Updated SJC gold price

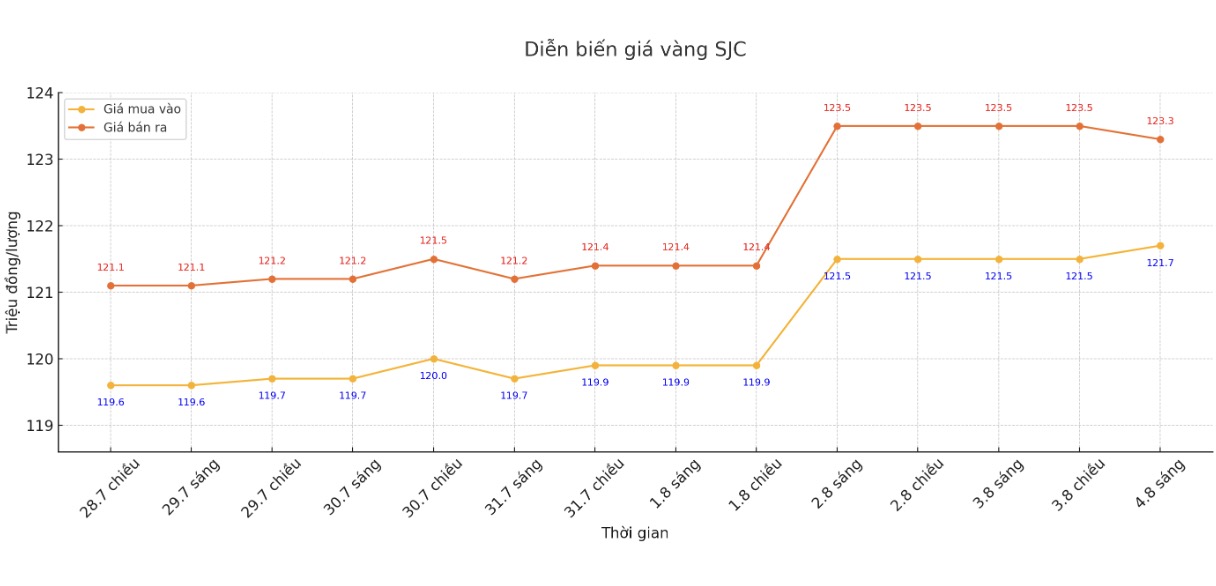

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 121.7-123.3 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 121.7-123.3 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 200,000 VND/tael for selling. The difference between buying and selling prices is at 1.6 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 120.7-123.3 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and a decrease of 200,000 VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

9999 round gold ring price

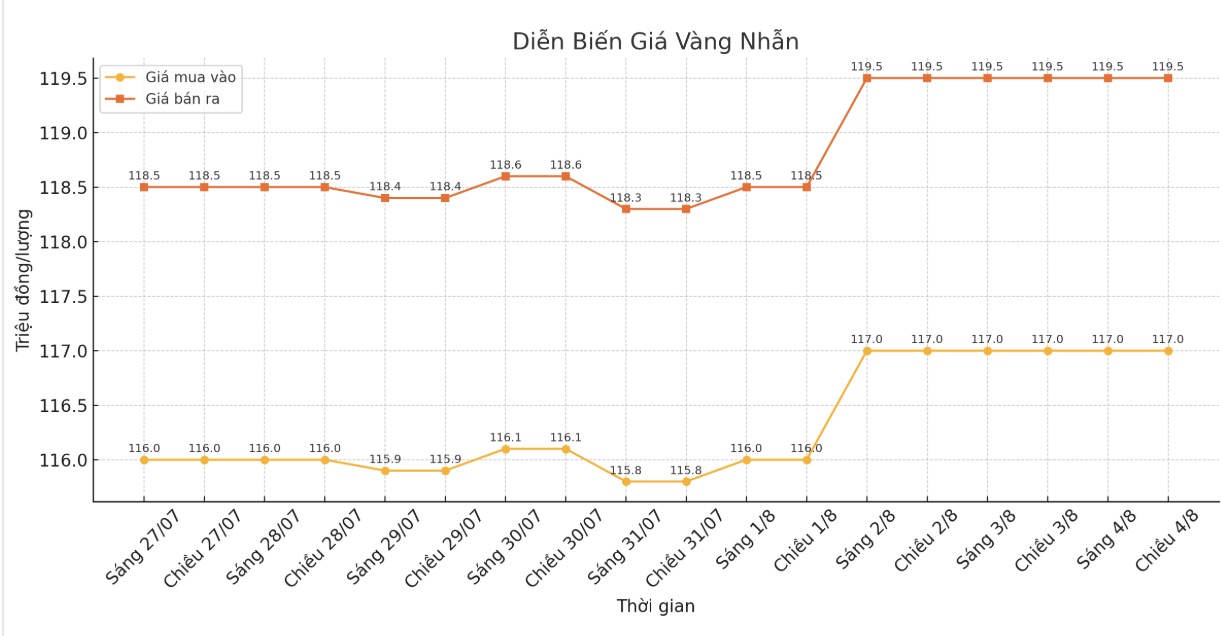

As of 9:00 a.m., DOJI Group listed the price of gold rings at 117-111.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116-119 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

At 8:55 a.m., the world gold price was listed around 3,350.1 USD/ounce, down 11.4 USD/ounce.

Gold price forecast

World gold prices fell slightly at the beginning of the week before the profit-taking wave as the precious metal increased in price.

Although there are signs of a slight correction, according to the weekly gold survey of an international financial information platform, the sentiment of market analysts is very positive.

Chris Vecchio - Head of futures and foreign exchange strategy at Tastylive.com commented: "Taxes make countries reduce USD trading, so I think gold will continue to benefit as the world looks for an alternative currency asset".

Gold has had a few difficult weeks as the US dollar recovers and fake selling positions are liquidated, but perhaps this is the dosage that gold needs to regain its glory, he added.

Darin Newsom - Senior Analyst at Barchart.com - said he is optimistic about gold due to increasing geopolitical instability from the US President Donald Trump trade war.

Michael Brown Market strategist at Pepperstone still maintains an optimistic view on gold, believing that global trade instability is the main driver of golds value as a currency asset.

The trend of diversifying reserves away from the US dollar and moving towards gold, especially in emerging markets, will continue in the near future. Demand for shelter amid concerns about the US economy will continue to strengthen the upward trend. The prices to watch are $3,400/ounce, then the peak around $3,445/ounce, and the possibility of breaking a new record at $3,500/ounce. I absolutely do not rule out the possibility of gold prices reaching a new peak before the end of 2025" - Michael Brown said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...