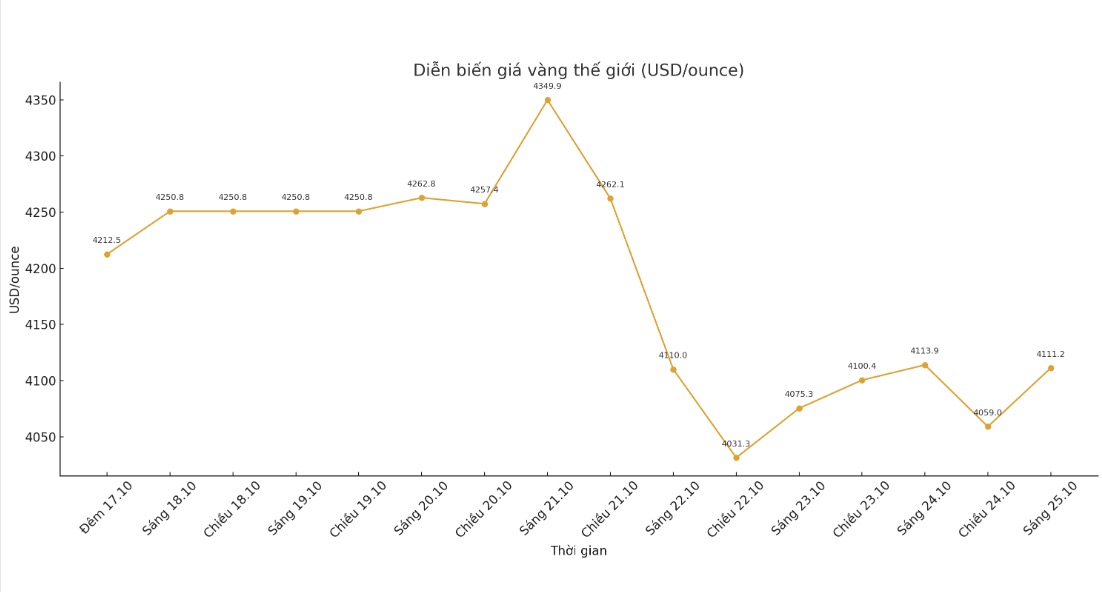

Gold prices narrowed down in the trading session on October 25, after lower-than-expected US inflation data reinforced expectations that the US Federal Reserve (FED) would cut interest rates next week. However, the precious metal still recorded its first week of decline after 10 consecutive weeks of increase.

US gold futures for December ended the session down 0.2%, to $4,137.8/ounce. Overall, world gold prices have fallen more than 3% for the whole week.

Gold and silver increased as the US core CPI in September was lower than expected, but that is probably not enough to erase sell-off this week. Market developments show that gold, especially silver, may continue to decline before entering the sideways phase, said Mr. Tai Wong, an independent metals trader.

Earlier this week, spot gold set a new record of $4,381.21/ounce, but fell more than 6% due to profit-taking and signs of cooling down US-China trade tensions, weakening demand for shelter.

Spot silver prices fell 0.6% to $48.65 an ounce, heading for a week of more than 6%.

Data from the US Department of Labor showed that the consumer price index (CPI) for the 12 months up to September increased by 3%, lower than the forecast of 3.1% by economists.

Traders have almost bet on the Fed cutting interest rates at next weeks meeting, and expect another cut in December.

Low interest rates help reduce the opportunity cost of holding non-yielding assets such as gold.

Meanwhile, the White House confirmed that US President Donald Trump will meet with Chinese President Xi Jinping next week, before the deadline for November 1 to impose additional tariffs on Chinese goods.

If gold breaks through the $4,000/ounce mark, the market could see a deeper sell-off, with the next support zone around $3,850/ounce, said Mr. Phillip Streible, chief strategist at Blue Line Futures.

Since the beginning of the year, gold has increased by 55% thanks to geopolitical and trade tensions, strong buying from central banks and expectations of the FED reducing interest rates.

For other precious metals, platinum prices fell 1% to $1,608.77/ounce; palladium fell 0.5%, down to $1,450.05/ounce.

See more news related to gold prices HERE...