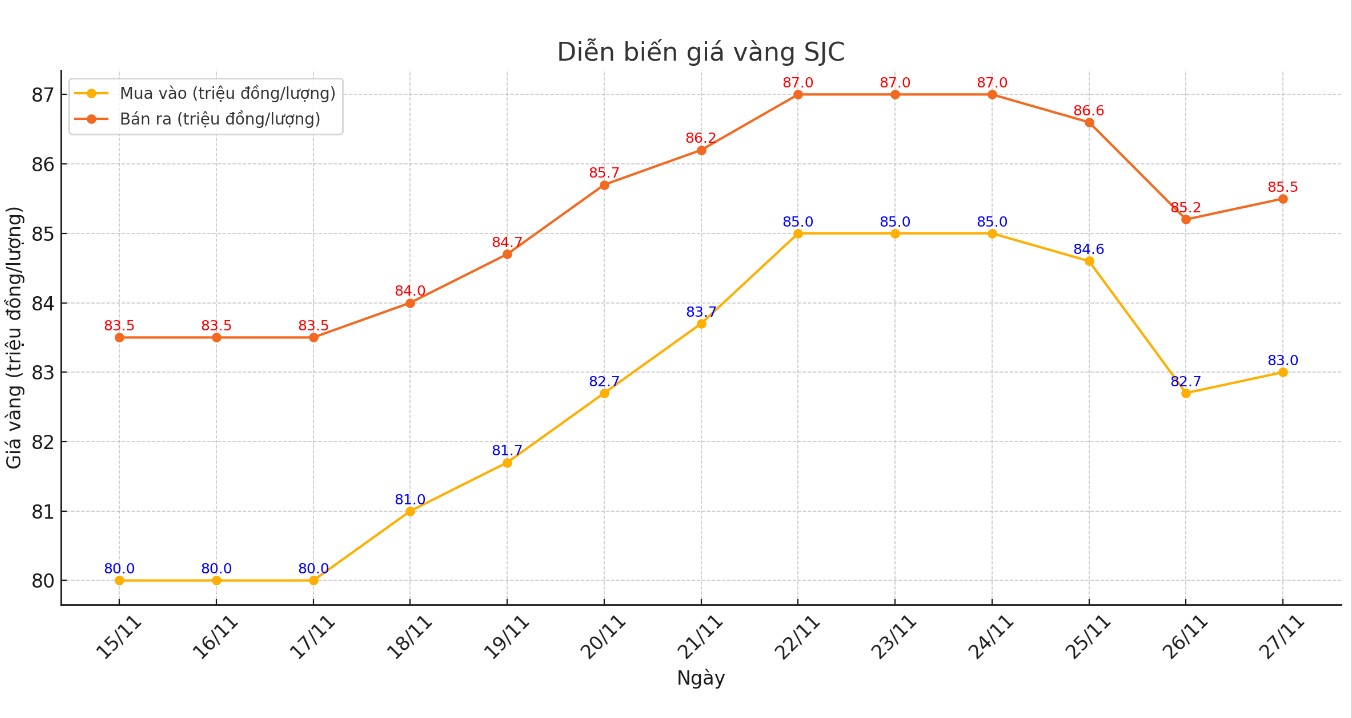

Update SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by DOJI Group at 83-85.5 million VND/tael (buy - sell).

Compared to the close of the previous trading session, gold price at DOJI increased by 300,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83-85.5 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC increased by 300,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 83-85.5 million VND/tael (buy - sell), unchanged.

Compared to the close of the previous trading session, gold price at Bao Tin Minh Chau increased by 200,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

The difference between buying and selling gold prices is listed at around 2 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

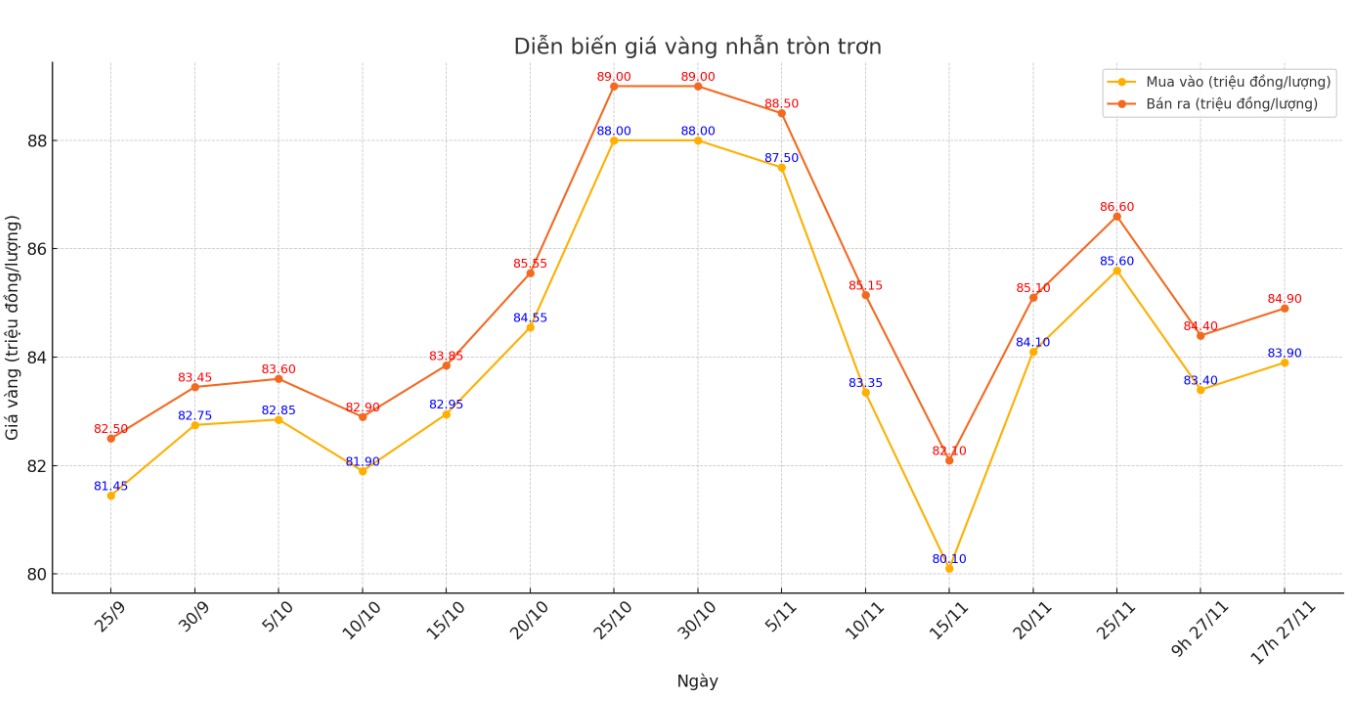

Price of round gold ring 9999

As of 5:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.9-84.9 million VND/tael (buy - sell), an increase of 1.6 million VND/tael for buying and an increase of 1.5 million VND/tael for selling compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 82.98-84.98 million VND/tael (buy - sell); increased by 750,000 VND/tael for buying and increased by 550,000 VND/tael for selling.

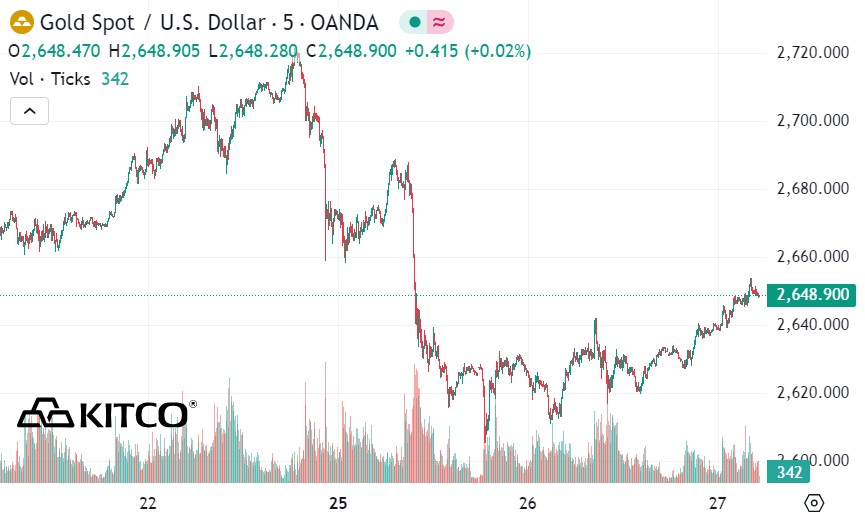

World gold price

As of 5:00 p.m., the world gold price listed on Kitco was at 2,648.9 USD/ounce, up 16.3 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices increased in the context of the USD index decreasing. Recorded at 5:00 p.m. on November 27, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.417 points (down 0.52%).

Markets are buzzing about the possibility that US President-elect Donald Trump will broker a ceasefire between Russia and Ukraine, two possibilities that are bringing risk appetite back into the market.

The minutes of the Federal Reserve’s November meeting, just released, provided important information on the new economic outlook. Fed officials expressed increased confidence in the direction of the economy, especially regarding inflation and the labor market. The minutes showed that policymakers believed inflation was moving closer to the Fed’s 2% target and assessed the current labor market as strong.

These observations have important implications for monetary policy. The Federal Open Market Committee (FOMC) voted unanimously to cut its benchmark interest rate by another quarter of a percentage point, bringing the target range down to 4.5%-4.75%.

Market expectations remain divided on the likelihood of future rate cuts, with the CME FedWatch tool showing a 63.1% chance of another rate cut at the December meeting.

The economic landscape is further complicated by potential policy changes from the new administration. President-elect Donald Trump’s proposed economic strategies, including imposing significant tariffs on imports from Canada, Mexico and China, are drawing the attention of financial analysts.

Saxo Bank said that Mr Trump's plans for tariffs, tax cuts and deportations could cause high inflation, making gold an attractive safe-haven asset for investors seeking protection against economic uncertainty.

See more news related to gold prices HERE...