Michael Moor - founder of Moor Analytics - believes that gold prices will continue to increase. On a long term, I have warned since 2018 that when gold breaks above $1,183/ounce, it will enter a new uptrend, and in fact prices have increased sharply. In the short term, on July 1, there were signs of price reversal and increase. If gold continues to surpass some key technical levels, prices could increase by 64 to 133 USD, he predicted.

Jim Wyckoff - a veteran expert in the precious metals industry also predicted that gold prices will increase again this week: "The urban area is still leaning towards an uptrend, and geopolitical tensions are escalating".

Alex Kuptsikevich - an analyst at FxPro commented that gold prices have been moving sideways in a narrow range for 12 weeks and the range of fluctuations is getting smaller. The 50-day average road continues to support prices. The main reason is the return of risk-off sentiment, which has caused long-term government bond yields to decrease - a rival to gold.

However, he also warned that the stronger USD trend is a strength for gold prices. The June FOMC meeting minutes supported gold, as two officials were ready to vote for policy easing in July, he said.

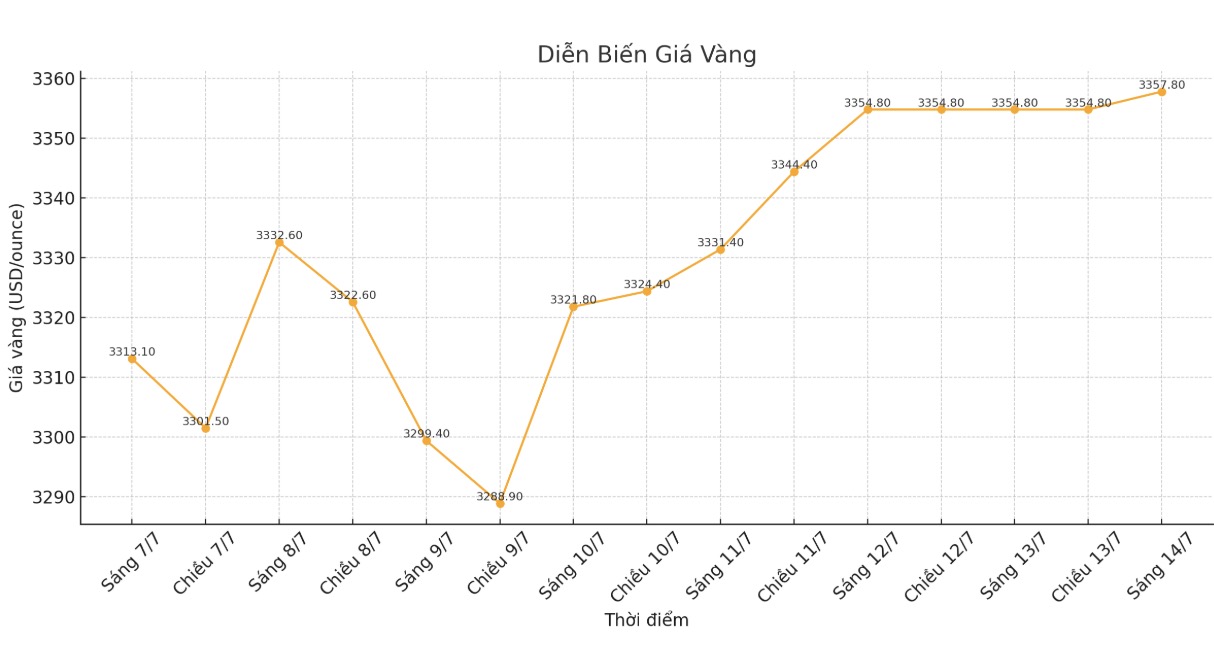

Kuptsikevich believes that the possibility of gold breaking out of the 3,250 - 3,450 USD/ounce zone is quite low. Gold is being supported by central bank buying and global uncertainty. However, the increase from 2022-2025 also shows that gold has been overbought. If gold breaks above $3,370 - $3,400/ounce next week, it will be a strong signal. But if it remains at 3,300 - 3,350 USD/ounce, the risk of a downward correction will increase.

CPM Group's analysts recommended buying gold with a short-term target of $3,375/ounce on August 1. They said gold has accumulated since the recovery of $3,376 an ounce on July 3. Many people are waiting for the economic and political situation to become clearer. This is also the weak season for gold. The market is moving into a waiting state.

However, in the long term, they still expect gold prices to be higher. A rally of $3,375 an ounce for the rest of July is feasible. A higher increase to the old target of 3,425 USD is also possible, but it is uncertain in July".

Meanwhile, Adam Button, head of currency strategy at Forexlive.com, said that the financial market is now clearly divided into two sides since the US passed a large-scale budget bill last week. Optimistic investors poured money into stocks in the hope that deficits would boost growth, while pessimistic investors turned to gold and safe-haven assets, worried that the huge debt would cause future consequences.

Button added: " there is a flow of money flowing into silver and gold. Silver is perhaps leaning towards individual investors, while gold reflects the sentiment of central banks or global reserve managers, who have a cautious view of Donald Trump and the politics, may be waiting for the tariffs to ease before selling the USD to switch to holding gold.

I am neutral on gold next week, said Colin Cieszynski, chief strategist at SIA Wealth Management. The main factor is still the fluctuations of the USD around political statements or tariffs which is very unpredictable.

Daniel Pavilonis - senior commodity broker at RJO Futures - analyzed the potential impact of the US budget bill on gold price increase:

The core thing is that debt is too large, and the only way out is to degrade currency and inflate to erase debt. That is the main driver for gold prices to increase recently, along with central bank purchases.

Gold has been moving sideways for the past few months. I used to think it was peaking and would fall to the 200-day moving average. But tariffs and sanctions on Russian oil could potentially keep gold prices high, he said.

Pavilonis predicts that the US CPI to be released next week and the upcoming EU tax will not have a strong impact on gold. We will see some volatility, but gold prices may still be flat for a few months. This will help build a support zone before a new breakthrough".

In the long term, he does not think the FOMC will be the next trigger. Its not for rate cuts. To increase prices, there needs to be stronger buying cash flow and a big enough topic to attract capital. It could be a geopolitical event, bigger than the Iran- Israel tensions.