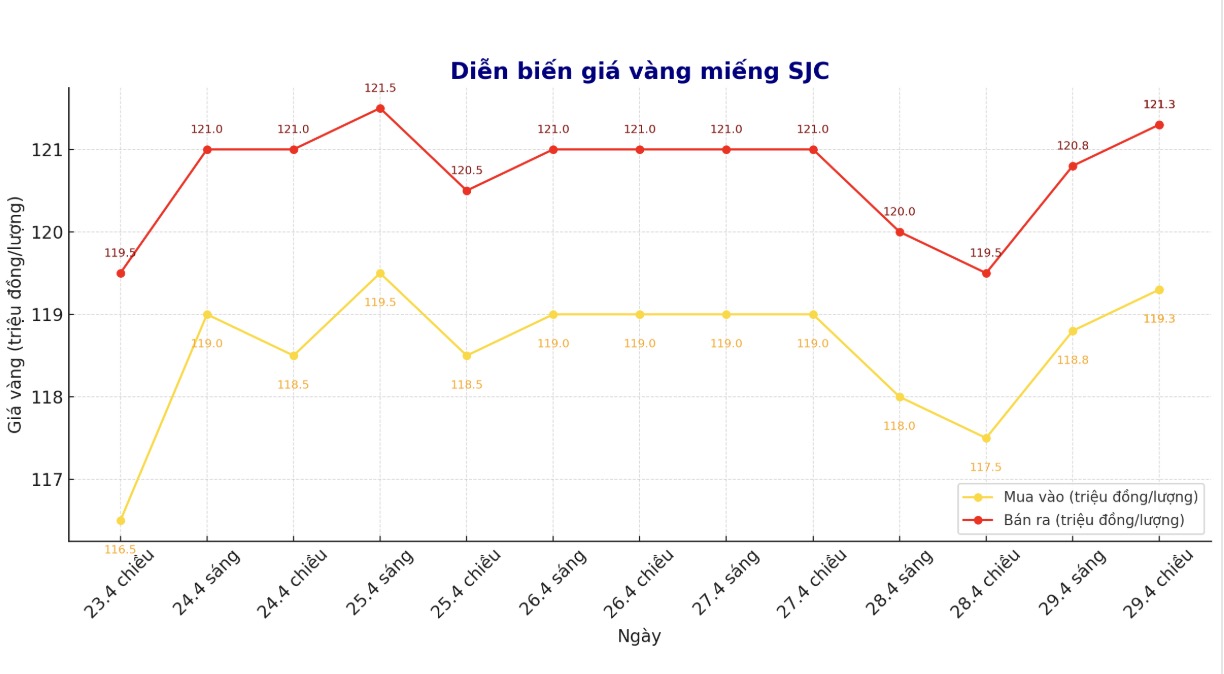

Updated SJC gold price

As of 4:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.3-121.3 million/tael (buy in - sell out), an increase of VND 1.8 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 119.3-121.3 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.3-121.3 million VND/tael (buy - sell), an increase of 1.8 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121.3 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for buying and an increase of 1.8 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

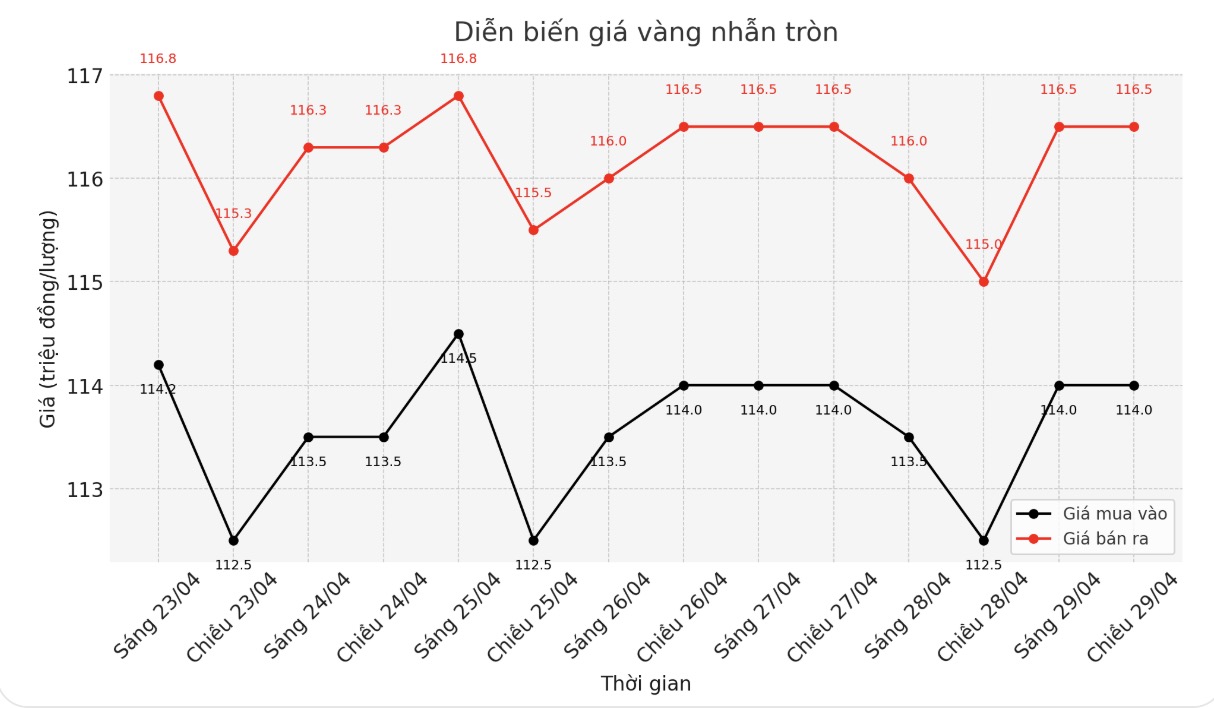

9999 round gold ring price

As of 16:35, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy in - sell out), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.1-120.1 million VND/tael (buy - sell), an increase of 1.4 million VND/tael for buying and an increase of 1.6 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

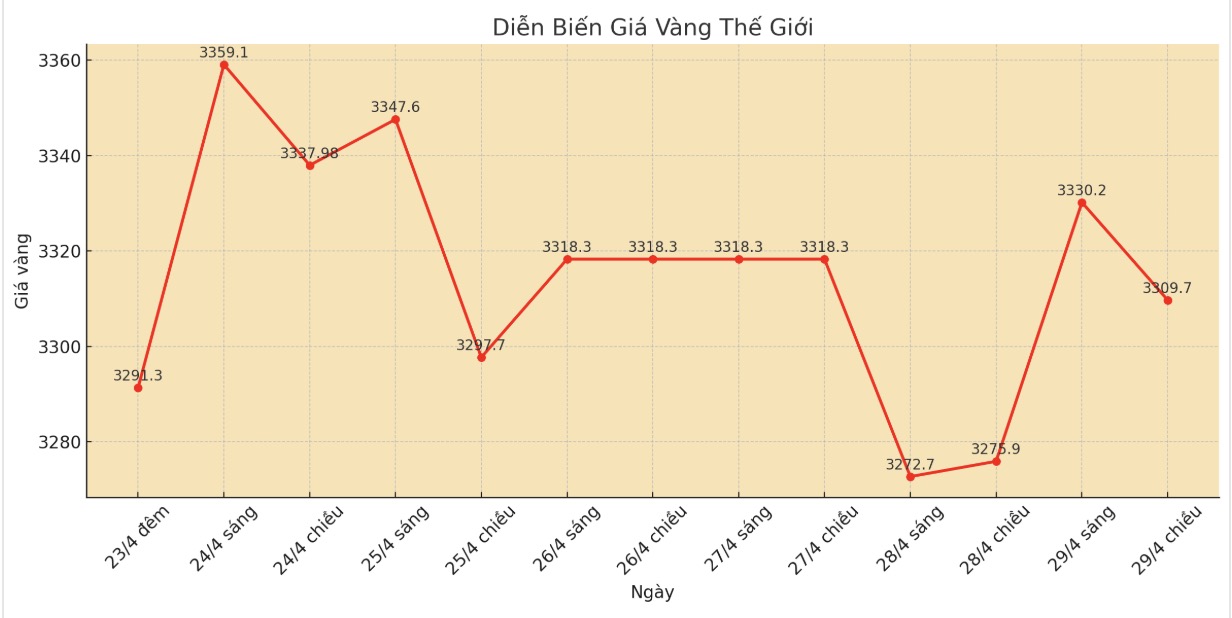

World gold price

At 4:50 p.m., the world gold price listed on Kitco was around 3,309.7 USD/ounce, up 33.8 USD.

Gold price forecast

World gold prices are under pressure as trade tensions between the US and major partners cool down, reducing the safe-haven attractiveness of the precious metal.

Its clear that the risk environment has improved recently, as the market is optimistic that the worst possible trade tensions are over, given the positive signals about trade deals, IGs market strategist Yeap Jun Rong said.

TD Securities commodity strategist Daniel Ghali said that gold selling pressure is depleted and the downside risk is currently at an extremely low level.

According to UBS analyst Giovanni Staunovo, the US Federal Reserve's (FED) still expected interest rate cuts later this year could prompt gold prices to retest the $3,500/ounce mark.

Meanwhile, Bob Haberkorn - senior commodity broker at RJO Futures - warned that the risk of gold being sold off still exists. He said that technical indicators show that gold prices may continue to decline, with the possibility of new buying power around 3,100 USD/ounce. In the coming time, gold prices may fluctuate in the current range and even fall below 3,200 USD/ounce.

Investors are waiting for US economic data to assess the policy direction of the US Federal Reserve (FED).

See more news related to gold prices HERE...