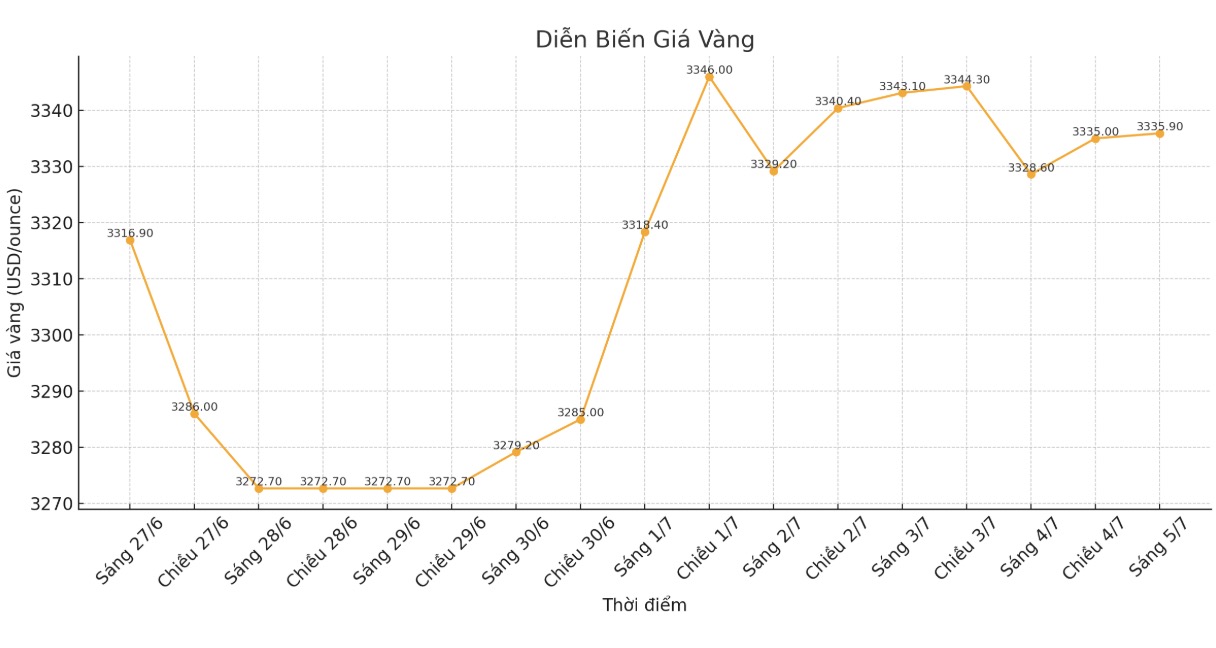

After holding the key support level around $3,250/ounce, the gold market is looking to close the short trading week with a significant increase. However, according to some experts, this precious metal still lacks strong upward momentum to escape the current accumulation phase.

Gold prices left the peak due to strong job growth in June, which somewhat weakened the market's increase. Gold prices fell about 1% after data showed the US economy created 147,000 more jobs last month, exceeding economists' forecast of 111,000 jobs. At the same time, the unemployment rate fell to 4.1%.

The better-than-expected non-farm payrolls data has all but erased hopes that the Federal Reserve could cut interest rates this month. The market previously set a probability of a rate cut of about 25%.

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that the gold sell-off is not a surprise, as the market has adjusted expectations about interest rates. However, he emphasized that the long-term upward trend of gold is still intact, although prices are fluctuating sideways.

Gold probably needs a rate cut to break out, which means it is still stuck. In the coming weeks of low liquidity, gold needs to hold $3,245/ounce and silver at $35.3 to avoid further technical adjustments. I remain optimistic, as the key factors supporting gold have not disappeared and will not disappear in the near term, he said.

Mr. James Stanley - senior market strategist at Forex.com - still maintains a positive view, considering the corrections as a buying opportunity.

Investors are easily caught up in short-term fluctuations and forget the whole picture. Gold is focusing on the bigger picture, trying to look ahead. Governments will continue to spend until they can't, and continuing to degrade the prescribed price will continue to support gold," he said.

Mr. Stanley's optimism comes as the US Congress passes the budget bill. Earlier this week, gold prices surpassed $3,300/ounce after the Senate approved the bill. According to the National Assembly Budget Office, the bill is expected to increase the federal budget deficit by more than $3,000 billion over the next 10 years, while the US public debt has exceeded $37 trillion.

Experts say the continued US deficit spending will put pressure on the USD, which is closing the week at a record low for many years around 97 points.

In the latest development of Donald Trump's large-scale tax cut bill overcoming the final hurdle in the US Congress, as the Republican-controlled House of Representatives approved a huge spending package, expected to fund his domestic agenda and cause millions of Americans to lose health insurance.

The vote with a narrow ratio of 218 - 214, thereby permanently maintaining tax cuts since 2017, providing new tax incentives that he pledged in the 2024 election campaign and financing immigration suppression.

The bill also cuts health and food security programs, abolishing dozens of incentives for green energy. The nonpartisan Congressional Budget Office (CBO) said the law would add $3.4 trillion to the already-36.2 trillion USD national debt.

In addition to debt issues, the US dollar is also expected to face further challenges next week as US President Donald Trump's global trade war returns to the center. The 30-day postponement for Mr Trump's sweeping tariff packages expires on July 9.

Mr. Michael Brown - senior market analyst at Pepperstone - said that adjusting interest rate expectations could help the USD receive short-term support, but the long-term weakness will continue, thereby strengthening the positive outlook of 37 trillion USD.

I still believe the main driver is capital flows, as reserve managers reduce their share of the USD and diversify to alternative channels such as gold. That will continue to strengthen the upward trend of gold at this time. Therefore, I consider this a buying scenario when prices are adjusted, with the main trend still going up - likely to return to the historical peak around 3,500 USD/ounce before the end of the year" - he said.