Update SJC gold price

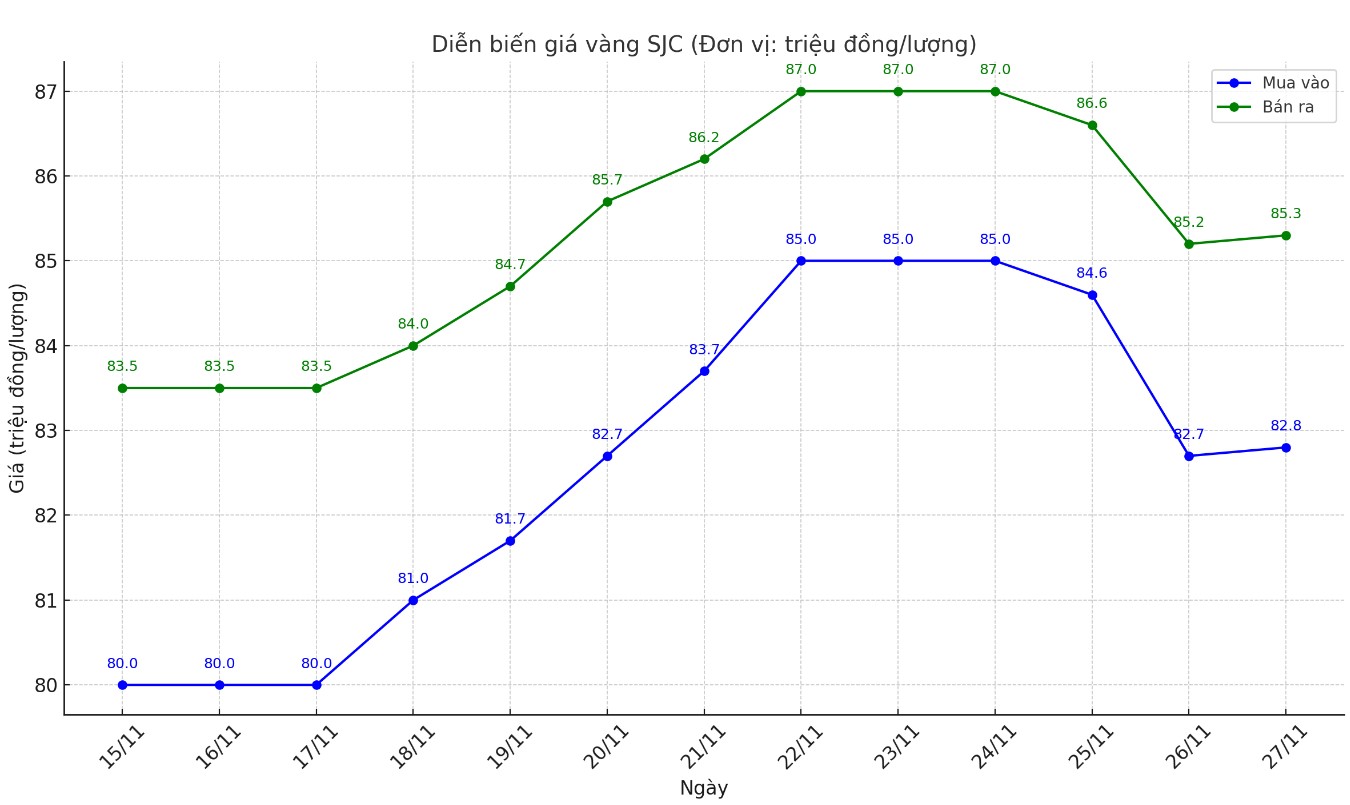

As of 9:40 a.m., the price of SJC gold bars was listed by DOJI Group at 82.8-85.3 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 82.8-85.3 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.8-85.3 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Although it has decreased compared to the previous trading session, this difference is still very high.

This price difference is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make profits, especially in the short term.

Price of round gold ring 9999

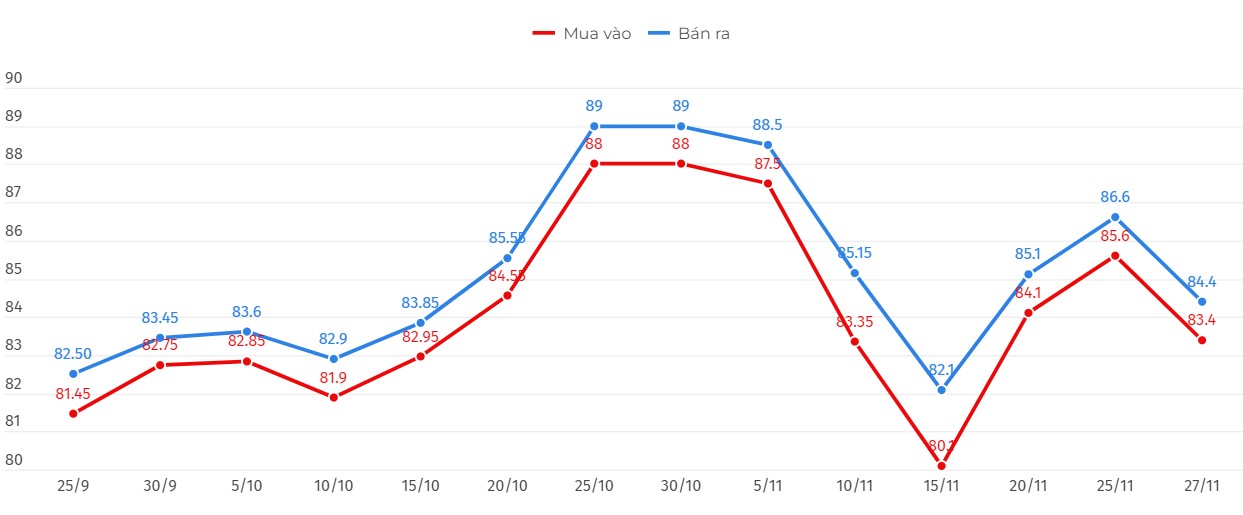

As of 9:40 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.4-84.4 million VND/tael (buy - sell); an increase of 1.1 million VND/tael for buying and unchanged for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.38-84.48 million VND/tael (buy - sell), down 350,000 VND/tael for buying and down 200,000 VND/tael for selling compared to early this morning.

World gold price

As of 9:40 a.m., the world gold price listed on Kitco was at 2,638.3 USD/ounce, up 12.1 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell amid the rising USD. Recorded at 9:40 a.m. on November 27, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.212 points (up 0.34%).

Despite the decline, world gold prices still maintained the level of 2,630 USD/ounce. Neils Christensen - analyst of Kitco News commented that gold prices are holding high as this precious metal continues to react to uncertain geopolitical changes related to the upcoming administration of President-elect Donald Trump.

However, one market analyst still expects gold's uptrend to continue through 2025. In a recent interview with Kitco News, Nitesh Shah, Head of Commodities & Macroeconomics Research at WisdomTree, said he expects the US dollar to weaken in 2025, creating favorable conditions for gold prices to rise.

He added that while Donald Trump's "America First" policies could support the dollar early next year, it will be difficult to maintain that momentum as government budget deficits continue to rise.

“It is very likely that public debt will increase and that will weaken the dollar,” he said.

At the same time, Shah noted that the Federal Reserve's easing cycle will help push bond yields lower, another positive factor for higher gold prices.

Minutes from the Fed’s November meeting, released today, provided important insights into the central bank’s economic outlook. Fed officials expressed growing confidence in the trajectory of the economy, particularly on inflation and the labor market. The minutes showed policymakers believed inflation was moving toward the Fed’s 2 percent target and that the labor market was currently strong.

These observations have important implications for monetary policy. Market expectations remain divided on the likelihood of future rate cuts, with the CME FedWatch tool predicting a 63.1% chance of another rate cut at the December meeting.

See more news related to gold prices HERE...