Gold prices fell in the trading session on Friday and are heading for the first week of decline after 10 consecutive increases, under pressure from the strengthening of the USD and the move to close the position of investors before the US released an important inflation report on the day.

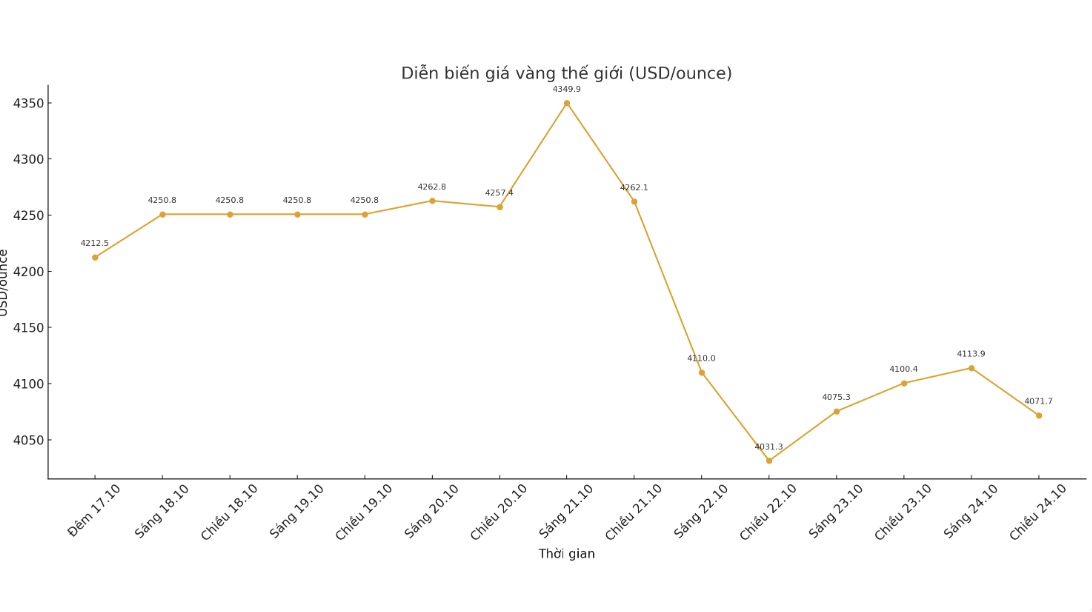

Spot gold fell 0.9% to $4,086.46 an ounce at 6:33 a.m. GMT. Since the beginning of the week, gold prices have lost 3.8%, heading for the strongest weekly decline since November 2024.

US gold futures for December fell 1.1%, to $4,101.8/ounce.

USD Index (.DXY) rose for the third consecutive session against major currencies, making gold more expensive for holders of other currencies.

Mr. Tim Waterer - Head of Market Analysis at KCM Trade - commented: "The meeting between US and Chinese leaders is likely to help cool down trade tensions, thereby supporting the USD and somewhat weakening the demand for shelter for gold".

The White House confirmed that US President Donald Trump will meet with Chinese President Xi Jinping during his trip to Asia next week, reducing doubts about the possibility of the meeting being canceled amid rising trade tensions.

The focus of the market is currently the US Consumer Price Index (CPI) report, which is expected to show core inflation remaining at 3.1% in September. The report was delayed due to the US government's shutdown.

Investors have almost completely priced in the possibility that the Federal Reserve (FED) will cut interest rates by another 25 basis points at its meeting next week

Even with a short-term correction, the upward trend in gold is still very clear, supported by strong fundamentals, said Russell Shor, senior analyst at Tradu.

Investors still predict the FED will cut interest rates by another 25 basis points at next week's meeting. Lower interest rates typically support gold prices due to the decrease in the cost of non-yielding property.

Normally, gold tends to increase in price in a low interest rate environment, because the opportunity cost of holding non-yielding assets such as gold will decrease

USD Index increased by 0.6% for the week, making gold more expensive for holders of other currencies.

In other precious metals markets, spot silver fell 1.6% to $48.13 an ounce and was on track for its worst week since March, falling 7.2% to date. platinum prices fell 1.1% to $1,610.59/ounce, while palladium lost 3.8% to $1,401.18/ounce.

See more news related to gold prices HERE...