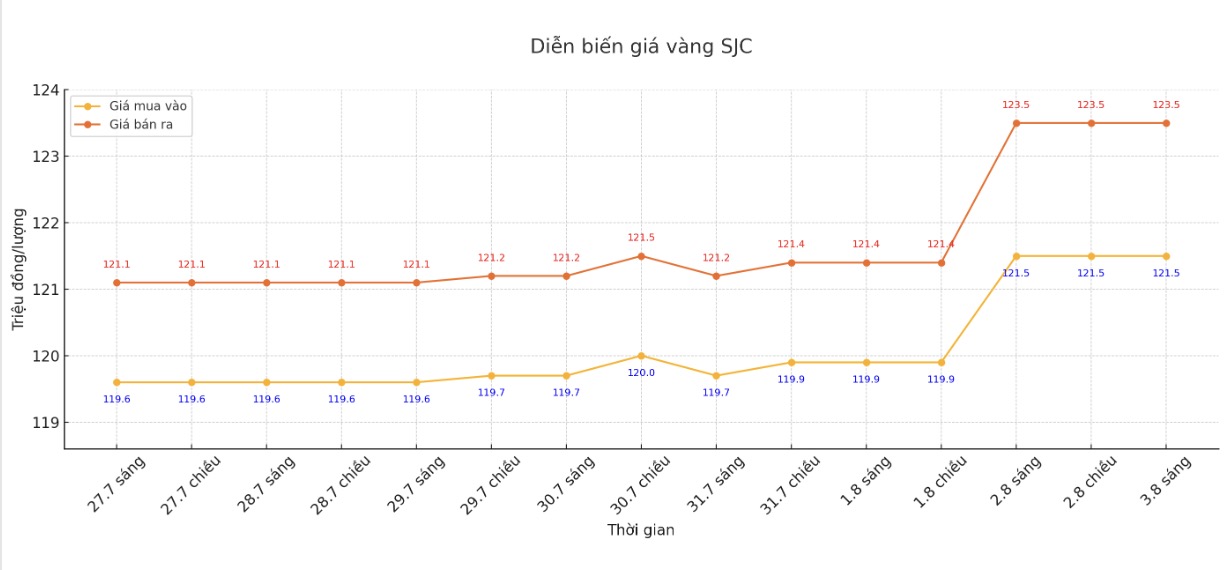

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 121.5-123.5 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (July 27, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 1.9 million VND/tael for buying and increased by 2.4 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 121.5-123.5 million VND/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was increased by 1.9 million VND/tael for buying and 2.4 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

If buying SJC gold at Bao Tin Minh Chau and Saigon Jewelry Company SJC in the session of July 27 and selling it in today's session (8/ 3), buyers will make the same profit of VND 400,000/tael.

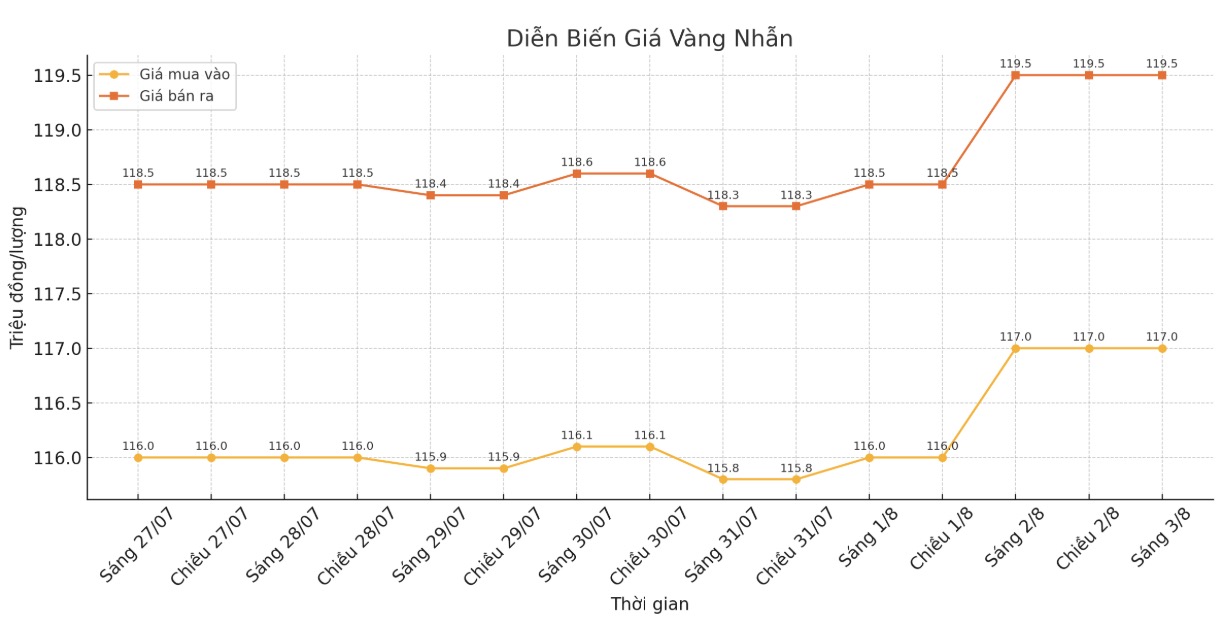

9999 gold ring price

This morning, Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy - sell); an increase of 1 million VND/tael in both directions compared to a week ago. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of July 27 and selling in today's session (September 3), buyers at Bao Tin Minh Chau will lose 2 million VND/tael, while the loss when buying in Phu Quy is 1.9 million VND/tael.

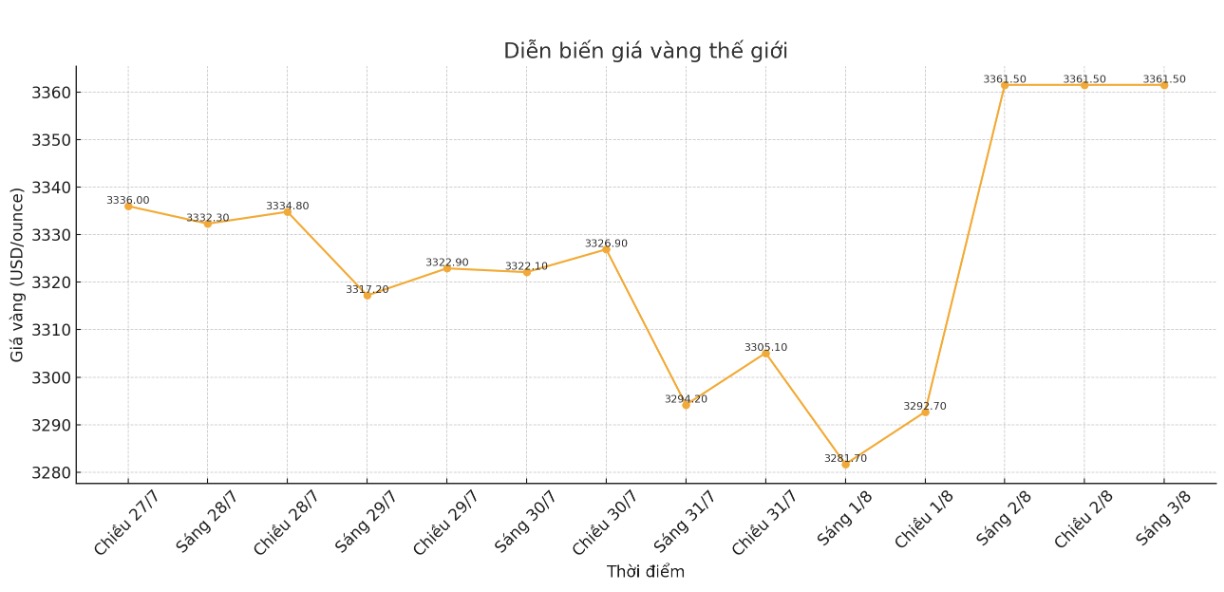

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,361.5 USD/ounce, up 25.5 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

World gold prices had a strong breakout over the weekend, erasing losses at the beginning of the week and soaring towards the important resistance level of 3,400 USD/ounce, in the context of weak US labor data raising hopes that the US Federal Reserve (FED) will cut interest rates in September.

The weaker-than-expected jobs report weakens confidence in the US economy, putting pressure on the USD as the market expects the Fed to ease policy to stimulate growth, said Aaron Hill, senior market analyst at FP Markets. With gold, poor labor data further strengthens the role of safe-haven assets, boosting prices as investors seek stability.

Jamie Cox CEO at Harris Financial Group commented: In September, the Fed will almost certainly cut interest rates, possibly by 50 basis points to make up for the lost time.

According to the CME FedWatch tool tool tool, the probability of the Fed cutting interest rates in September has now increased to about 92%, compared to only 38% on Thursday.

Meanwhile, Lukman Otunuga - Senior Market Strategist at FXTM - commented: "Buyers are attacking strongly with the mark of 3,400 USD/ounce less than 2%. When it closes the week above $3,330/ounce, gold prices could head towards $3,400.

Mr. Naeem Aslam - Investment Director at Zaye Capital Markets - commented that interest rate cut expectations are changing rapidly and gold is likely to reach the mark of 3,400 USD/ounce.

If the Fed signals a dovish stance, speculative capital flows could push prices above the psychological level of 3,400, especially in the context of investors seeking safe assets amid economic uncertainty.

Technical indicators such as the upward trend in gold ETFs and the volume of open-end contracts are supporting the possibility of a breakthrough. Investors seem to be preparing for an autumn rally, as gold typically improves after August. Although fluctuations may hold back short-term gains, the general trend is still positive and the quiet summer season may be over.

Notable economic data next week

Tuesday: ISM Service PMI (USA).

Wednesday: The US auctions a 10-year Treasury note.

Thursday: Bank of England monetary policy decision, US weekly jobless claims.

See more news related to gold prices HERE...