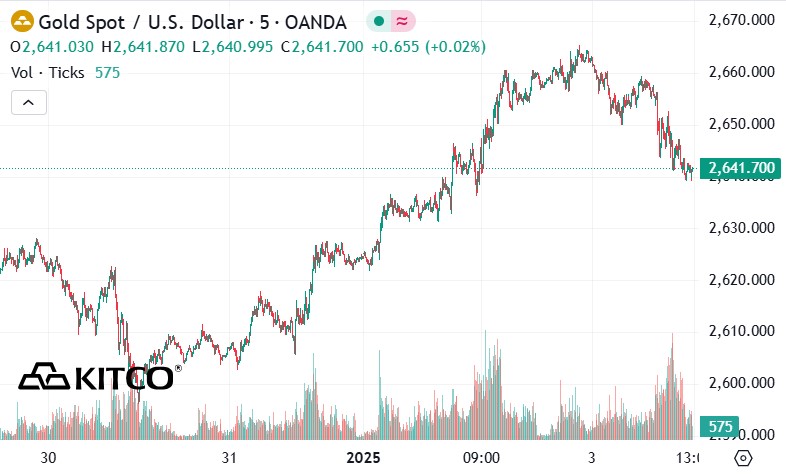

Gold prices rose to a three-week high on Thursday, but fell on Friday, weighed down by a dollar that has held at its highest level in more than two years and a recent surge in U.S. Treasury yields.

The gold market is struggling to find momentum and could face more challenges as the US manufacturing sector recorded an improvement, moving closer to neutral, according to the latest data from the US Institute for Supply Management (ISM).

ISM announced Friday that its manufacturing Purchasing Managers' Index (PMI) rose to 49.3 in December, up from 48.4 in November. While the manufacturing sector remained in contraction territory, the figure was better than expected, with consensus forecasts calling for a flat reading of around 48.2.

According to Kitco, the gold market is also continuing to be affected by low trading volume, as many people consider this the last day of the two-week Christmas holiday.

Despite signs of decline, investors remain impressed with the precious metal's ability to recover and maintain its price, despite a strong US dollar and rising US Treasury yields.

A report from SP Angel showed that increased demand for gold in Asia helped to reduce the negative impact from a strong US dollar and rising bond yields.

In global equity markets, Asian and European indices were mixed in overnight trading. US indices are expected to open in the green when the New York session begins.

According to Bloomberg, the yuan breaking this level is "inevitable" in the context of the continued strengthening of the USD and the sharp decline in Chinese government bond yields. China's economic fundamentals suggest that the yuan is likely to continue to weaken in the coming time.

In other markets, Nymex crude oil futures were mostly steady, hovering around $73 a barrel. The yield on the 10-year US Treasury note continued to rise, currently at 4.551%.

According to David Morrison, senior analyst at Trade Nation (an online financial trading service provider, including products such as forex, stocks, indices, commodities and other financial instruments), the rising bond yields not only reflect expectations of US economic growth but also pressure from large budget deficits and the expected issuance of more bonds to meet budget spending.

Technically, the gold market is currently favoring a short-term bullish trend. The next target is to break through the key resistance level at $2,700/ounce, while key support levels are located at $2,650 and $2,636.10/ounce.

According to Jim Wyckoff - senior analyst at Kitco, the gold market reached 6.0 points on the technical scale, showing that the uptrend is dominant.

In other developments, China's yuan surpassed 7.3 CNY/USD for the first time since late 2023. This could be a signal that the People's Bank of China is looking to adapt to growth pressures by devaluing the domestic currency.

See more news related to gold prices HERE...