Gold price reverses to increase

Gold and silver prices rose slightly, snapping two sessions of declines, as investors bought into the dip, according to Kitco. However, heightened risk aversion earlier this week is expected to limit gains in the safe-haven metals.

Earlier in the week, reports that Israel and Hamas may be close to a ceasefire prompted many investors to take profits and reduce their long positions in the market. In addition, the market is also talking about the possibility that US President-elect Donald Trump will mediate a ceasefire between Russia and Ukraine. These two possibilities are bringing risk sentiment back into the market.

Stock markets were volatile after President-elect Donald Trump made trade tariff announcements late Monday, pledging to impose steep tariffs on three of America’s largest trading partners: Canada, Mexico and China.

The information was shared by Mr. Donald Trump on the social network Truth Social on November 25. Mr. Trump said that the first of many executive orders he will issue when he officially takes office as US president on January 20, 2025, is to impose a 25% tax on all goods from Mexico and Canada. This move will end the regional free trade agreement, according to NBC News.

European and Asian stock markets fell on the news. A headline on Bloomberg read: “Tariff Man is Back.”

Technical analysis

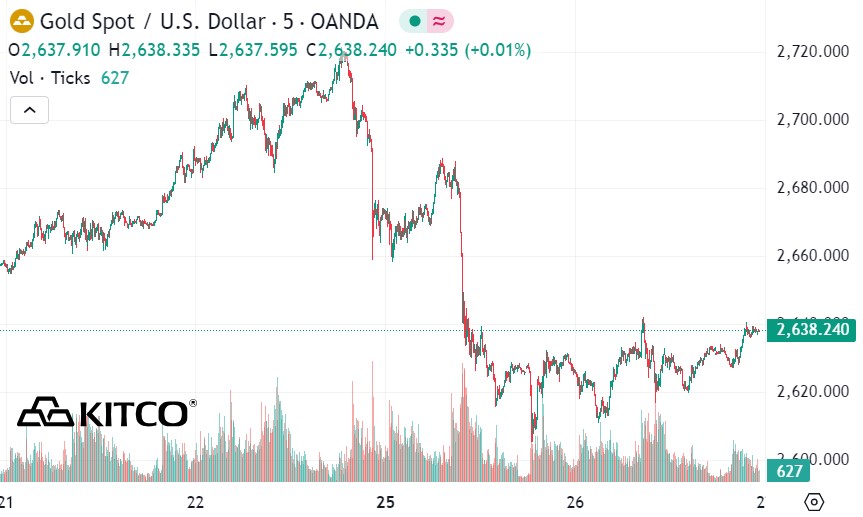

Gold December Futures: Both bulls and bears are in a balance in the short term. The next upside price target for bulls is a close above $2,723.20 an ounce. On the downside, the next downside price target for bears is a break below the support level of $2,600 an ounce.

In fact, the decline in gold prices in the first sessions of the week was beyond the expectations of most experts. With the trading week shortened due to the Thanksgiving holiday in the US, analysts predicted that trading volume would increase sharply at the beginning of the week. In the weekly survey of market experts by Kitco News, market experts also changed from pessimistic to strongly optimistic.

Of the 18 analysts who participated, 89% predicted that gold prices would rise this week. Similarly, in the online survey, 66% of individual investors also said that gold prices would continue to rise. However, given the geopolitical and economic developments in the world, gold prices are going against the forecast.

See more news related to gold prices HERE...