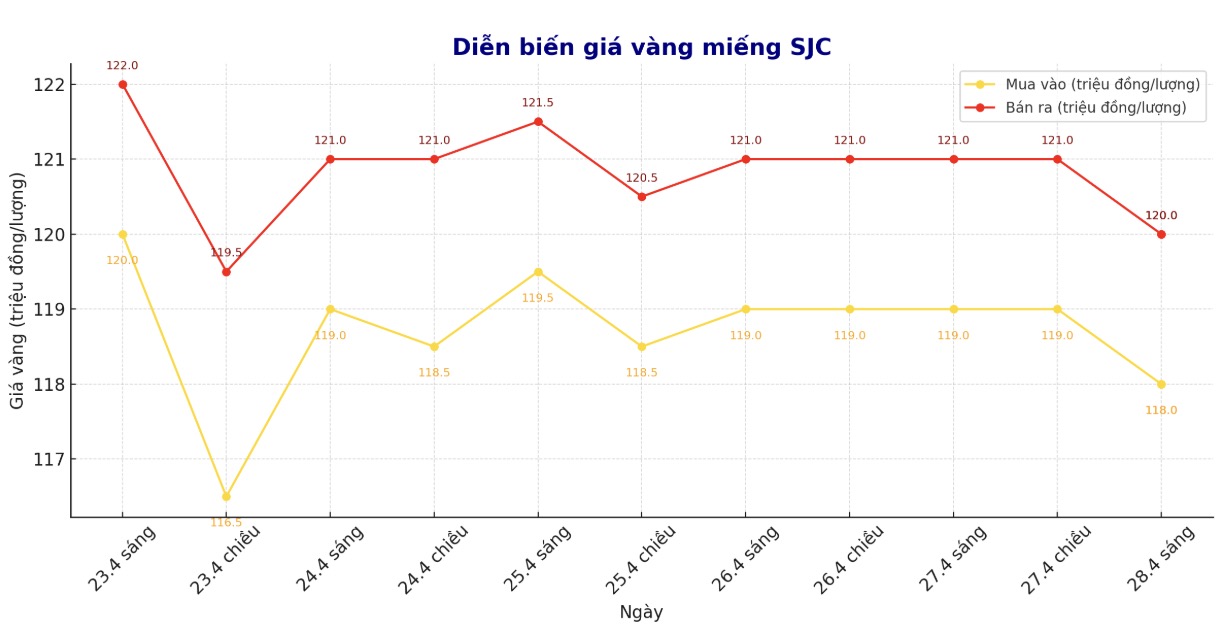

Updated SJC gold price

As of 9:20 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118-120 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-120.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118-120 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117.5-120 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

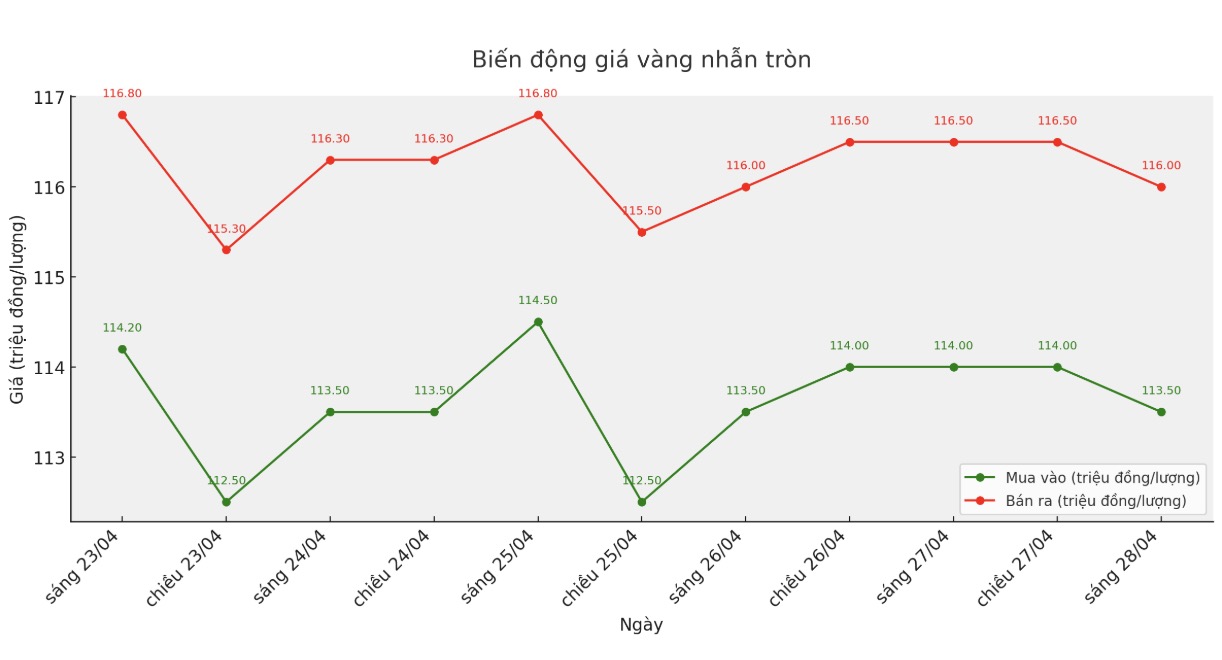

9999 round gold ring price

As of 9:20 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113.5-116 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

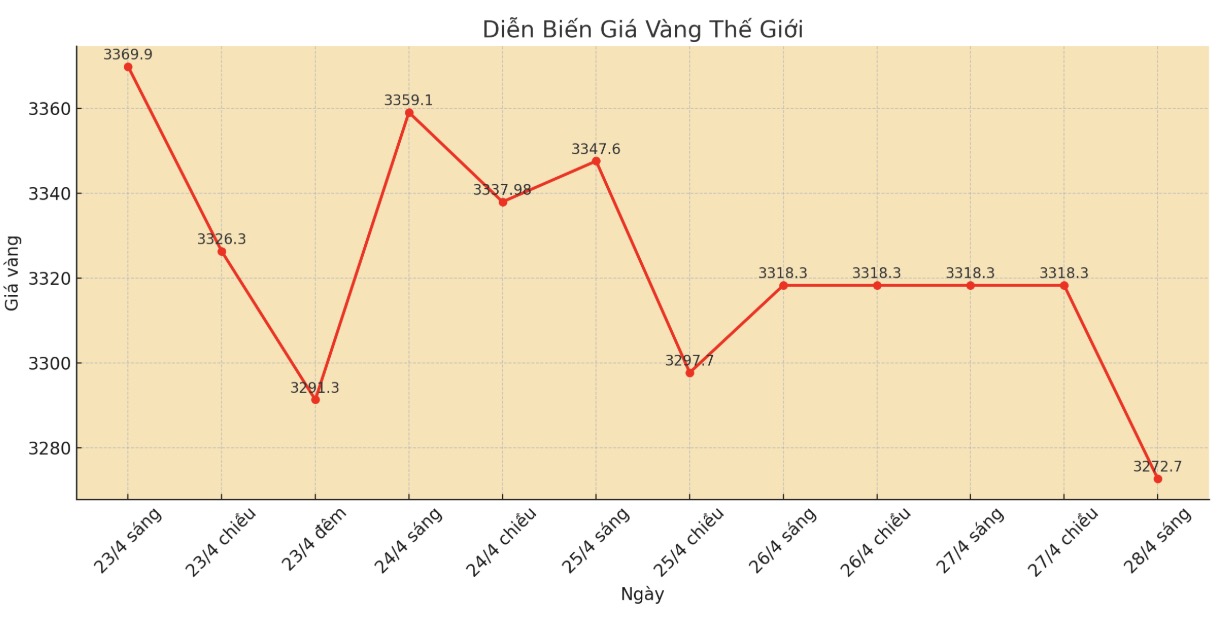

World gold price

At 9:30 a.m., the world gold price listed on Kitco was around 3,272.7 USD/ounce, down 45.6 USD.

Gold price forecast

Last week, gold prices fluctuated strongly when they exceeded 3,500 USD/ounce and then decreased by more than 90 USD due to the strengthening of the USD and the expectation of cooling down US-China tensions. Currently, world gold prices are falling sharply.

Many experts warn that gold prices may continue to decline in the short term because the prolonged sell-off has weakened the increase of this precious metal.

FxPro expert Alex Kuptsikevich said the risk of a price drop is increasing after gold increased sharply and quickly fell to 3,260 USD/ounce. He warned that if gold breaks through the $3,300/ounce mark, profit-taking could increase sharply, pulling prices below $3,000/ounce.

Kitco expert Jim Wyckoff also predicted that gold prices will continue to fall due to worsening technical charts and increased risk-off investment sentiment.

Bob Haberkorn - senior broker at RJO Futures - commented that gold prices may fall to $2,500/ounce but still maintain an upward trend in the long term. He said that gold prices are currently under pressure from optimism about the possibility of reaching a trade deal. Gold could fall below $3,200 an ounce, or even $3,180 an ounce, before bottom-fishing buying power appears.

Meanwhile, Frank Holmes - CEO of U.S. Global Investors - predicts that gold could reach 6,000 USD/ounce by the end of President Donald Trump's term, thanks to the wave of de-dollarization and China's increased gold purchases.

Gold is currently around $3,300/ounce after peaking at $3,509/ounce. JPMorgan predicts gold will reach $4,000/ounce in 12 months, but Holmes believes prices will increase if the central bank continues to hoard gold.

Important economic data for the week

Monday: Federal election in Canada.

Tuesday: New Employment ratio (JOLTS) and US Consumer Confidence Index.

Wednesday: ADP Employment Report, Preliminary Q1 GDP, US pending housing contracts; Japanese Central Bank monetary policy meeting.

Thursday:Weekly jobless claims and the US Manufacturing across Market Management Index (ISM Manufacturing PMI).

Friday: Non-farm Payrolls report in the US.

See more news related to gold prices HERE...