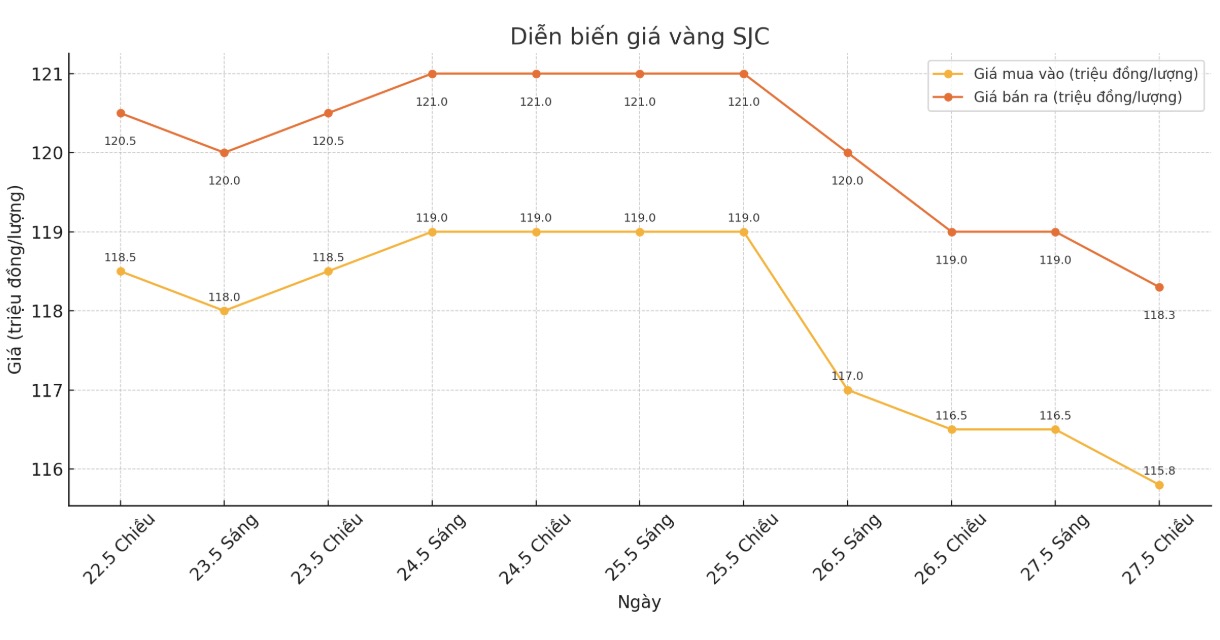

Updated SJC gold price

As of 5:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 115.8-118.3 million/tael (buy in - sell out), down VND 700,000/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115.8-118.3 million VND/tael (buy - sell), down 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115.8-118.3 million VND/tael (buy - sell), down 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 115.3-118.3 million/tael (buy in - sell out), down VND 700,000/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

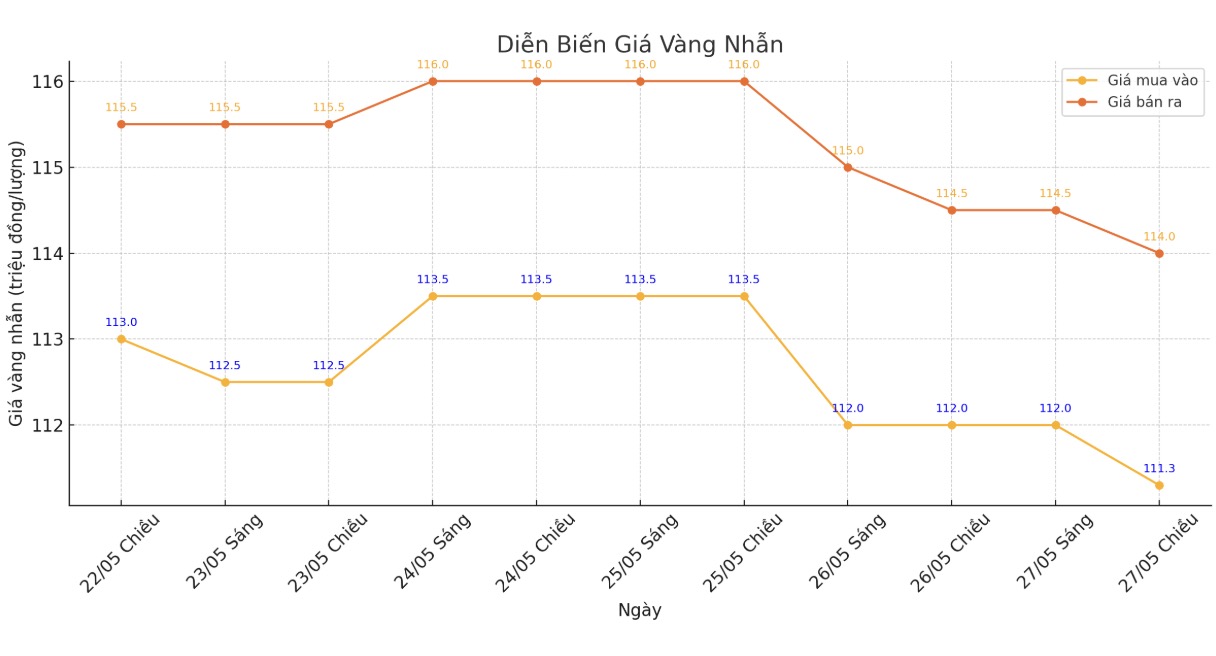

9999 round gold ring price

As of 5:15 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.3-114 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.8-116.8 million VND/tael (buy - sell), down 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5-114.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

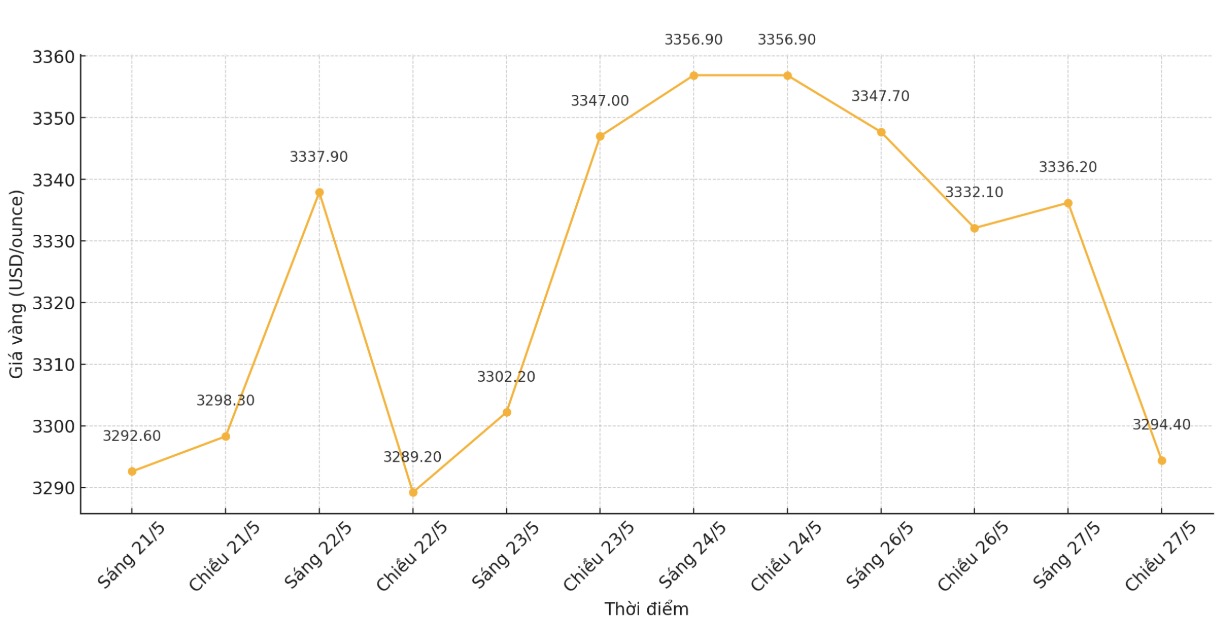

World gold price

At 5:15 p.m., the world gold price listed on Kitco was around 3,294.4 USD/ounce, down sharply by 37.7 USD/ounce.

Gold price forecast

According to Reuters, gold prices fell as the USD regained some of its previous decline, in the context of persistent concerns about US financial prospects and the waiting for important economic data, causing investors to be cautious about interest rate movements.

Kelvin Wong - senior analyst for the Asia Pacific region at OANDA - commented: "Currently, gold prices are showing an adjustment trend and the market is waiting for a new momentum. However, investors are also concerned about the widening US budget deficit, which is a factor supporting gold prices while putting pressure on the US dollar to weaken.

Meanwhile, the USD (.DXY index rebounded after hitting nearly a month's low in the previous session, making USD-denominated gold less attractive to investors using other currencies.

The US House of Representatives last week passed President Donald Trump's version of the tax cut bill, which is expected to add about $3.8 trillion to the total US government's total public debt of $26.2 trillion over the next 10 years, according to the Congressional Budget Office.

Meanwhile, Donald Trump has withdrawn his threat to impose a 50% tariff on imports from the European Union next month, postponing the deadline to July 9 to continue negotiations between Washington and the bloc of 27 countries.

Notable economic data this week

Tuesday: Long-term US orders, US consumer confidence, monetary policy decision of the Reserve Bank of New Zealand.

Wednesday: FOMC meeting minutes for May.

Thursday:Weekly jobless claims, preliminary Q1/2025 GDP, US pending home sales.

Friday: US PCE core inflation index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...