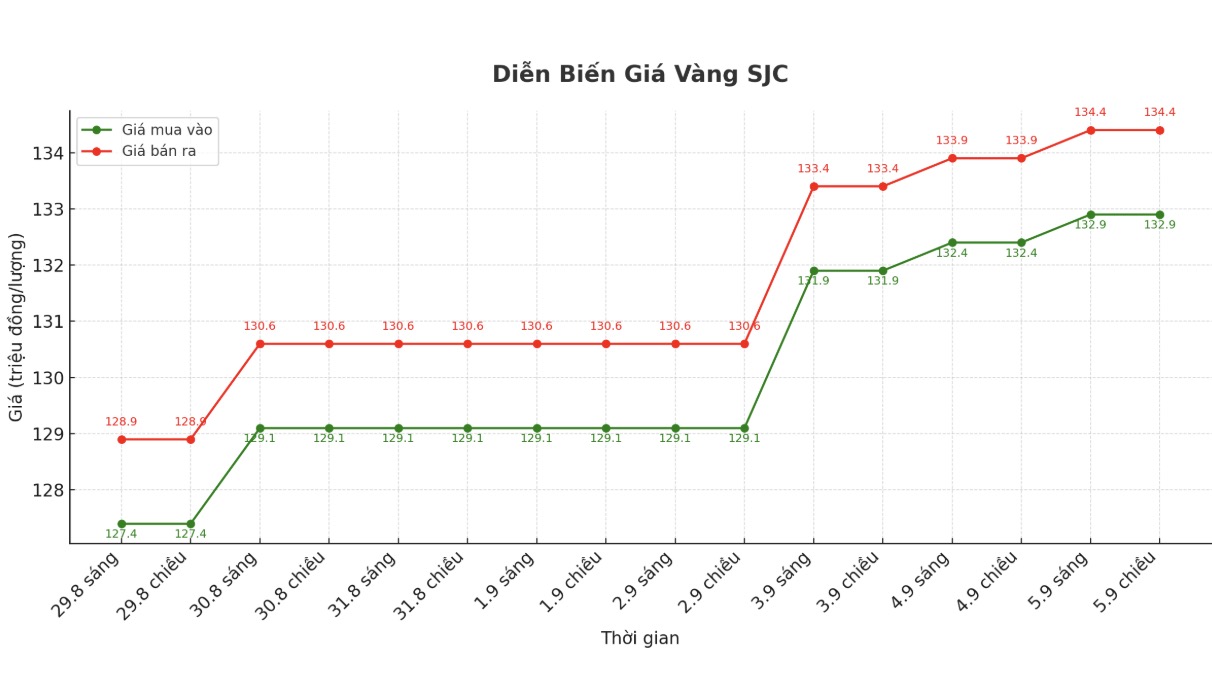

SJC gold bar price

As of 5:30 p.m., DOJI Group listed the price of SJC gold bars at VND132.9-134.4 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 132.9-134.4 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 131.9-134.4 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

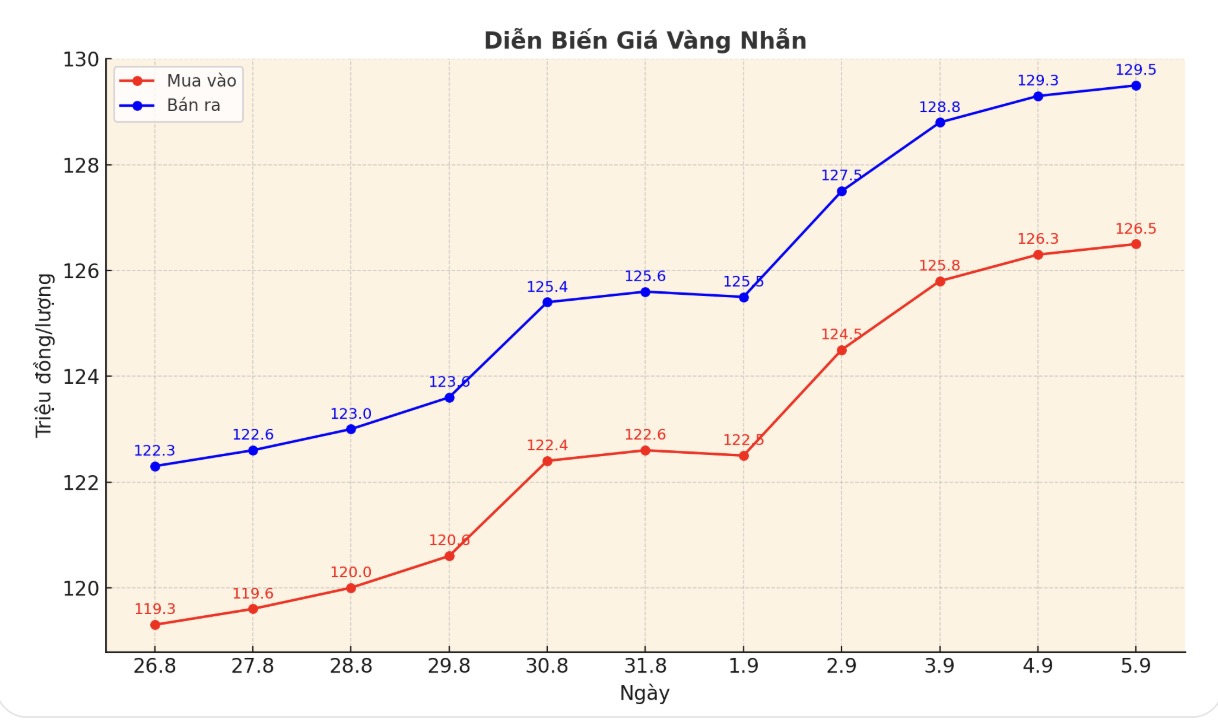

9999 gold ring price

As of 5:30 p.m., DOJI Group listed the price of gold rings at 126.5-129.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 126.8-129.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.5-129.5 million VND/tael (buy in - sell out), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

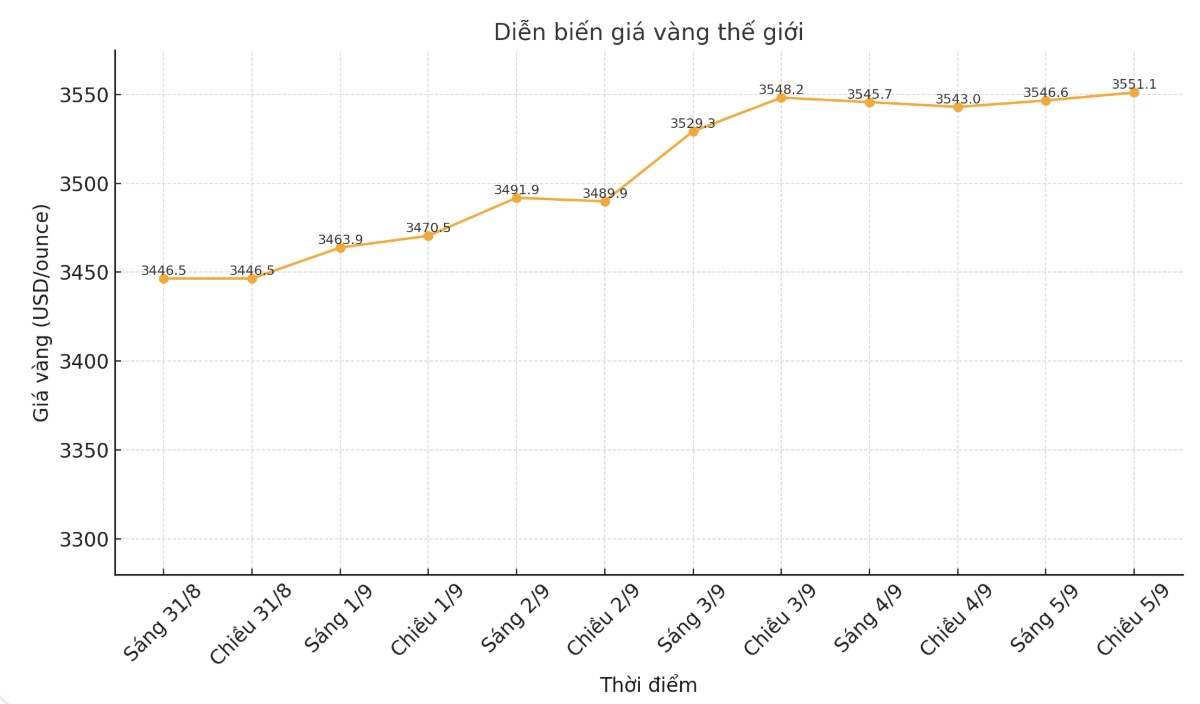

World gold price

The world gold price was listed at 5:30 p.m. at 3,551.1 USD/ounce, up 8.1 USD.

Gold price forecast

Gold prices rose on Friday and are on track for a three-month strongest week of gains, driven by growing expectations that the US Federal Reserve will cut interest rates this month, as attention turned to the US non-farm payrolls report due later in the day.

Mr. Tim Waterer - chief analyst at KCM Trade - said: "Gold is gradually increasing today, but traders do not want to push prices up too high before having non-farm payrolls data. Market factors are still leaning towards gold with the possibility of interest rate cuts, Donald Trump's efforts to orient the Fed towards a more loose direction, along with the Russia-Ukraine conflict that has not cooled down.

Some say that the breakout of over $3,500/ounce has put the gold market in overbought territory. However, gold prices still have room to increase as instability continues to dominate global sentiment, according to an analyst.

In the latest report, Suki Cooper - Head of Commodity Research at Standard Chartered Bank predicts that gold prices will average about 3,700 USD/ounce in the fourth quarter.

The recent rally has been driven by a series of factors, including tariff concerns, expectations of monetary easing, the growing US public debt burden and concerns about the Feds independence, she said. Gold's safe-haven appeal continues to increase ahead of the US jobs report and the US Federal Reserve (FED) meeting in September.

Cooper stressed that gold not only set a new record against the US dollar but also appreciated against most other major currencies. This widespread demand will continue to support the long-term uptrend.

Its not surprising that global gold trading volume is rising sharply, but there are two bright spots, she said.

First, cash flow into gold ETP funds increased the fastest since February.

Second, trading volume on the Shanghai Gold Exchange also broke out faster than other regions. This increase is not concentrated in one area.

The rally began after Fed Chairman Jerome Powell signaled a monetary policy change in his speech at the Jackson Hole annual meeting. He said the balance of changing risks could force the Fed to adjust policy.

As a result, the market has been buring on a rate cut this month and rising inflation has not changed those expectations. Cooper believes that weak economic data could further boost easing expectations.

Gold, like other markets, is tracking US NFP data and the September Fed meeting. According to our macro experts, if the August NFP is below 40,000, the market will aim for a 50 basis point cut, she said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...