The US reached a trade framework agreement with the EU in Scotland on Sunday, which imposed a 15% import tax on most EU goods at half of the previous threat level, thereby avoiding a larger-scale trade war.

Risk-off sentiment has spread in the financial market, with European stocks rising to a four-month high, led by auto and pharmaceutical stocks.

At the same time, talks between the US and China are scheduled to take place on Monday in Stockholm, amid expectations that the world's two largest economies will continue to extend the trade ceasefire agreement for another 90 days.

There are two opposing factors that are keeping gold prices in a state of balance. The US-EU trade deal reduces demand for safe-haven assets, said UBS commodity analyst Giovanni Staunovo.

However, this deal also partly reduces inflation uncertainty for the US Federal Reserve (FED), which could facilitate the Feds rate cuts later in the year which is typically in the interest rate of gold, he added.

Investors are now shifting their attention to the Fed's policy meeting this weekend.

The Fed is expected to keep the benchmark interest rate unchanged at around 4.25% - 4.50% after a two-day policy meeting ended on Wednesday. The market is still pricing in the possibility of a rate cut in September.

US President Donald Trump said on Friday he had a positive meeting with Fed Chairman Jerome Powell, suggesting the possibility of the Fed leaning towards cutting interest rates.

Gold often benefits in a low interest rate environment.

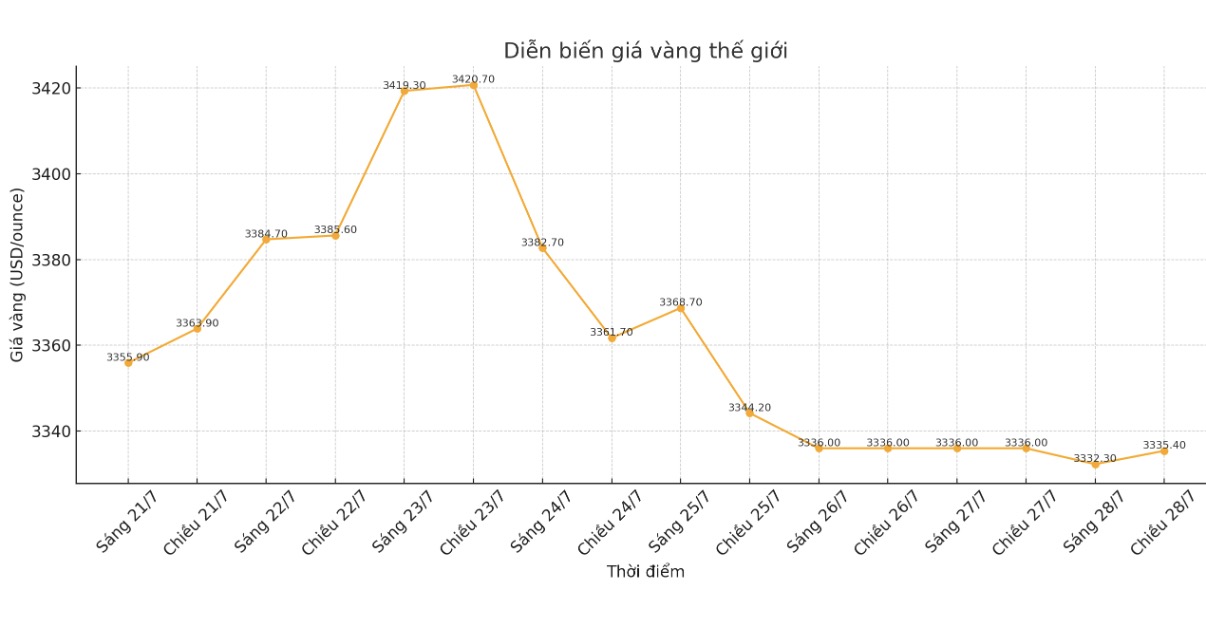

The spot gold price at 4:45 p.m. on July 28 (Vietnam time) was listed at $3,335.4/ounce, after reaching its lowest level since July 17. US gold futures also stabilized at $3,336.30/ounce.

In other precious metals, spot silver rose 0.3% to $38.23 an ounce; platinum held steady at $1,402.48/ounce, while gold rose 2% to $1,244.73/ounce.