Gold prices rose on Friday and are on track for a three-month strongest week of gains, driven by growing expectations that the US Federal Reserve will cut interest rates this month, as attention turned to the US non-farm payrolls report due later in the day.

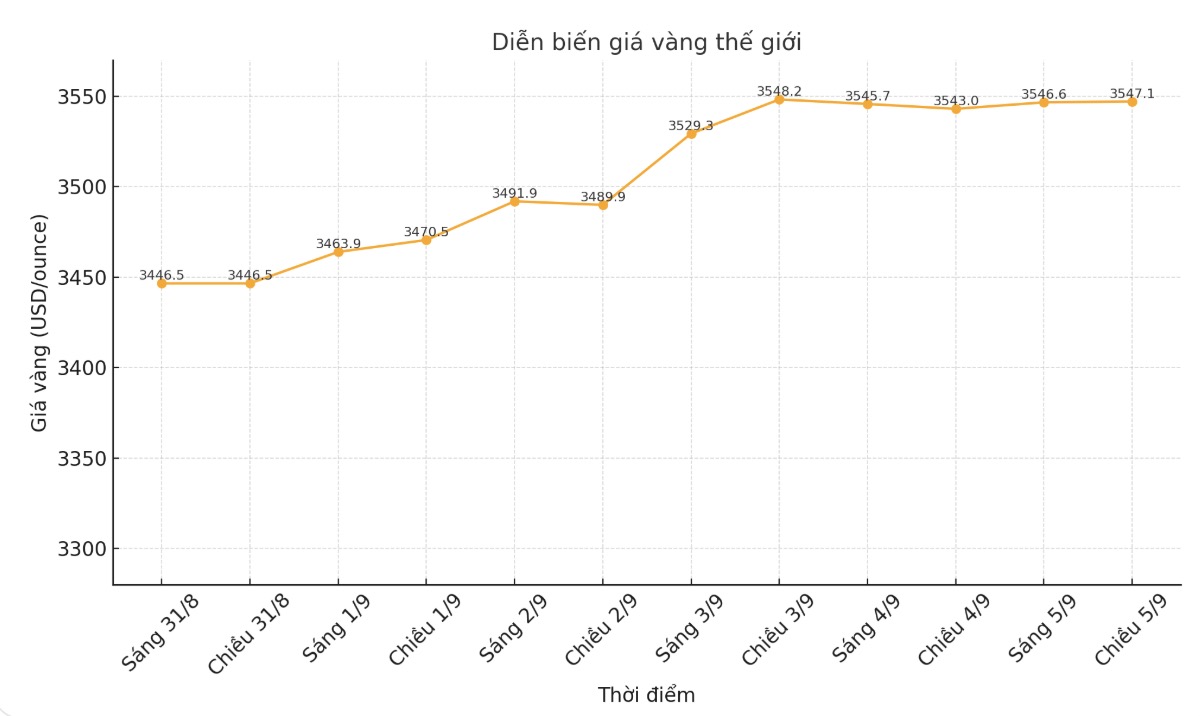

At 6:40 a.m. GMT, spot gold rose 0.2% to $3,552.71/ounce, nearing a record high of $3,578.50/ounce set on Wednesday.

Since the beginning of the week, this precious metal has increased by 3.1%. US December gold futures also increased 0.1% to $3,611.7/ounce.

Mr. Tim Waterer - chief analyst at KCM Trade - said: "Gold is gradually increasing today, but traders do not want to push prices up too high before having non-farm payrolls data. Market factors are still leaning towards gold with the possibility of interest rate cuts, Donald Trump's efforts to orient the Fed towards a more loose direction, along with the Russia-Ukraine conflict that has not cooled down.

The number of new unemployment claims in the US increased more than expected last week, reflecting a weakening labor market. In addition, the ADP private sector employment report showed that the number of new jobs in August was also lower than expected.

Many Fed officials this week said that concerns about the labor market reinforce the view of cutting interest rates. FED Governor Christopher Waller affirmed that he believes the US Central Bank should cut interest rates at the upcoming meeting.

According to CME Group's FedWatch tool, traders are now almost certain that the Fed will cut interest rates by 25 basis points at the end of the two-day policy meeting, which ends on September 17. Gold - non-interest-bearing assets often benefit from a low interest rate environment.

The market is waiting for the US non-farm payrolls report released at 12:30 GMT for more basis on the Fed's interest rate roadmap.

Meanwhile, the record high in gold prices has reduced physical demand in Asian centers, forcing dealers in China and India to offer discounts to attract customers.

In other markets, spot silver rose 0.4% to $40.84/ounce and is on track for a third straight year. platinum rose 0.9% to $1,379.24 an ounce, while palladium moved sideways at $1,127.4 an ounce.

See more news related to gold prices HERE...