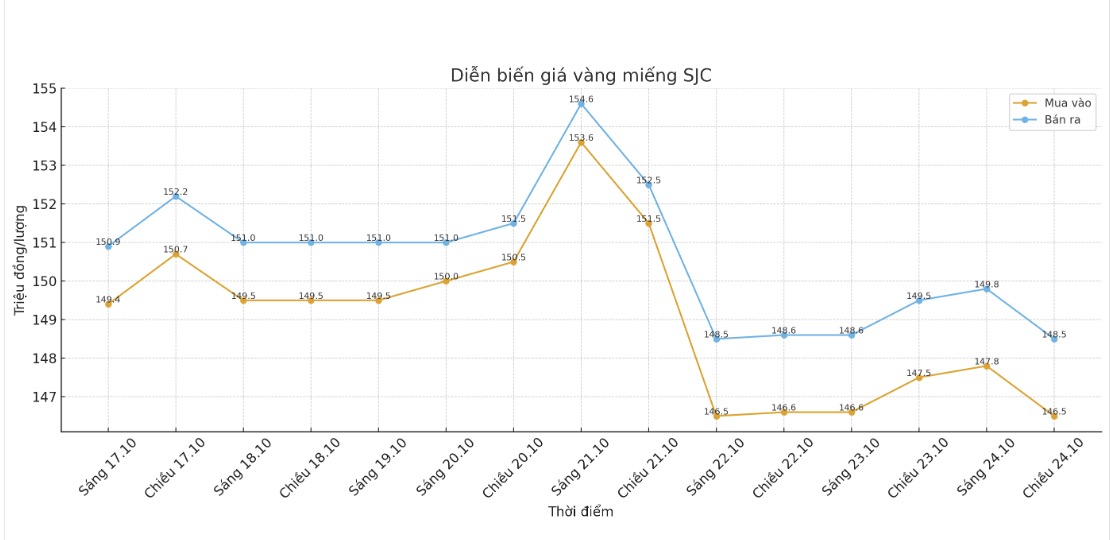

SJC gold bar price

As of 7:00 p.m., DOJI Group listed the price of SJC gold bars at 146.5-148.5 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.8-148.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and a decrease of 700,000 VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146-148.5 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

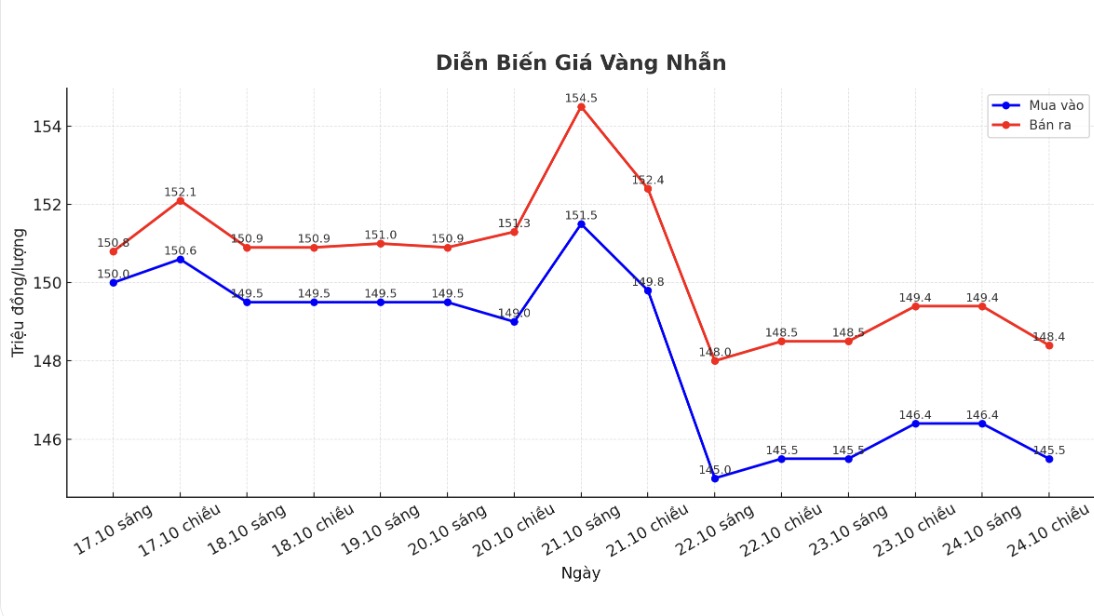

9999 gold ring price

As of 7:00 p.m., DOJI Group listed the price of gold rings at 145.5-148.4 million VND/tael (buy - sell), down 900,000 VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling is 2.9 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.5-148.5 million VND/tael (buy - sell), down 1 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

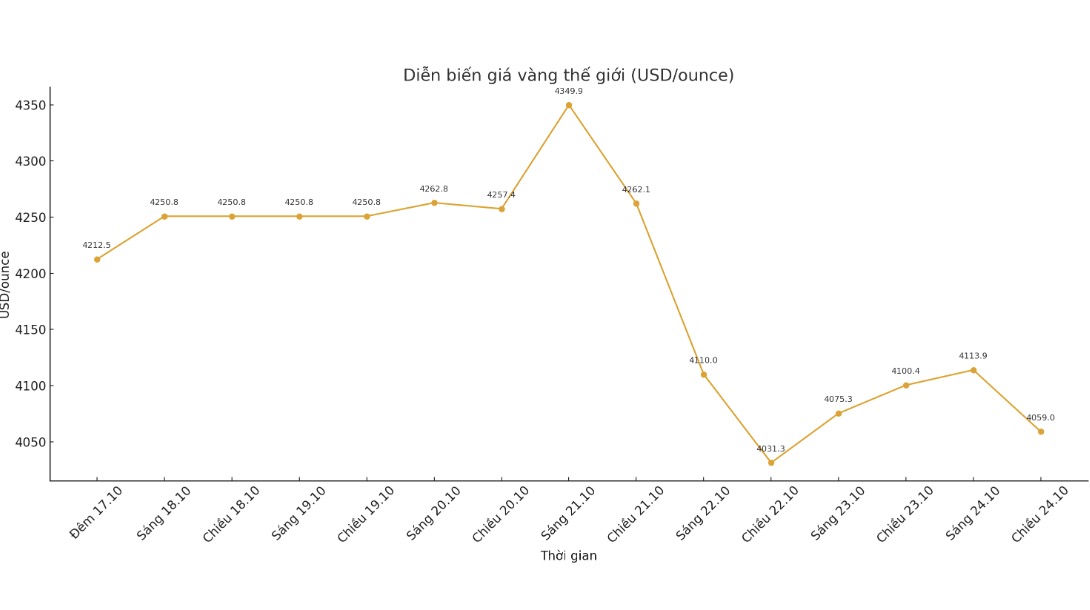

World gold price

The world gold price was listed at 7:00 p.m. at 4,059 USD/ounce, down 41.4 USD compared to a day ago.

Gold price forecast

Gold prices fell in the trading session on Friday and are heading for the first week of decline after 10 consecutive increases, under pressure from the strengthening of the USD and the move to close the position of investors before the US released an important inflation report on the day.

Mr. Tim Waterer - Head of Market Analysis at KCM Trade - commented: "The meeting between US and Chinese leaders is likely to help cool down trade tensions, thereby supporting the USD and somewhat weakening the demand for shelter for gold".

The White House confirmed that US President Donald Trump will meet with Chinese President Xi Jinping during his trip to Asia next week, reducing doubts about the possibility of the meeting being canceled amid rising trade tensions.

The focus of the market is currently the US Consumer Price Index (CPI) report, which is expected to show core inflation remaining at 3.1% in September. The report was delayed due to the US government's shutdown.

Investors have almost completely priced in the possibility that the Federal Reserve (FED) will cut interest rates by another 25 basis points at its meeting next week

Even with a short-term correction, the upward trend in gold is still very clear, supported by strong fundamentals, said Russell Shor, senior analyst at Tradu.

Investors still predict the FED will cut interest rates by another 25 basis points at next week's meeting. Lower interest rates typically support gold prices due to the decrease in the cost of non-yielding property.

Despite the decline in gold prices, JP Morgan analysts predict that gold prices could average $5,055/ounce in the fourth quarter of 2026.

Gold continues to be our most confident asset this year, and we expect room for price increases as the market enters the Fed rate cutting cycle, said Ms. Natasha Kaneva, Head of Global Commodity Strategy at JP Morgan.

Mr. Gregory Shearer - Head of Basic Metals and Quarter metals Strategy - said that the gold price increase prospects are supported by "the Fed's interest rate cutting cycle accompanied by concerns about stagnant inflation, concerns about the Fed's independence and the need to defend against the risk of currency depreciation".

Analysts also said that the recent correction is a positive signal. The price decline reflects that the market is digesting the gains too quickly since August, Kaneva explained.

Its normal to worry about big fluctuations... The story is very clear: there are too many buyers, and almost no sellers, she said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...