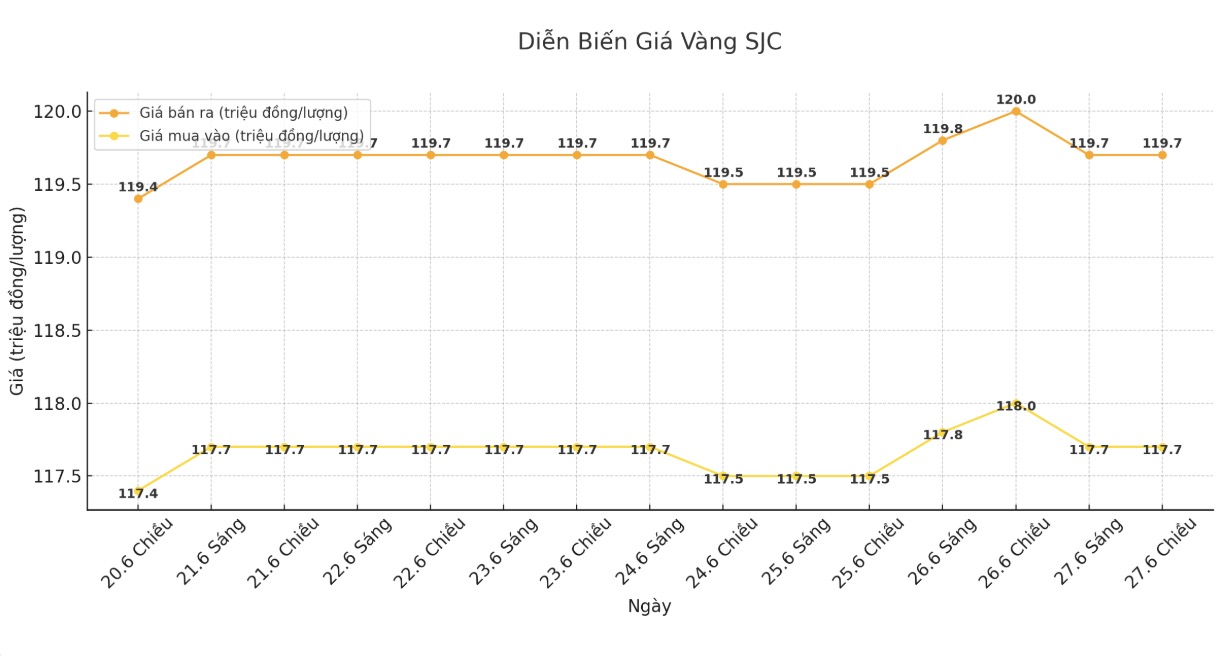

SJC gold bar price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.7 hydrologically 19.7 million VND/tael (buy in - sell out); down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 117.7 crore VND/tael (buy - sell); down VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-119 seven million VND/tael (buy in - sell out); down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.2-119 seven million VND/tael (buy in - sell out); kept the same for buying and decreased by 300,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

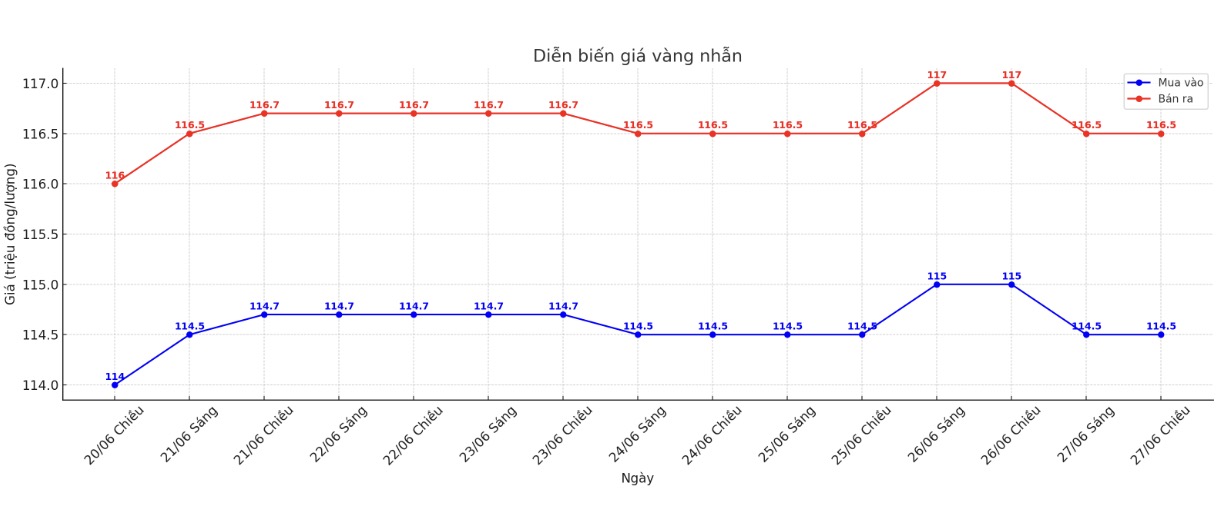

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at VND 114.5-116.5 million/tael (buy in - sell out), down VND 500,000/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.4-116.4 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

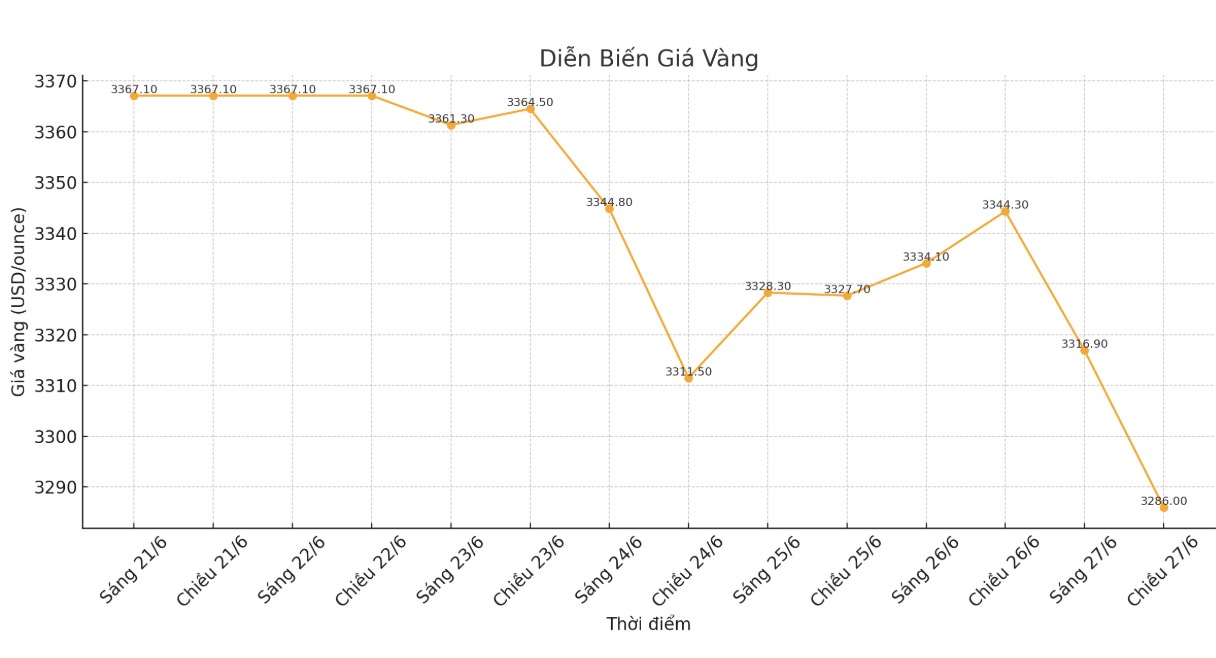

World gold price

The world gold price was listed at 6:10 p.m. at 3,286 USD/ounce, down 52.5 USD.

Gold price forecast

World gold prices fell sharply, losing the mark of 3,300 USD/ounce in the trading session on Friday. The precious metal is heading for its second consecutive week of decline.

Gold prices fell as a ceasefire between Israel and Iran and progress in US-China trade negotiations weakened safe-haven demand, as investors awaited US inflation data.

ANZ commodity strategist Soni Kumari commented that the market is showing some optimism about risky assets, which puts pressure on gold prices. She said that the tension in the Middle East eased after the ceasefire agreement and progress in US-China trade negotiations, reducing market uncertainty, dragging gold prices further down.

Iran and Israel have gradually returned to normal life after 12 days of the most intense confrontation ever between the two countries, with a ceasefire effective from Tuesday.

Meanwhile, the US has reached an agreement with China to accelerate shipments of rare earths to the US, a White House official said on Thursday, in an effort to end the trade war between the world's two largest economies.

Investors are waiting for the US PCE core inflation data to be released at 12:30 GMT for more clues on the policy direction of the US Federal Reserve (FED). Analysts surveyed by Reuters forecast that core PCE inflation this month will increase by 0.1% compared to the previous month and increase by 2.6% compared to the same period last year.

The market is now predicting that the FED will cut interest rates by a total of 63 basis points this year, starting in September.

US President Donald Trump believes that maintaining inflation at a low level means the Fed should soon cut policy interest rates, but so far only two Fed officials have supported the possibility of cutting interest rates at the July meeting.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...