According to Kitco - World gold prices retreated from a three-week high on Friday under pressure from a strong US dollar. The US dollar strengthened as the market braced for economic and trade changes under US President-elect Donald Trump.

"The new president's policy of increasing import tariffs has pushed the US dollar higher and put a lot of pressure on the metal market," said Nitesh Shah, commodity strategist at WisdomTree.

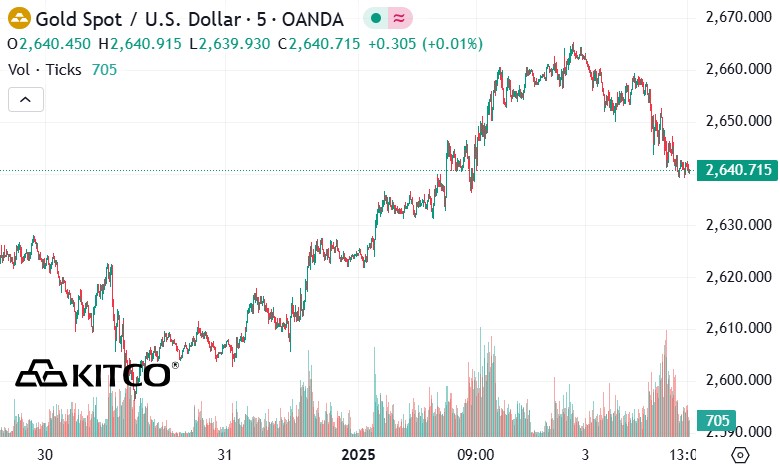

Spot gold fell 0.5% to $2,642.76 an ounce at 11:42 a.m. ET (16:42 GMT), after hitting its highest since Dec. 13. The precious metal has gained about 0.8% so far this week. U.S. gold futures fell 0.5% to $2,656.60 an ounce.

The dollar index (DXY) is on track for its strongest weekly performance since mid-November, making gold more expensive for foreign buyers. As of 1:05 a.m. on January 4, 2024 (Vietnam time), the US Dollar Index, which measures the greenback's performance against six major currencies, was at 108.865 points.

"For most metals, slowing global trade is often accompanied by a slowdown in the economy, which in turn reduces demand for metals," Shah said, referring to the potential impact of trade tariffs under US President-elect Donald Trump.

Pressure from a strong US dollar is likely to continue to weigh on gold. However, Shah added that rising debt levels in the US and other countries, coupled with geopolitical concerns that show no signs of abating, should help gold maintain support.

Donald Trump is scheduled to be inaugurated on January 20, 2025. His import tax and protectionist policies are expected by many experts to spur inflation.

This could slow the pace of interest rate cuts by the US Federal Reserve (FED), thereby limiting the rise in gold prices. After three interest rate cuts in 2024, the FED forecasts only two cuts in 2025 due to persistent inflation.

Gold, which typically performs well in a low-interest-rate environment, is benefiting from seasonal demand. “January typically sees the best price performance in 20 years as investors and asset allocators take new long positions, combined with strong jewelry demand during the holiday season,” said Ross Norman, a leading precious metals expert.