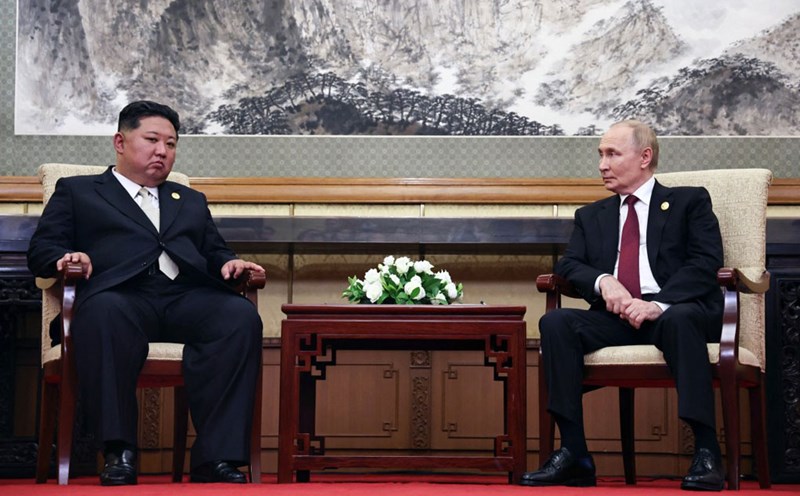

Updated SJC gold price

As of 10:30, the price of SJC gold bars was listed by DOJI Group at 131.9-133.4 million VND/tael (buy - sell), a sharp increase of 2.8 million VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 131.4-133.4 million VND/tael (buy - sell), an increase of 2.8 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 131-133.4 million VND/tael (buy - sell), an increase of 2.9 million VND/tael for buying and an increase of 2.8 million VND/tael for selling. The difference between buying and selling prices is at 2.4 million VND/tael.

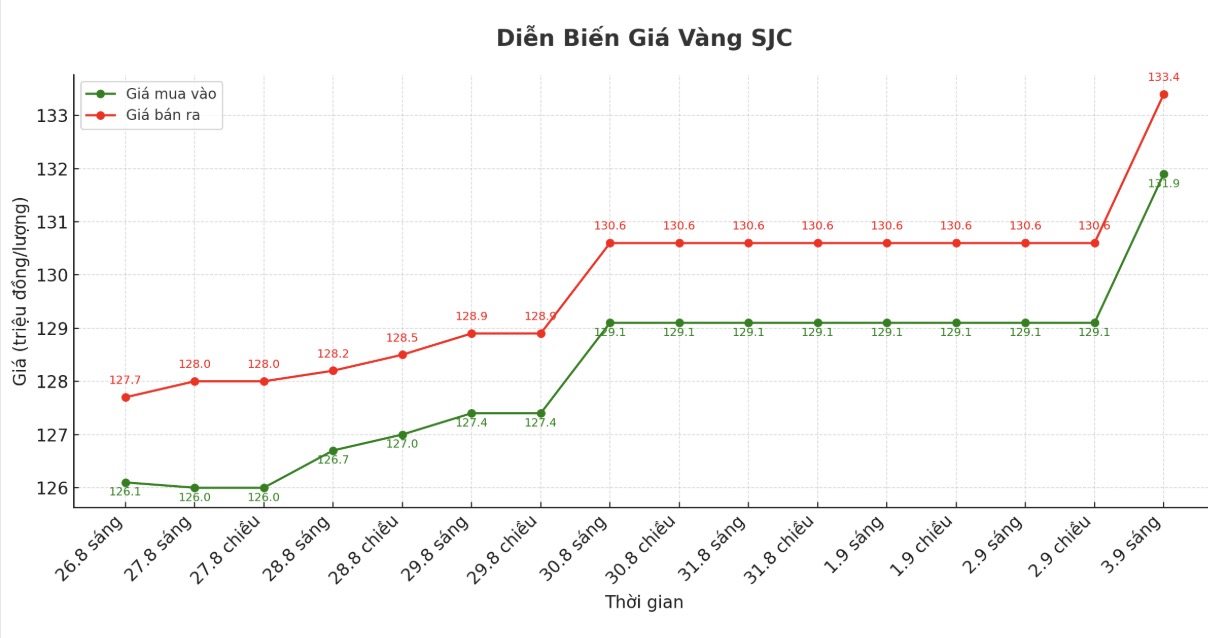

9999 round gold ring price

As of 10:30, DOJI Group listed the price of gold rings at 125.8-128.8 million VND/tael (buy - sell), an increase of 1.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 125.7-128.77 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 125.2-128.2 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

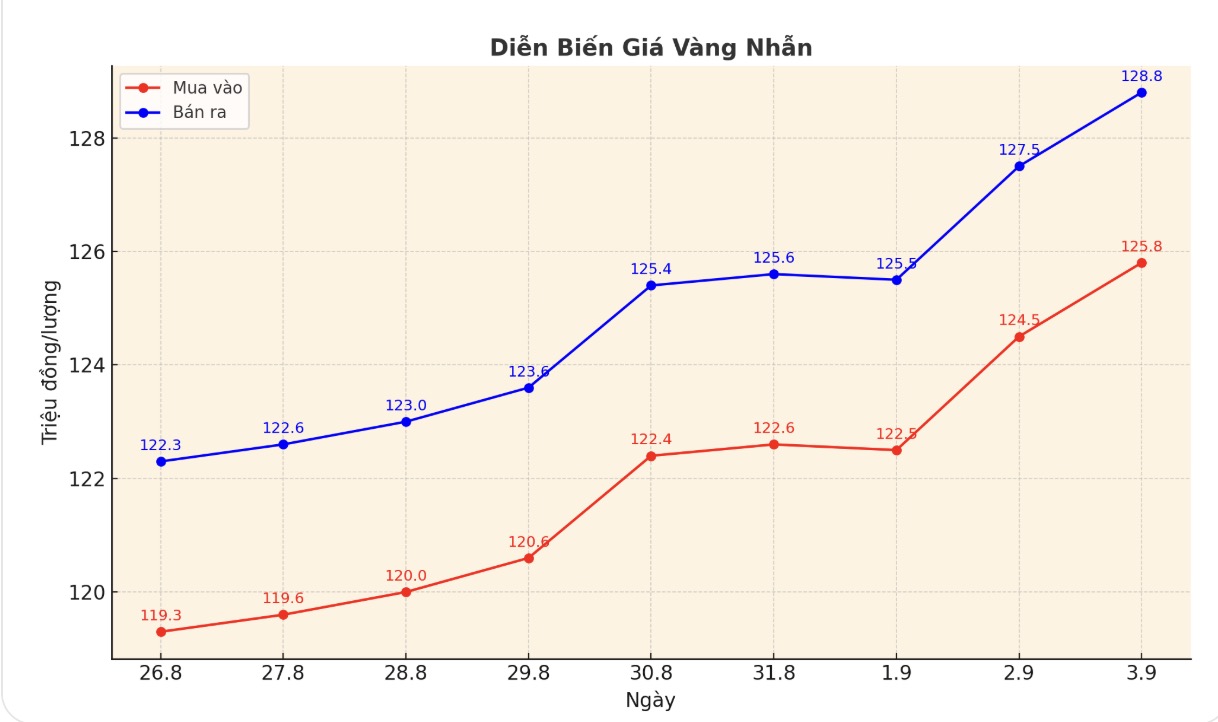

World gold price

At 10:15, the world gold price was listed around 3,529.3 USD/ounce, up 37.4 USD compared to a day ago.

Gold price forecast

Safety-haven demand has been high as September has begun volatile, amid uncertainty about the legality of US tariffs.

Investors rushed to buy gold as safe-haven sentiment increased, fueled by expectations of a Fed rate cut soon, along with increasingly clear concerns about the agency's independence.

Gold has gained more than 30% since the start of the year, becoming one of the best-performing commodities. In the session, spot gold prices sometimes reached 3,526 USD/ounce. The most recent silver futures price reached 41.34 USD/ounce, raising the increase since the beginning of the year to more than 40%.

Meanwhile, the global stock market mostly fell overnight. US stock indexes also fell sharply near the middle of the session.

Part of the reason came from the US appellate court's ruling last Friday, when it declared most of the US tariffs illegal, adding to market uncertainty in a shortened trading week due to the holiday. The ruling also questioned President Donald Trump's authority to impose import tariffs.

With a vote of 7-4, the court ruled that the application of global tax beyond the authority granted in the International Emergency Economic Power Act (IEEPA) in 1977, calling it an "unprecedented" act and " fundamental change".

Although the court allowed the tax rate to remain unchanged while the lawsuit continued, this ruling risks freezing businesses from deciding to invest until the tariff cost became clearer.

Bond yields increased at the beginning of the week, along with the sell-off in the stock market. History shows that September was inherently the least positive month for US stocks.

Technically, the December gold contract: Phe buys hold a strong technical advantage in the short term. The next target is to close above the resistance of 3,700 USD/ounce. The target for the sellers is to pull the price down to strong support at 3,400 USD/ounce.

The initial resistance level is 3,585.8 USD/ounce and 3,600 USD/ounce. The initial support level was 3,550 USD/ounce and then 3,500 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...