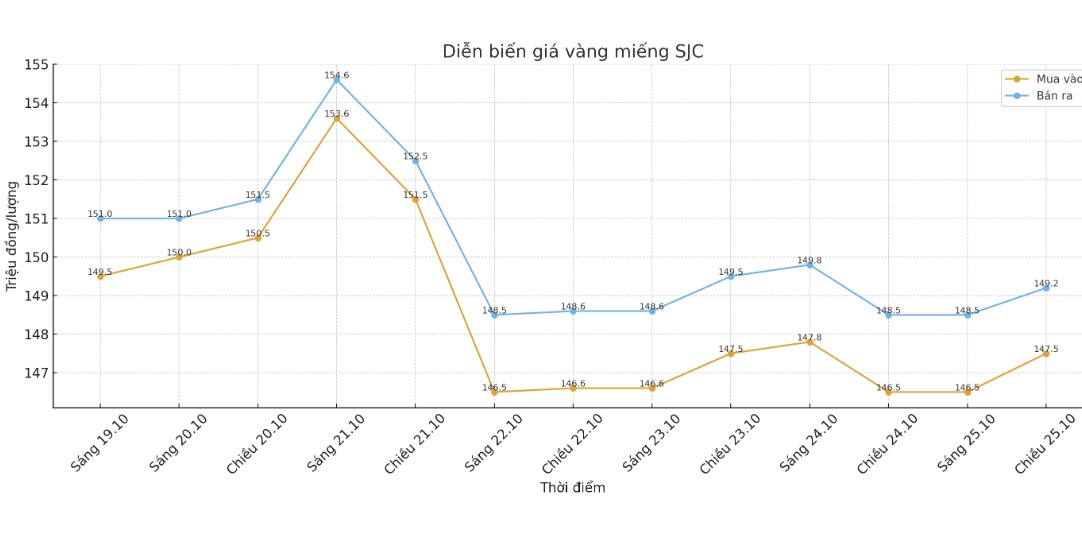

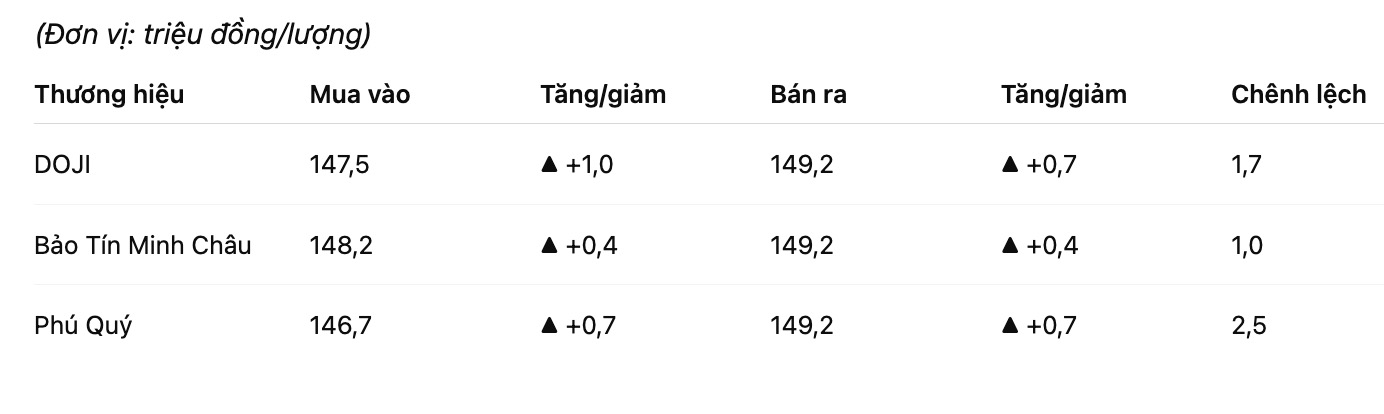

SJC gold bar price

As of 5:00 p.m., DOJI Group listed the price of SJC gold bars at 147.5-149.2 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 700,000 VND/tael for selling. The difference between buying and selling prices is at 1.7 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.2-149.2 million VND/tael (buy in - sell out), an increase of 400,000 VND/tael in both directions. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 146.79.2 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

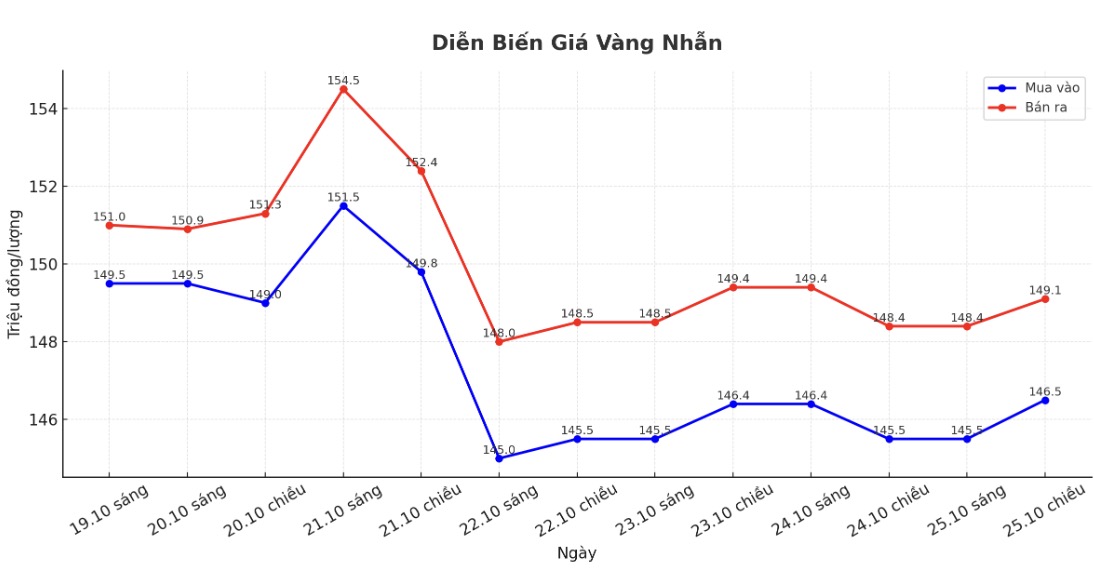

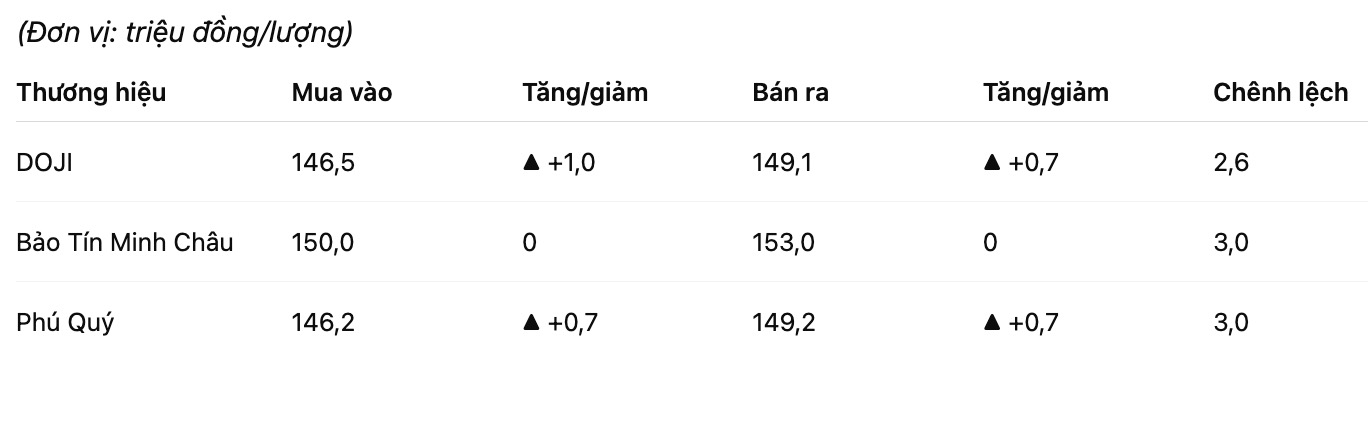

9999 gold ring price

As of 5:00 p.m., DOJI Group listed the price of gold rings at 146.5-149.1 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 700,000 VND/tael for selling. The difference between buying and selling is 2.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 146.2-149.2 million VND/tael (buy - sell), an increase of 700,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

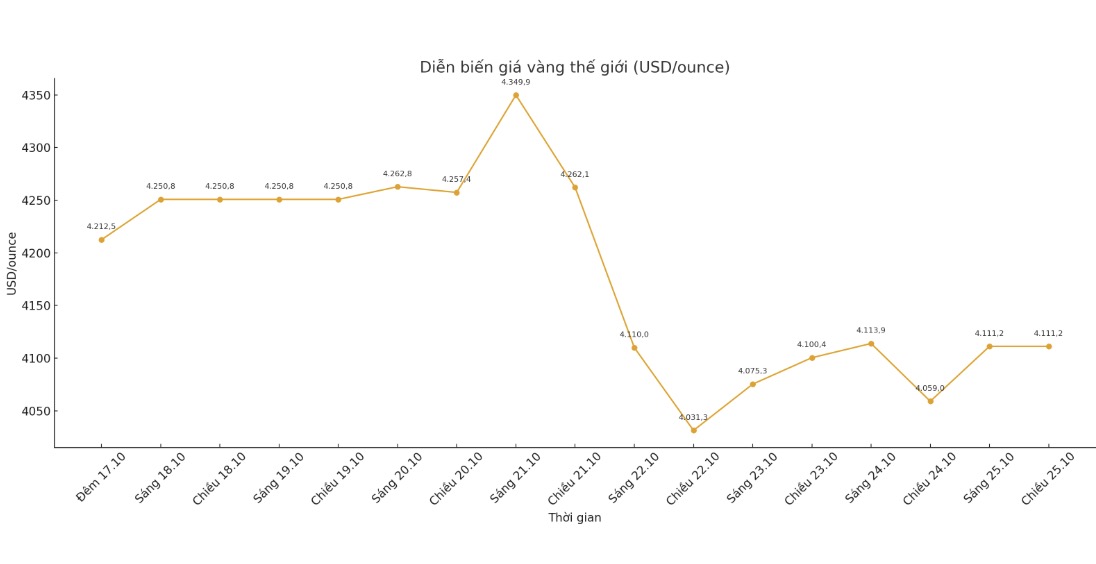

World gold price

The world gold price was listed at 5:50 p.m. at 4,111.2 USD/ounce, up 52.2 USD compared to a day ago.

Gold price forecast

Gold prices narrowed down in the trading session on October 25, after lower-than-expected US inflation data reinforced expectations that the US Federal Reserve (FED) would cut interest rates next week. However, the precious metal still recorded its first week of decline after 10 consecutive weeks of increase.

Gold and silver increased as the US core CPI in September was lower than expected, but that is probably not enough to erase sell-off this week. Market developments show that gold, especially silver, may continue to decline before entering the sideways phase, said Mr. Tai Wong, an independent metals trader.

Data from the US Department of Labor showed that the consumer price index (CPI) for the 12 months up to September increased by 3%, lower than the forecast of 3.1% by economists. Traders have almost bet on the Fed cutting interest rates at next weeks meeting, and expect another cut in December.

Low interest rates help reduce the opportunity cost of holding non-yielding assets such as gold.

Meanwhile, the White House confirmed that US President Donald Trump will meet with Chinese President Xi Jinping next week, before the deadline for November 1 to impose additional tariffs on Chinese goods.

If gold breaks through the $4,000/ounce mark, the market could see a deeper sell-off, with the next support zone around $3,850/ounce, said Mr. Phillip Streible, chief strategist at Blue Line Futures.

Mark Leibovit - publisher of VR Metals/Resource Letter newsletter - said that gold prices next week are likely to move sideways. Because there was no clear signal to buy or sell, he decided to stay on the sidelines and monitor market developments further.

Mr. Alex Kuptsikevich - senior analyst at FxPro - commented that gold prices will continue to decline next week, even lasting for many weeks: "Thursday was the strongest sell-off in 12 years. In the 21st century, there have only been 6 times when gold has fallen more than 3% in a session and then typically fell an average of 18% per month.

He compared it to the 2020 cycle when gold hit a peak and then entered a 30-week correction series: The newly established high level could become a price ceiling for the next few years, and could even repeat the 2011 scenario with a four-year downward market.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...