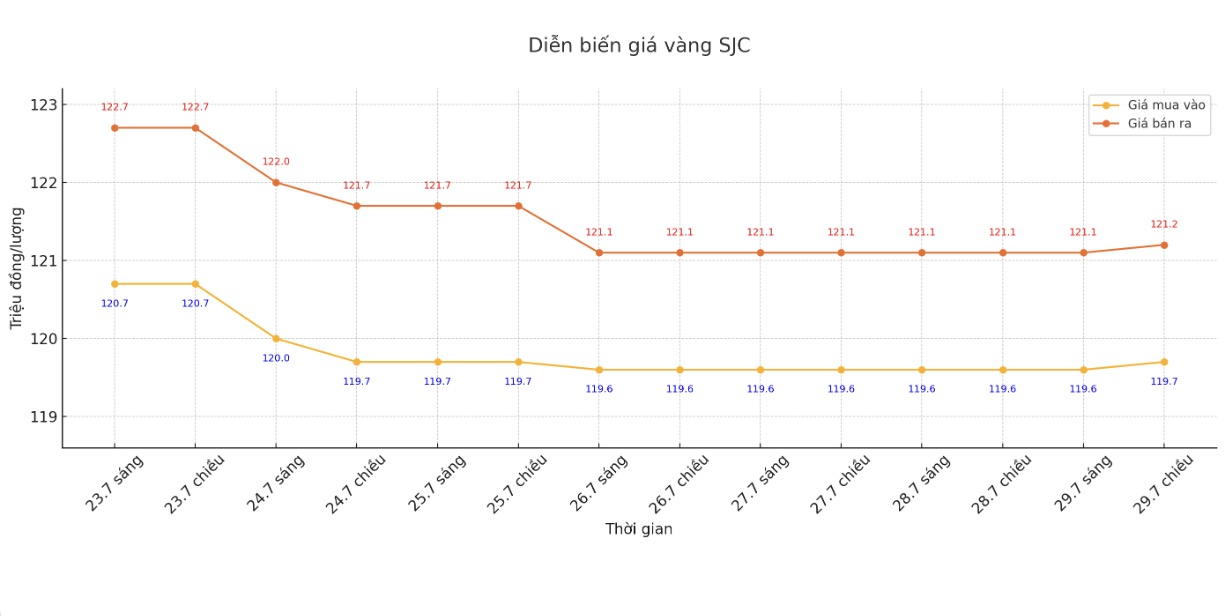

SJC gold bar price

As of 6:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.7-121.2 million/tael (buy in - sell out); increased by VND 100,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.7-121.2 million VND/tael (buy - sell); increased by 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.7-121.2 million VND/tael (buy - sell); increased by 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119.2-121.2 million VND/tael (buy - sell); increased by 400,000 VND/tael for buying and increased by 100,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

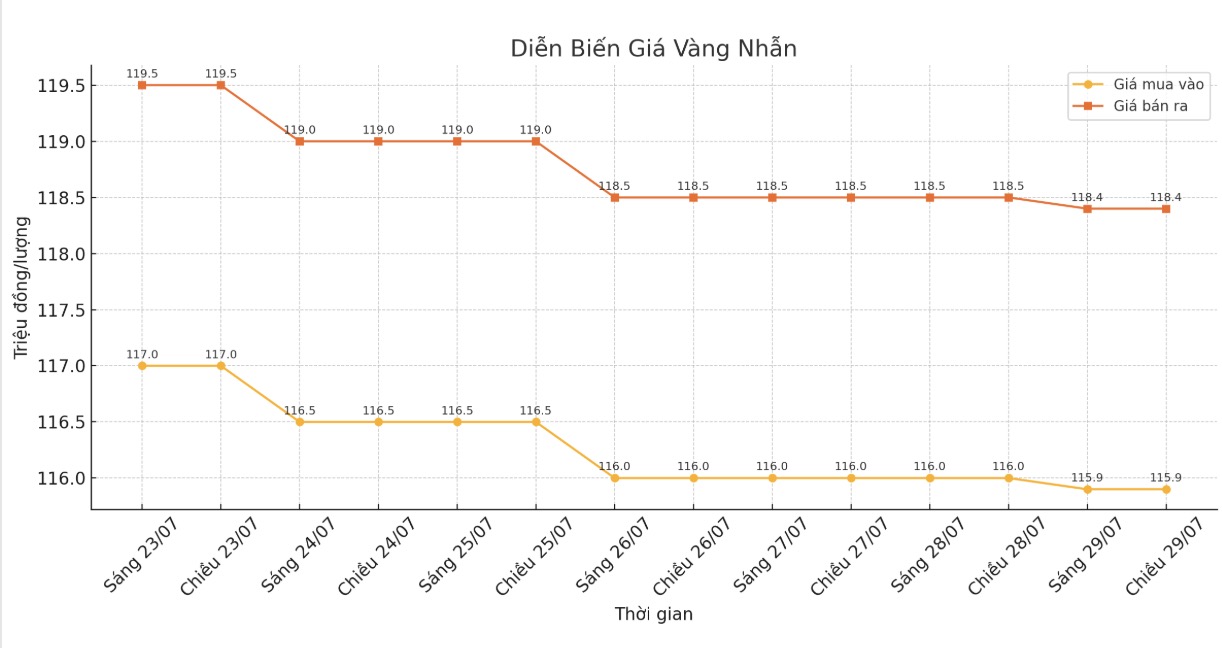

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 115.9-118.4 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.19.3 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115-118 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

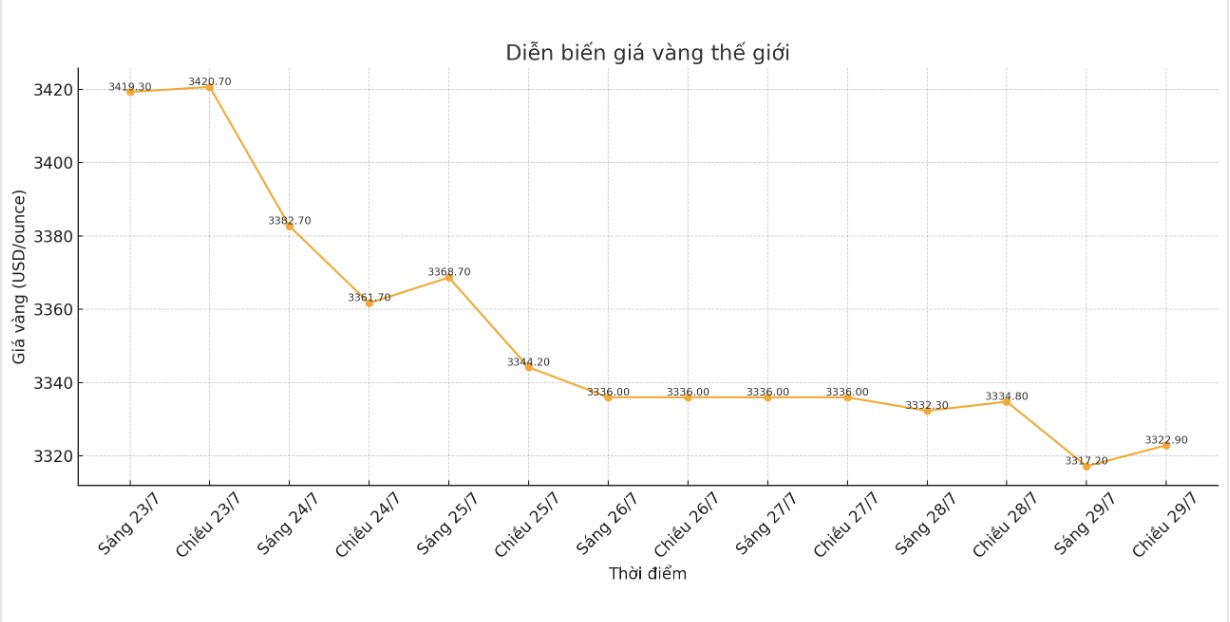

World gold price

The world gold price was listed at 6:00 p.m. at 3,322.9 USD/ounce, down 11.9 USD compared to 1 day ago.

Gold price forecast

Gold prices fell, hitting their lowest level in the past two weeks. Gold is under pressure from the soaring USD index. The rising price of the US dollar reduces the attractiveness of gold to international investors as gold becomes more expensive.

Over the weekend, the US and EU's agreement on a trade deal contributed to the increase in the price of the greenback. The two sides agreed to impose a 15% tax on some EU goods, much lower than the initial threat tax rate. This helps to somewhat ease concerns about the risk of a full-scale trade war.

Mr. Jigar Trivedi - senior commodity analyst at Reliance Securities - commented that the trade deal has been successful in easing concerns about economic conflicts between the superpowers. This often leads to downward pressure on gold prices, as gold is considered a safe haven asset in the context of instability.

Although gold prices are constantly correcting, analysts are still optimistic that this precious metal will remain above the $3,000/ounce mark thanks to safe-haven demand.

A survey by an international news agency with 40 analysts and traders recorded the forecast of a gold price trungential in 2025 of 3,220 USD/ounce, up from three months ago. The forecast for 2026 is also raised to $3,400/ounce.

Since the beginning of the year, gold prices have increased by 27%, peaking at 3,500 USD/ounce in April in the context of the US - China facing trade, pushing investors to seek safe assets.

Gold is not just a hedge, its a signal, says David Russell from GoldCore. He said prices could reach $4,000 an ounce by the end of 2026 if concerns about the US fiscal continue to rise.

The market is currently affected by uncertainty related to trade milestones and huge spending under the "One Big Beautiful Bill" law, causing US public debt to increase by 3,300 billion USD. According to Carsten Menke at Julius Baer, gold is in a short-term accumulation phase due to a lack of a clear catalyst to re-establish momentum.

Analysts also emphasized the role of central banks in supporting gold prices. China has increased its gold reserves for 8 consecutive months.

A ECB survey shows that nearly 40% of central banks buy gold to hedge against geopolitical risks and reduce dependence on the USD in the context of an increasingly Polar world.

Economic data to watch this week

Tuesday: New employment numbers (JOLTS), US consumer confidence.

Wednesday: ADP employment data, US preliminary GDP, Bank of Canada monetary policy decision, pending home sales, FED interest rate decision, Bank of Japan decision.

Thursday: US PCE, weekly jobless claims.

Friday: US non-farm payrolls, ISM manufacturing PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...