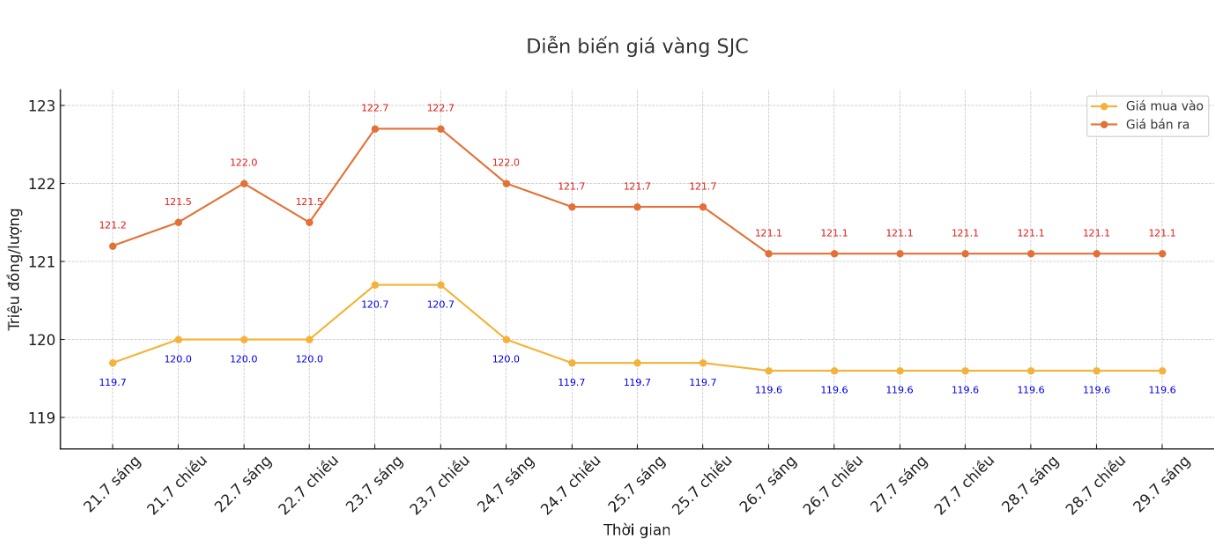

Updated SJC gold price

As of 9:35 a.m., the price of SJC gold bars was listed by DOJI Group at VND 119.6-121.1 million/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 119.5-121 million/tael (buy in - sell out), down VND 100,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 100,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

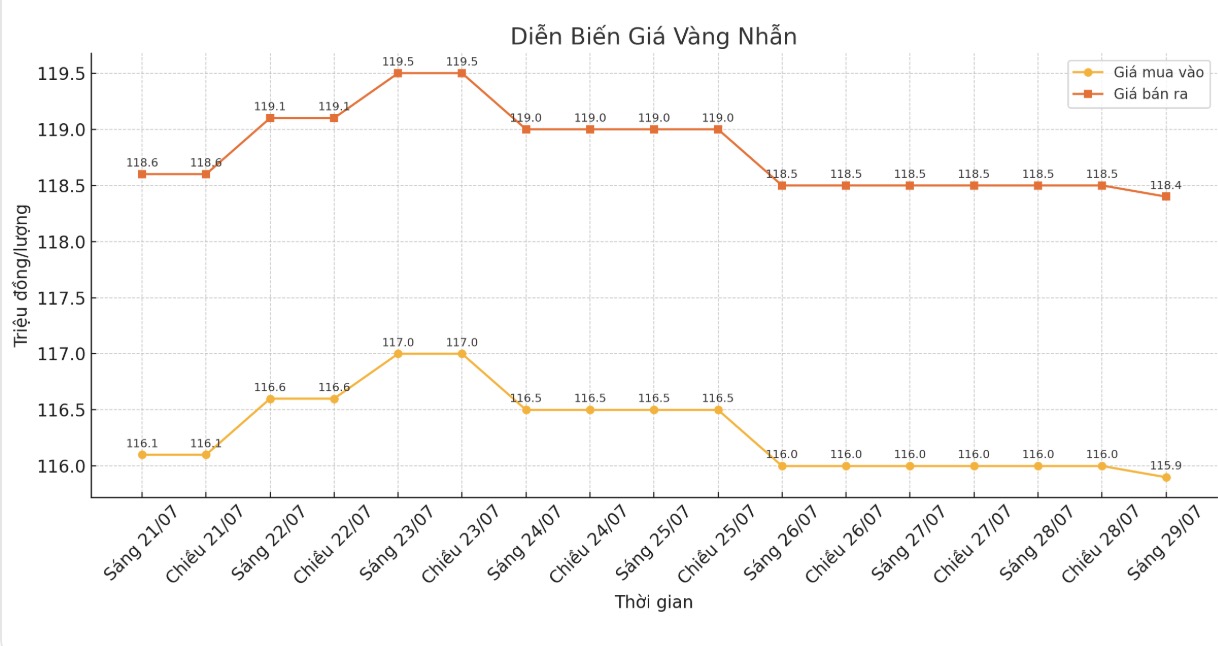

9999 round gold ring price

As of 9:30 a.m., DOJI Group listed the price of gold rings at 115.9-118.4 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.1-119.1 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.9-117.9 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

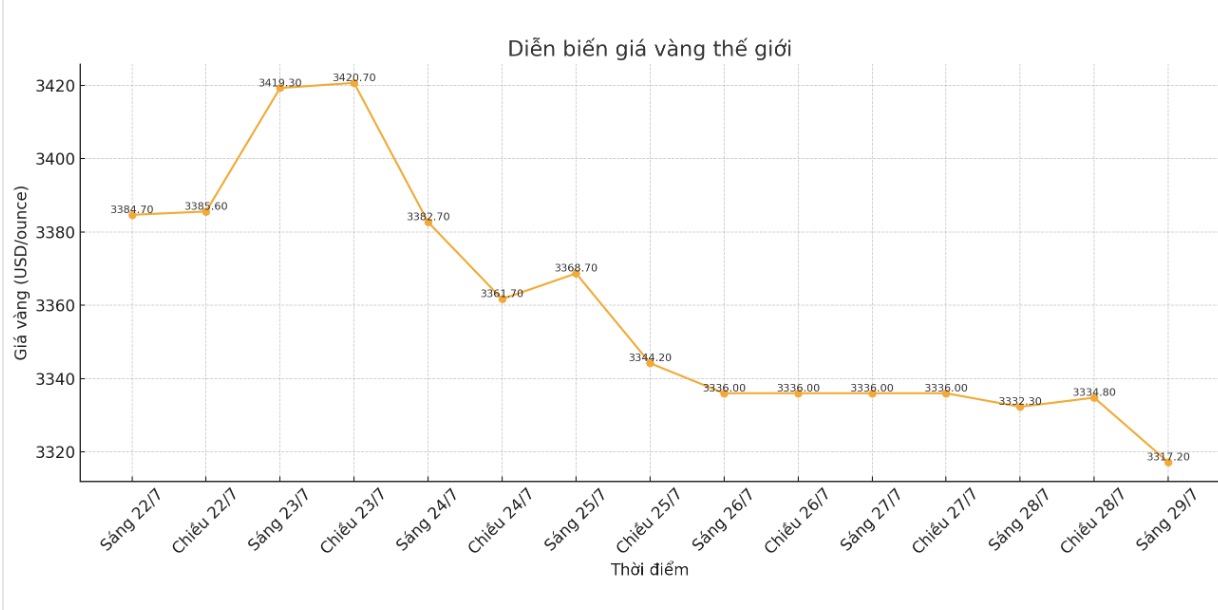

World gold price

At 9:40 a.m., the world gold price was listed around 3,317.2 USD/ounce, down 15.1 USD/ounce.

Gold price forecast

Gold prices fell sharply and hit a two-week low, while silver prices remained almost flat. Gold is under pressure from the soaring USD index and slightly increased US Treasury yields.

In addition, better risk-taking in the general market is also a negative factor for safe-haven metals.

The US and the European Union reached a trade deal over the weekend, which stipulates the EU will be subject to a 15% tariff on most of its exports to the US, including cars, to avoid a trade war with the US.

The strong increase in the USD index and the Euro decrease sharply after the agreement shows that the market believes that the US is gaining more favorable conditions.

Gold was sold before a meeting of the Federal Open Market Committee (FOMC) under the Federal Reserve (FED). The meeting began Tuesday morning and concluded Wednesday afternoon with a statement and press conference from Federal Reserve Chairman Jerome Powell.

Currently, FED officials are determined to keep interest rates unchanged, although the increasingly fierce debate could increase expectations of an interest rate cut in the fall. Mr. Powell is "under great pressure" from US President Donald Trump to lower interest rates. However, the Fed is widely expected to keep the federal rate unchanged this week.

Mr. Jigar Trivedi - senior commodity analyst at Reliance Securities - commented that the trade deal has been successful in easing concerns about economic conflicts between the superpowers. This often leads to downward pressure on gold prices, as gold is considered a safe haven asset in the context of instability.

According to Peter Grant - an expert from precious metals trading company Zaner Metals, according to technical analysis, gold prices are expected to find an important support level around 3,300 USD/ounce.

This expert believes that the FED's decision is a welcome factor. The US's moves on interest rates, monetary policy orientation and economic prospects from the FED will have a direct impact on the attractiveness of gold.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...