Update SJC gold price

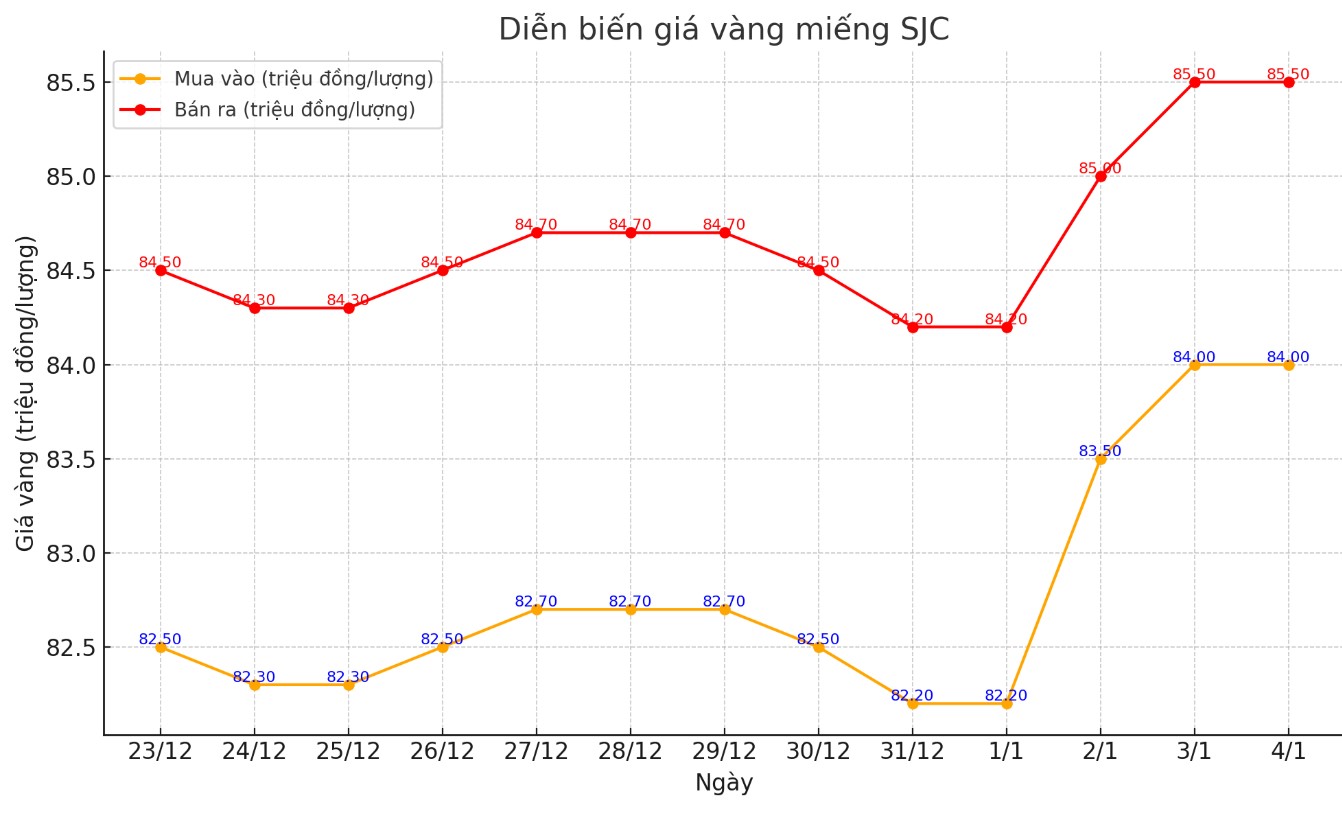

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84-85.5 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84-85.5 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.1-85.5 million VND/tael (buy - sell); increased 100,000 VND/tael for buying and kept the same for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.4 million VND/tael.

Price of round gold ring 9999

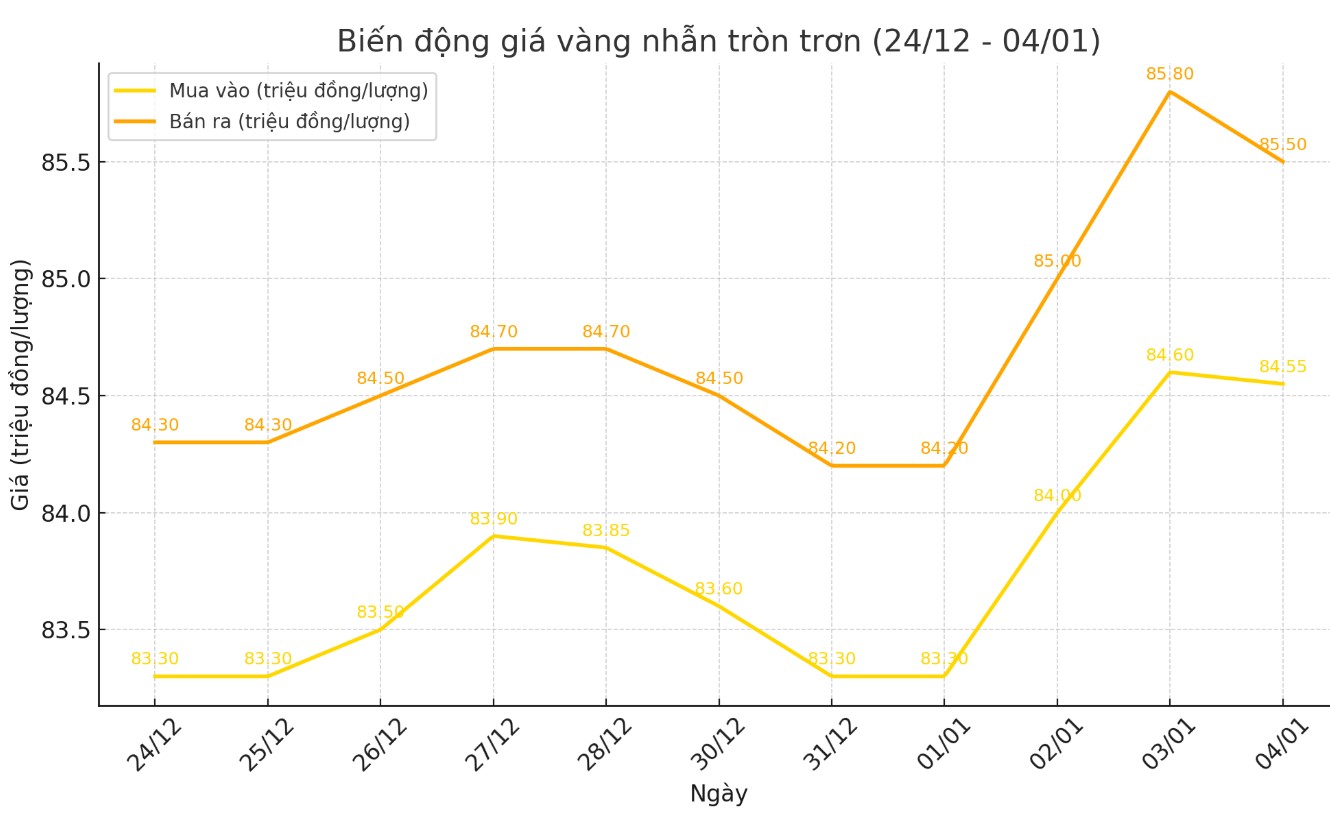

As of 5:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.55-85.55 million VND/tael (buy - sell); both buying and selling prices remain unchanged compared to the closing price of yesterday afternoon's trading session.

Bao Tin Minh Chau listed the price of gold rings at 84.6-85.7 million VND/tael (buy - sell), keeping the buying price unchanged and decreasing the selling price by 100,000 VND/tael compared to the closing price of yesterday afternoon's trading session.

World gold price

As of 5:00 p.m., the world gold price listed on Kitco was at 2,639.7 USD/ounce, down 14.1 USD/ounce compared to the same time in the previous session.

Gold Price Forecast

The market fell mainly due to the stronger US dollar and investors preparing for economic and trade changes under President-elect Donald Trump (USA).

Recorded at 7:30 p.m. on January 4, the US Dollar Index measuring the greenback's fluctuations against six major currencies was at 108,800 points (down 0.38%).

WisdomTree commodity strategist Nitesh Shah said that the proposed tariff policies by President-elect Donald Trump have boosted the US dollar and created significant potential pressure on the metals market.

Speaking about the potential impact of Mr Trump's proposed trade tariffs, Shah said that for most metals, a slowdown in global trade is often accompanied by economic weakness and thus slowing demand for metals.

He added that while gold may be negatively impacted by the strength of the greenback, the precious metal will continue to be supported as US and other countries' debt is expected to continue to rise and geopolitical issues will not end anytime soon.

Markets are now bracing for potential economic and interest rate changes from US President-elect Donald Trump, whose inauguration on January 20 has raised concerns that his proposed tariffs and protectionist policies will fuel inflation.

This could slow the pace of rate cuts by the US Federal Reserve (FED). After three rate cuts in 2024, the FED is expected to make only two cuts in 2025 amid persistent inflation.

Meanwhile, independent analyst Ross Norman expressed optimism about gold in January. According to him, the first month of the year always witnessed the best price increase in the past 20 years as investors and asset allocators opened new long positions along with abundant jewelry inventory for the festive season.

Technically, the gold market is currently favoring a short-term bullish trend. The next target is to break through the key resistance level at $2,700/ounce, while key support levels are located at $2,650 and $2,636.10/ounce.

According to Jim Wyckoff - senior analyst at Kitco, the gold market reached 6.0 points on the technical scale, showing that the uptrend is dominant.

In other developments, China's yuan surpassed 7.3 CNY/USD for the first time since late 2023. This could be a signal that the People's Bank of China is looking to adapt to growth pressures by devaluing the domestic currency.

See more news related to gold prices HERE...