Update SJC gold price

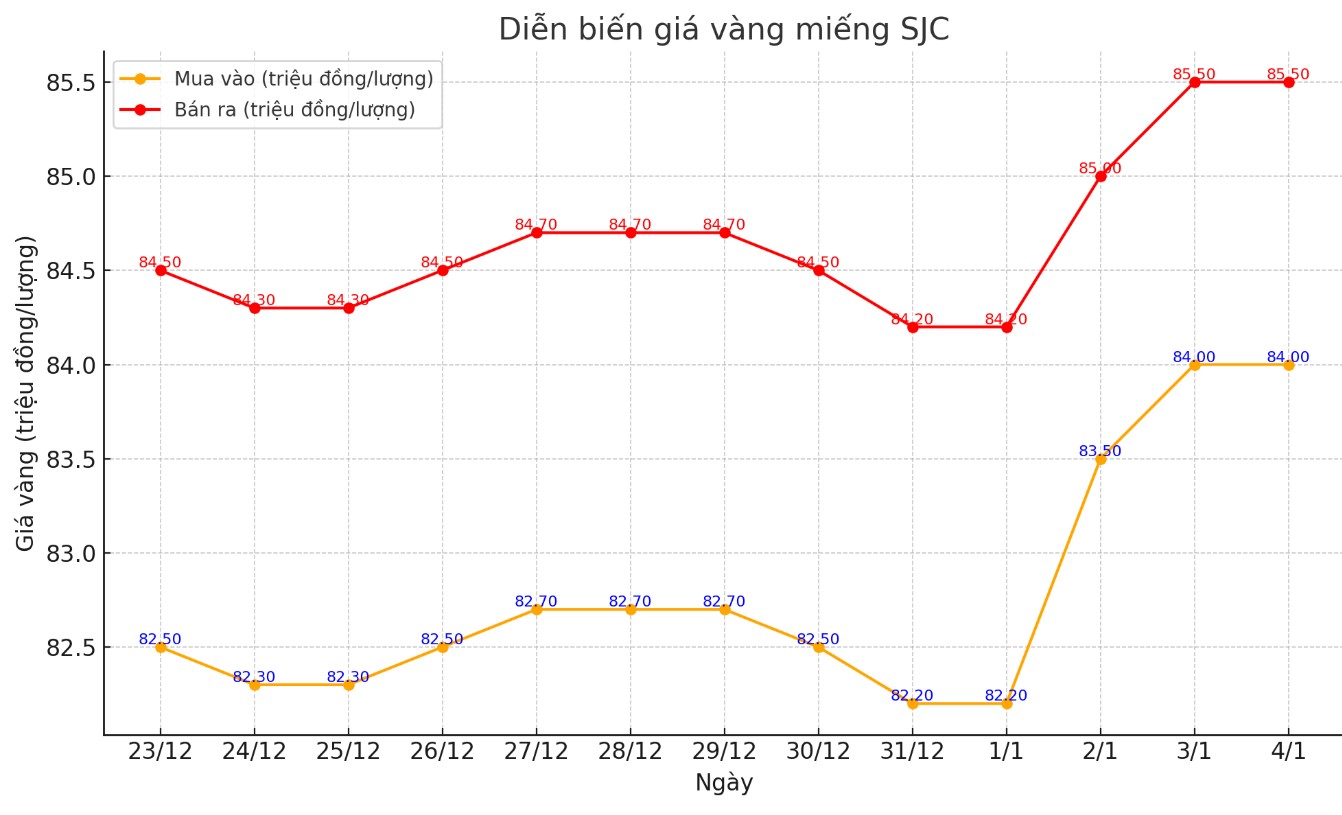

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84-85.5 million VND/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84-85.5 million VND/tael (buy - sell); both buying and selling prices remain unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold at 84-85.5 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 1.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

Price of round gold ring 9999

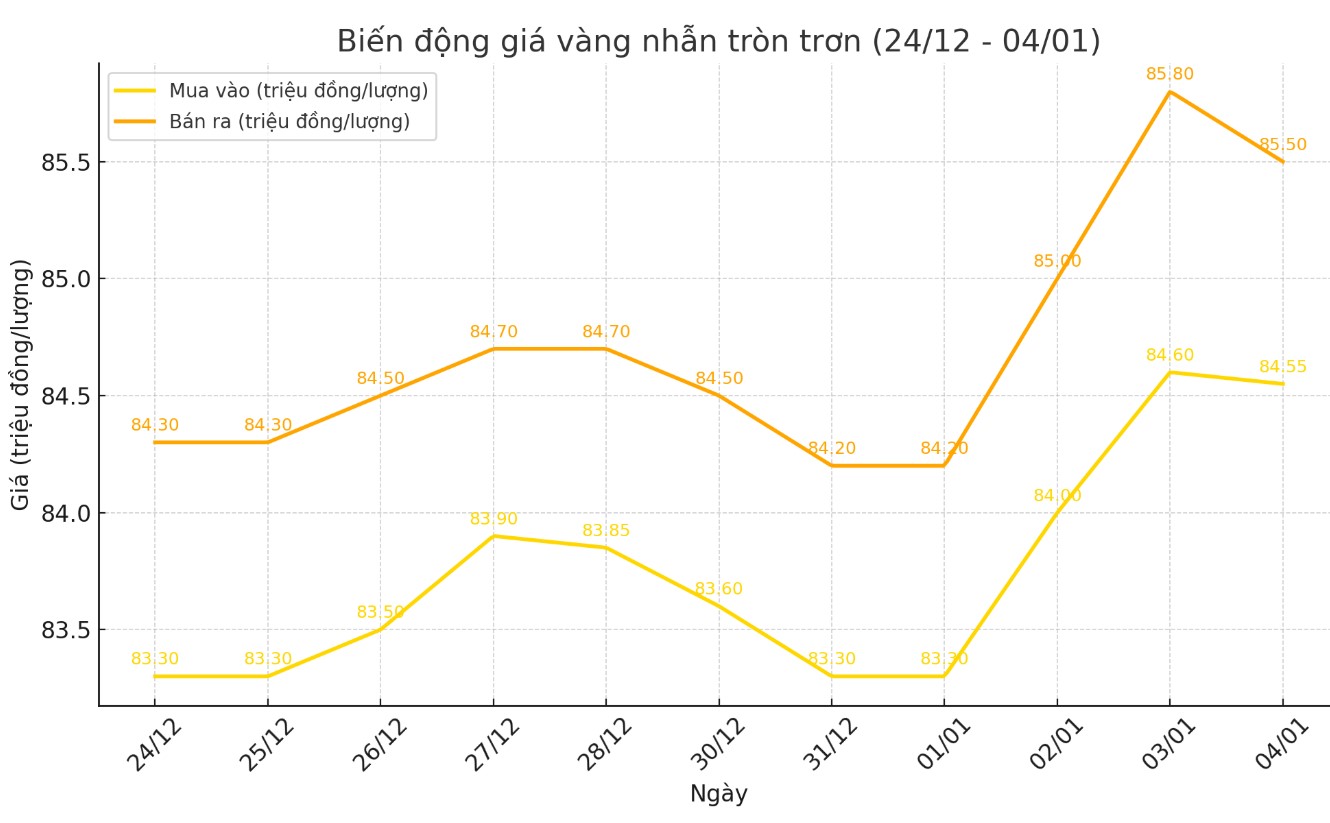

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.55-85.5 million VND/tael (buy - sell); an increase of 50,000 VND/tael for buying and unchanged for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 84.6-85.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for both buying and selling compared to early this morning.

World gold price

As of 8:45 a.m., the world gold price listed on Kitco was at 2,639.7 USD/ounce, down 18 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell despite the US dollar also falling. Recorded at 8:45 a.m. on January 4, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.780 points (down 0.4%).

On Thursday, the world gold price rose to a three-week high. However, by Friday's trading session, the precious metal had declined. The decline continued today, Saturday, January 4.

Gold’s appeal has been weighed down by a recent surge in U.S. Treasury yields. The gold market has also struggled to find momentum and could face further challenges as U.S. manufacturing activity improved, moving closer to neutral, according to the latest data from the Institute for Supply Management (ISM).

ISM announced Friday that its manufacturing Purchasing Managers' Index (PMI) rose to 49.3 in December, up from 48.4 in November. While the manufacturing sector remained in contraction territory, the figure was better than expected, with consensus forecasts calling for a flat reading of around 48.2.

Strong demand from Asian markets will help gold prices avoid further downside pressure, despite rising US dollar and bond yields, according to brokerage SP Angel. Gold prices have recently risen mainly due to concerns related to the upcoming tax policies of the Donald Trump administration, including the possibility of re-imposing additional tariffs.

Trading Economics said the current gold rally is being driven by loose US monetary policy, record gold purchases from central banks and persistent geopolitical tensions, including Russian drone attacks in Kyiv and Israeli military moves in Gaza.

Analyst James Hyerczyk from FX Empire said that gold prices have a positive outlook thanks to a combination of factors such as tariff policies under President-elect Donald Trump, rising inflation and the US Federal Reserve's slower rate cutting process.

The World Gold Council said that the continuous buying by central banks around the world is an important factor supporting gold prices. This year, many other forces are also promoting the increase in the value of this precious metal.

See more news related to gold prices HERE...