectations that the US Federal Reserve (Fed) will cut interest rates, along with strong gold buying activities by central banks" - Zain Vawda said.

Investors are focusing their attention on the Fed's policy meeting. It is expected that the Fed will keep interest rates unchanged, while the market is also closely monitoring information related to the possible successor to Chairman Jerome Powell.

On other precious metals markets, spot silver prices rose 8.4% to 112.57 USD/ounce, after setting a historic peak of 117.69 USD in the previous session. Since the beginning of the year, silver prices have increased by more than 50%.

Meanwhile, spot platinum prices fell 2.5% to $2,689.12/ounce, after reaching a record high of $2,918.80 in the previous session. Palladium prices rose 3.3%, to $2,048.28/ounce.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...

It's a bit of a bit of a bit of a bit of a bit of a bit.