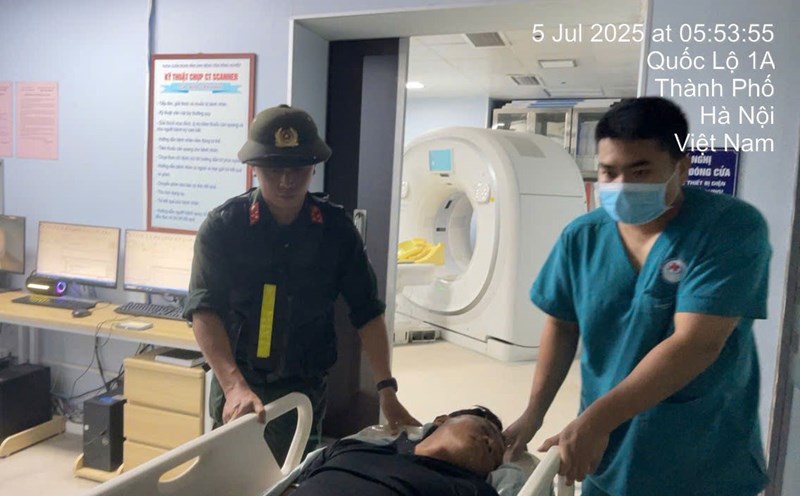

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.9-120.9 million/tael (buy in - sell out); down VND 400,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.9-120.9 million VND/tael (buy - sell); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 118.2-120.9 million VND/tael (buy - sell); down 400,000 VND/tael for buying and up 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

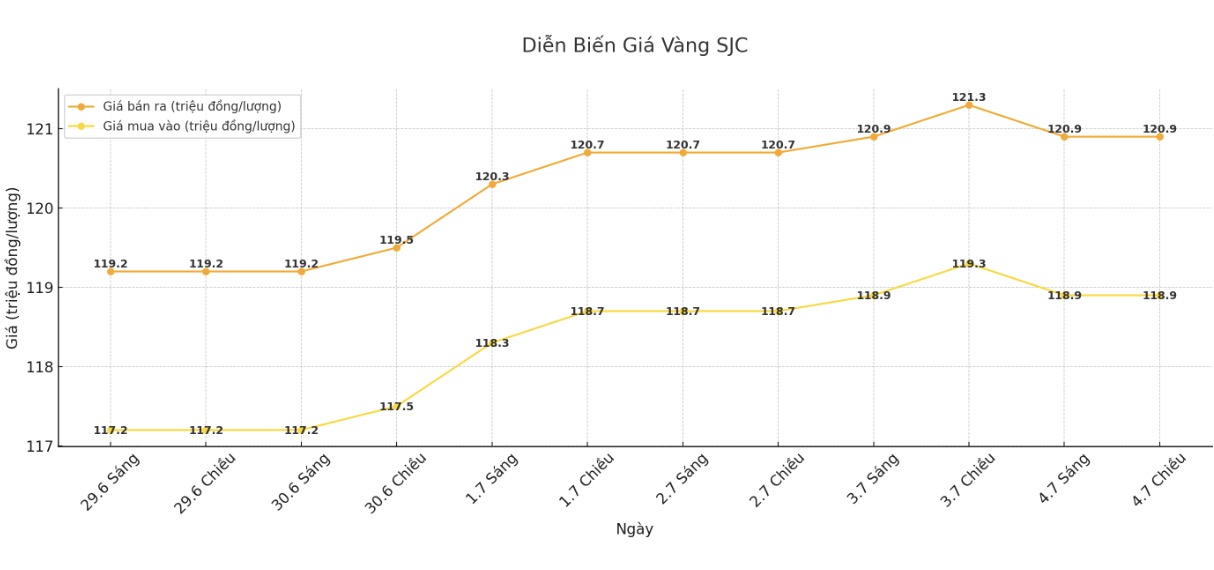

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 115.5-117.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.3-117.3 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

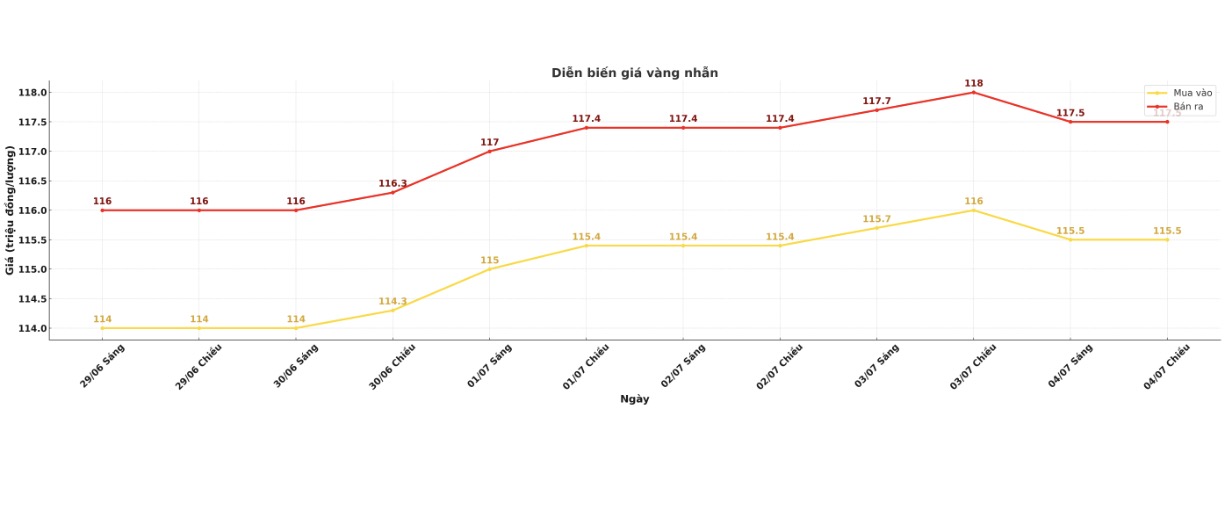

World gold price

At 1:40 a.m., spot gold was listed at $3,335.9 an ounce, up $6.5.

Gold price forecast

World gold prices fell after the US Department of Labor announced that the economy created 147,000 more jobs in June, higher than the forecast of 110,000. Positive data reinforces the view that the FED will have difficulty cutting interest rates early, causing the USD to strengthen and the attractiveness of gold to decrease.

Investors now see a 53% probability of the Fed cutting rates by the end of this year, starting in October rather than expecting a cut at the meeting later this month.

Mr. Chris Zaccarelli - Investment Director at Northlight Asset Management - predicted that the FED will delay interest rate cuts until at least the end of the third quarter or fourth quarter. This increases the cost of holding gold, supporting the USD and bond yields, thereby creating short-term downward pressure.

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that the gold sell-off was not surprising, as the market adjusted interest rate expectations. Although prices are moving sideways, the long-term uptrend is still intact. Gold needs a prospect of cutting interest rates to make a breakthrough. In the coming weeks, if it cannot hold $3,245/ounce, prices could adjust further, he said.

Mr. Robert Minter - Director of ETF Strategy at Abrdn - commented that US public debt has exceeded37,000 billion USD and the trend of global currency devaluations is supporting gold prices. Gold prices above $3,000 are reasonable for the current debt level. It is unlikely that gold will fall below this level. If the Fed cuts rates, gold could increase by $300/ounce, approaching $3,700, he predicted.

Mr. Carsten Menke - analyst at Julius Baer said that as US debt continues to increase, investors will be increasingly concerned about the greenback, which is beneficial for gold in the long term.

Economic data to watch next week

Tuesday: Reserve Bank of Australia monetary policy meeting.

Wednesday: Minutes of the Fed's June FOMC meeting.

Thursday: US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...