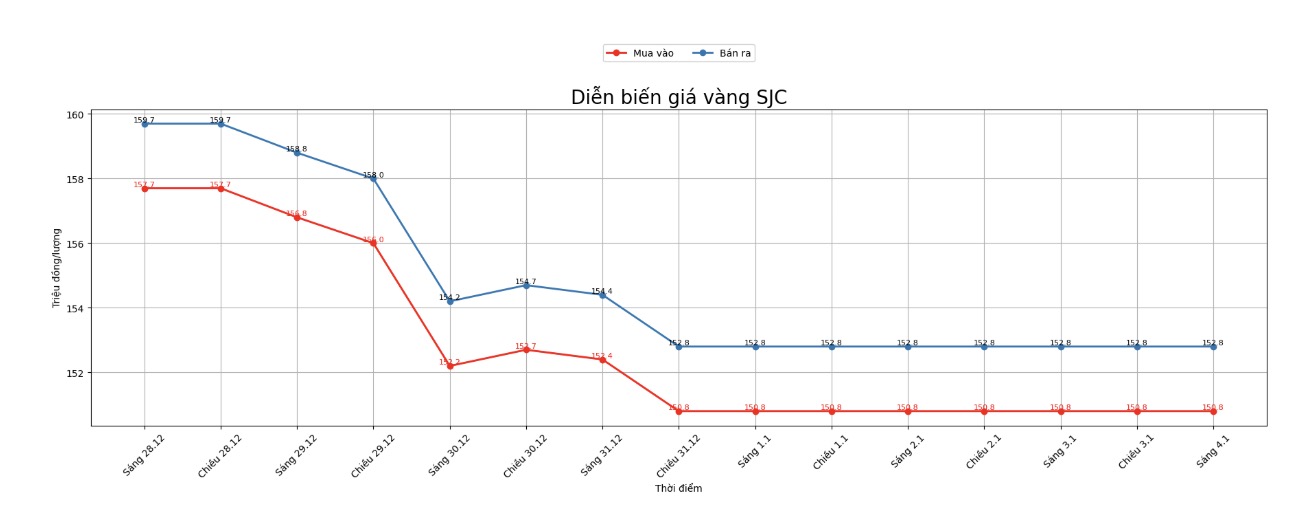

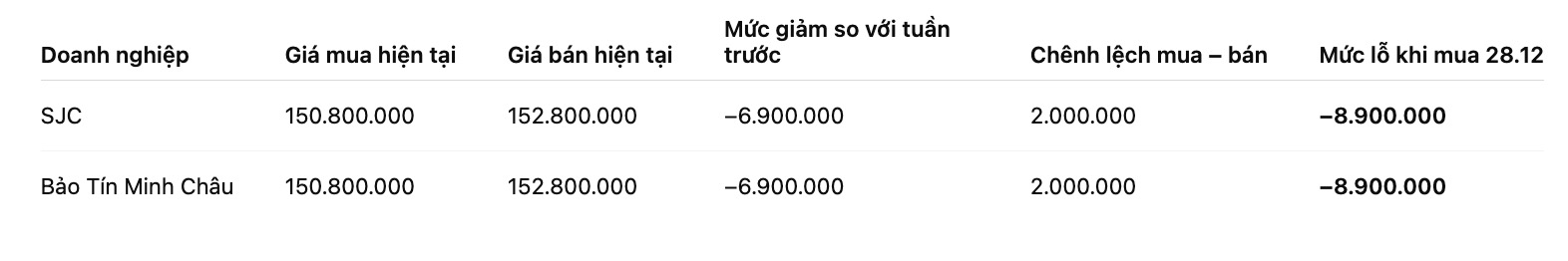

SJC gold bar price

Closing the weekly trading session, Saigon SJC Jewelry Company listed SJC gold price at 150.8-152.8 million VND/tael (buying - selling). The buying - selling difference is 2 million VND/tael.

Compared to the closing session of the previous week (December 28, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by 6.9 million VND/tael in both directions. The difference between buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at the threshold of 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 150.8-152.8 million VND/tael (buying - selling). The buying - selling difference is at 2 million VND/tael.

Compared to a week ago, the price of SJC gold bars was reduced by 6.9 million VND/tael by Bao Tin Minh Chau in both directions.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau on the December 28th session and selling it on today's session (January 4), buyers will lose 8.9 million VND/tael.

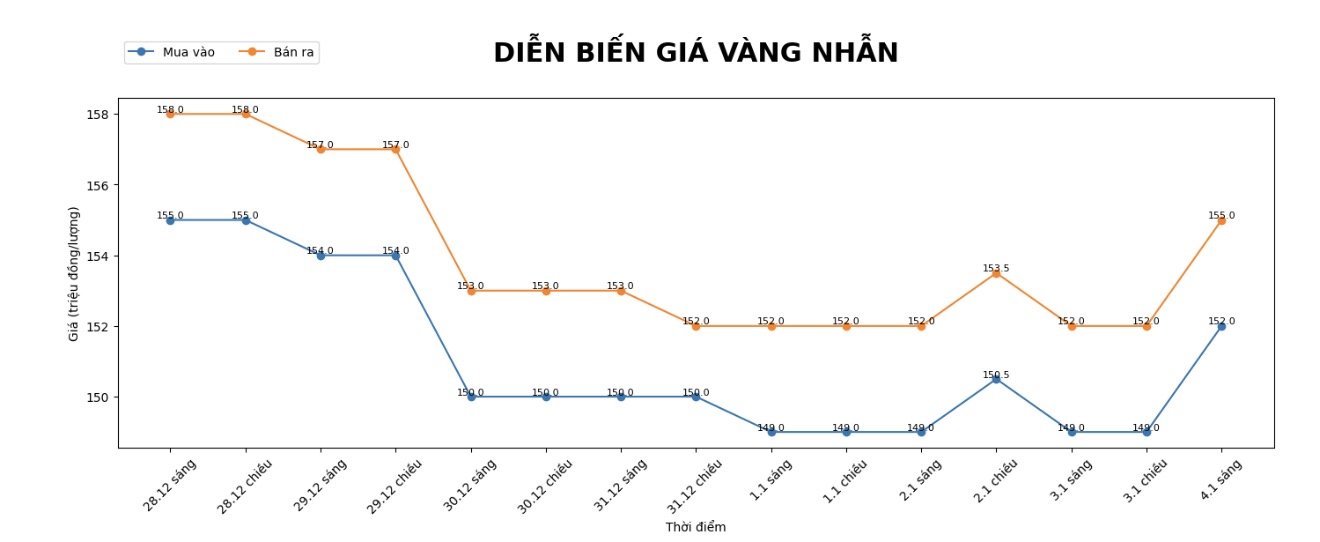

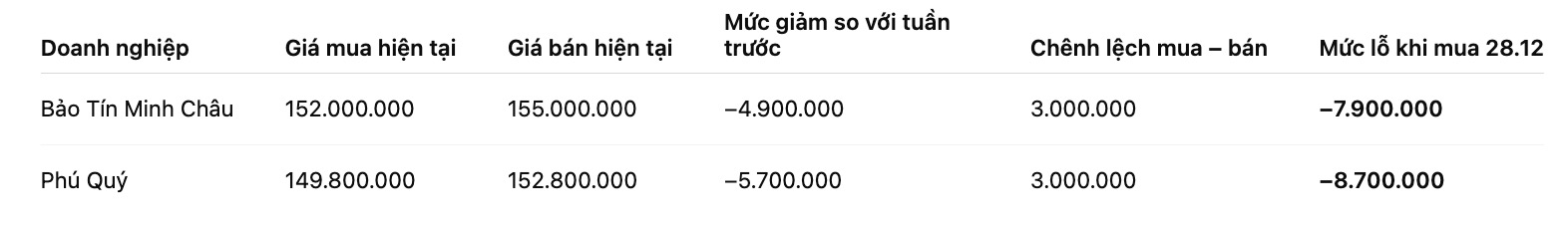

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling); down 4.9 million VND/tael in both directions. The buying - selling difference is at the threshold of 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 149.8-152.8 million VND/tael (buying - selling), down 5.7 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If buying gold rings in the December 28th session and selling out in today's session (January 4), buyers at Bao Tin Minh Chau will lose 7.9 million VND/tael. Meanwhile, the loss when buying at Phu Quy is 8.7 million VND/tael.

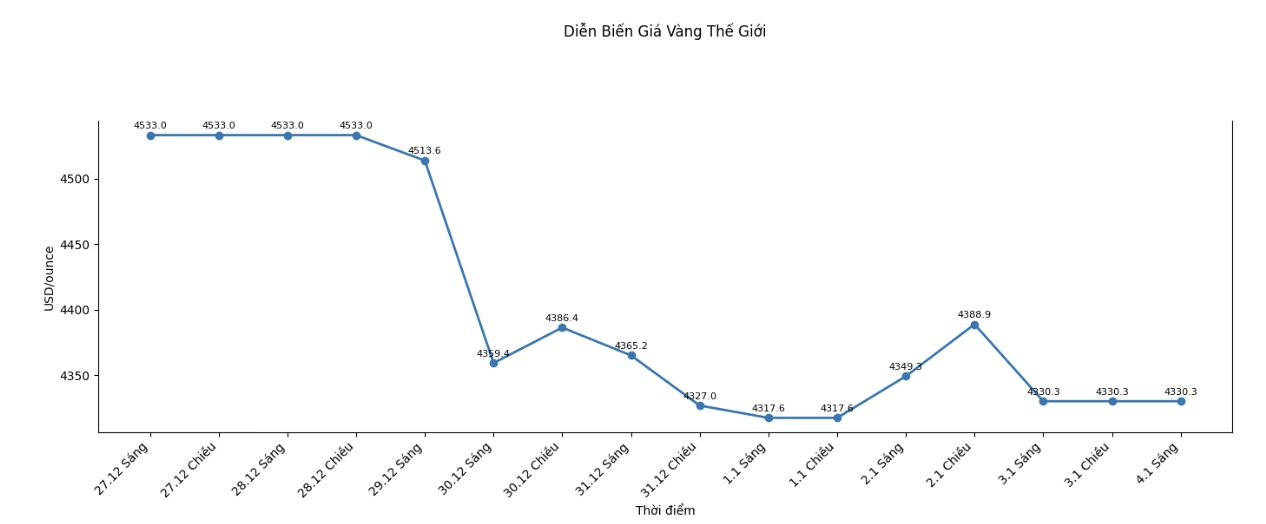

World gold price

Closing the weekly trading session, world gold prices were listed at the threshold of 4,330.3 USD/ounce, down sharply by 202.7 USD compared to a week ago.

Gold price forecast

A recent survey shows that individual investors are placing great faith in the outlook for gold price increases in 2026. Not only small investors, but many leading banks and financial institutions in the world have also made positive assessments of the trend of this precious metal in the medium term.

The annual survey conducted by an international financial information platform recorded the participation of 475 individual investors. The results showed that the majority of respondents believe that gold prices will continue to set new highs, far exceeding previously predicted levels in 2025. Only a small part, about 10%, believe that gold prices are likely to adjust down to below $4,000/ounce.

Notably, nearly 30% of survey participants expect gold to exceed the 6,000 USD/ounce mark next year. This is significantly higher than the historical peak of over 4,550 USD/ounce set at the end of December 2025. The largest proportion of investors, about 42%, predicts gold prices will fluctuate in the 5,000–6,000 USD/ounce range. Meanwhile, nearly 1/5 of opinions believe that gold will only peak around the 4,000–5,000 USD/ounce range, and the rest predict prices may retreat to the 3,000–4,000 USD/ounce range.

From an organizational perspective, major Wall Street banks still maintain an optimistic view, even though they believe that the price increase is unlikely to repeat the strong breakthrough of 2025. Goldman Sachs assesses gold as the most prominent asset in the commodity group in 2026, especially as demand from central banks continues to play a key role. According to this bank, if private investors increase the proportion of gold in their portfolios such as the public sector, precious metal prices could completely exceed the baseline scenario.

J.P. Morgan also believes that the gold rally cycle has not ended, thanks to sustained underlying drivers. The bank emphasized that new demand from major insurance companies in China and the digital asset community may help gold prices approach or exceed the 5,000 USD/ounce mark by the end of 2026.

Meanwhile, UBS believes that gold demand will continue to increase steadily, supported by low real yields, global economic instability and policy risks in the US. According to UBS, if financial or geopolitical risks increase, gold prices may reach significantly higher levels than previously forecast.

See more news related to gold prices HERE...