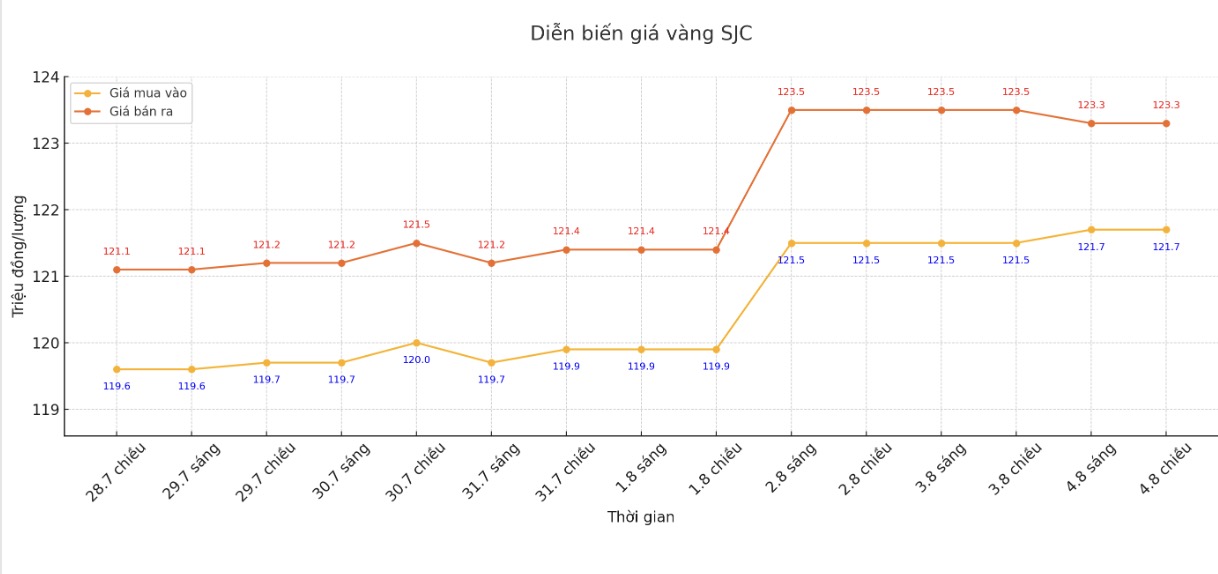

SJC gold bar price

As of 8:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND121.7-123.3 million/tael (buy - sell), an increase of VND200,000/tael for buying and a decrease of VND200,000/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

DOJI Group listed at 121.7-123.3 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 121.7-123.3 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 120.5-123.3 million VND/tael (buy - sell), keeping the same for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

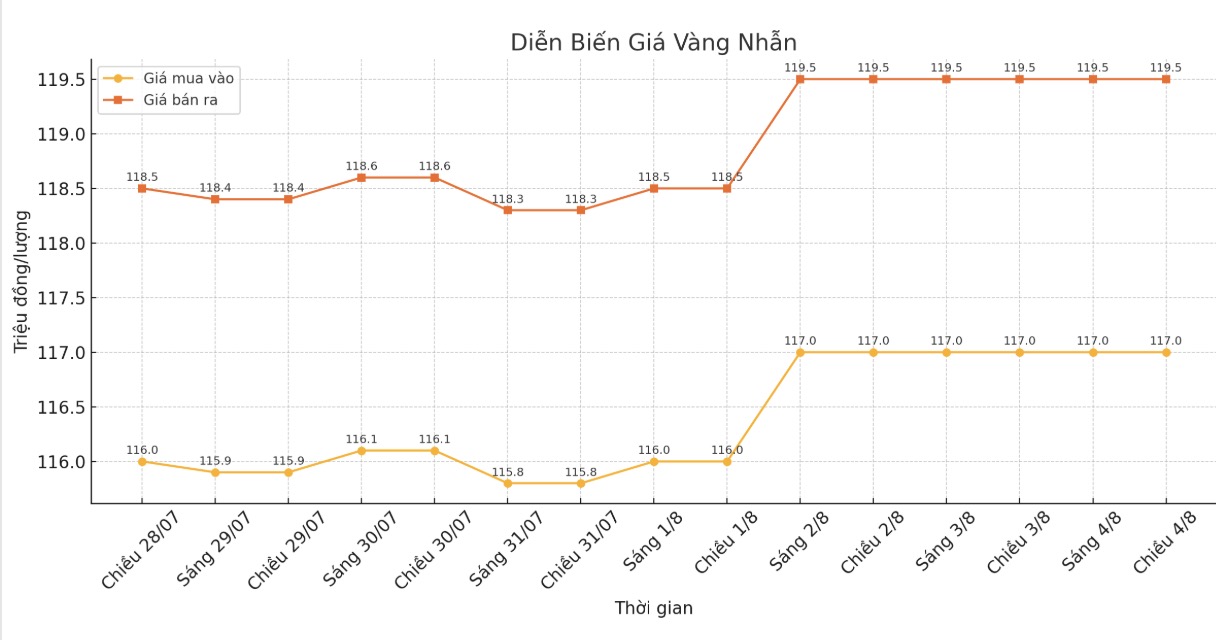

9999 gold ring price

As of 8:40 p.m., DOJI Group listed the price of gold rings at 117-111.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

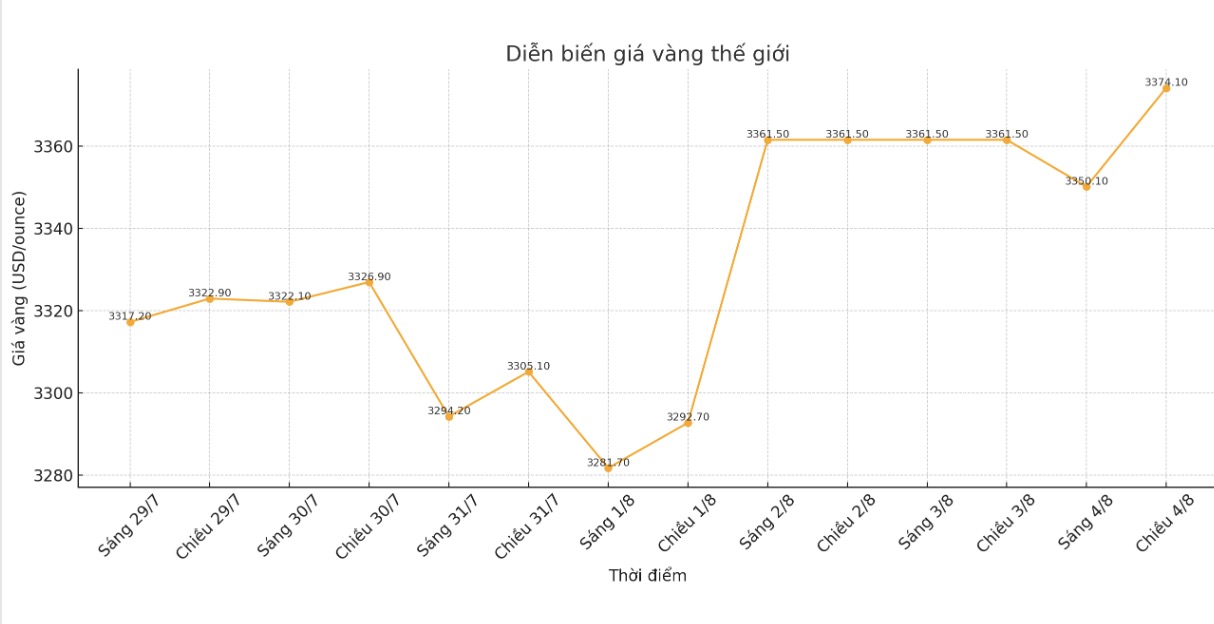

World gold price

The world gold price was listed at 8:44 p.m. at 3,374.1 USD/ounce, up 12.6 USD compared to 1 day ago.

Gold price forecast

Gold prices fell slightly in the first trading session of the week due to slight increase in US bond yields and profit-taking activities after last week's strong increase thanks to weak US employment data.

US 10-year bond yields edged up from a five-week low on Friday, reducing the appeal of gold an uncing assets.

"The market will continue to fluctuate within a narrow range, and today's correction reflects a general reversal in the markets after strong fluctuations on Friday, especially slight increases in yields and a recovery in the stock market" - Mr. Ole Hansen - Director of Commodity Strategy at Saxo Bank commented.

The recovery of the stock market along with the stable USD shows that the "buy when down" mentality is present after the sell-off due to the employment data at the end of last week.

According to the US Department of Labor, the number of non-farm jobs in July increased by only 73,000, while the June figure was adjusted down sharply to 14,000. These weak figures have reinforced expectations that the US Federal Reserve (FED) will cut interest rates in September, with the CME FedWatch tool showing a probability of up to 78%.

Although gold prices are having difficulty breaking out, the risk of stagnant inflation and the possibility of the FED continuing to lower interest rates has left sellers reserved. Hansen believes that if gold breaks above $3,430 an ounce, buying momentum could be activated.

Meanwhile, US President Donald Trump said he will soon nominate a candidate to replace the vacant position at the Fed after Governor Adriana Kugler resigned early.

Regarding trade, US Trade Representative Jamieson Greer said on Sunday's TV that the new tariffs Trump has imposed on many countries are expected to remain unchanged during negotiations.

Citi Bank has raised its gold price forecast for the next 3 months from $3,300 to $3,500/ounce, citing the deterioration of the short-term outlook for US growth and inflation.

Spot silver prices rose 0.9% to $37.34 an ounce, platinum rose 0.4% to $1,320.19 an ounce, while palladium fell 0.2% to $1,205.93/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...