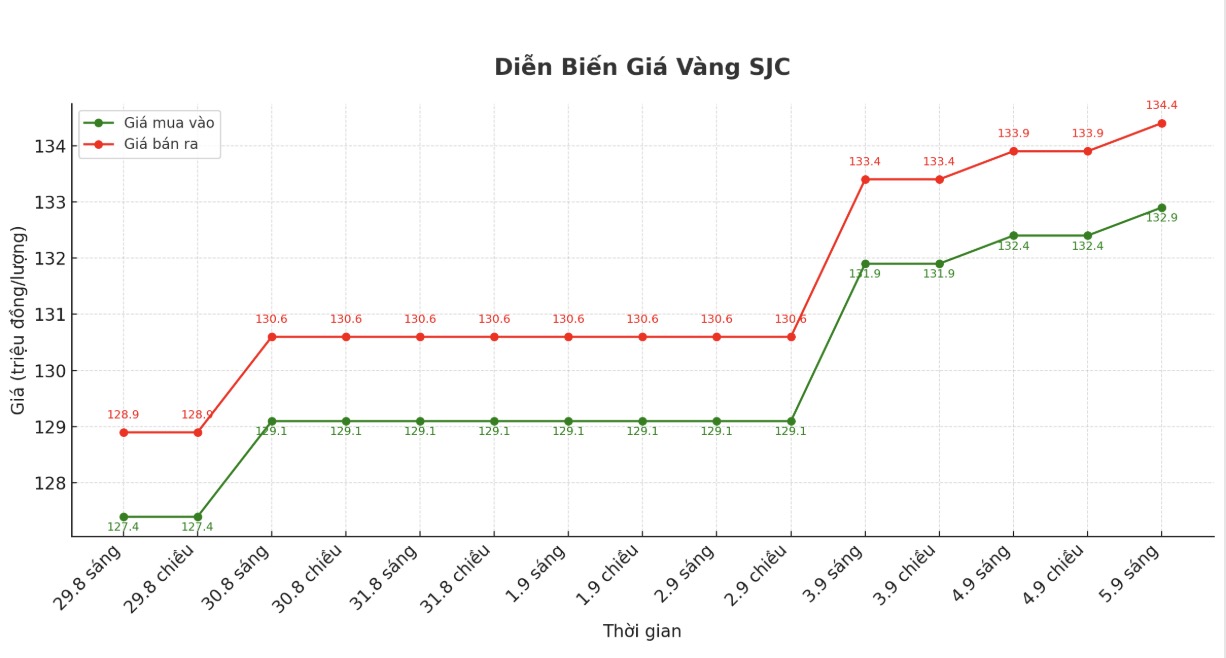

Updated SJC gold price

As of 9:45 a.m., DOJI Group listed the price of SJC gold bars at VND132.9-134.4 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 132.9-134.4 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 131.9-134.4 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

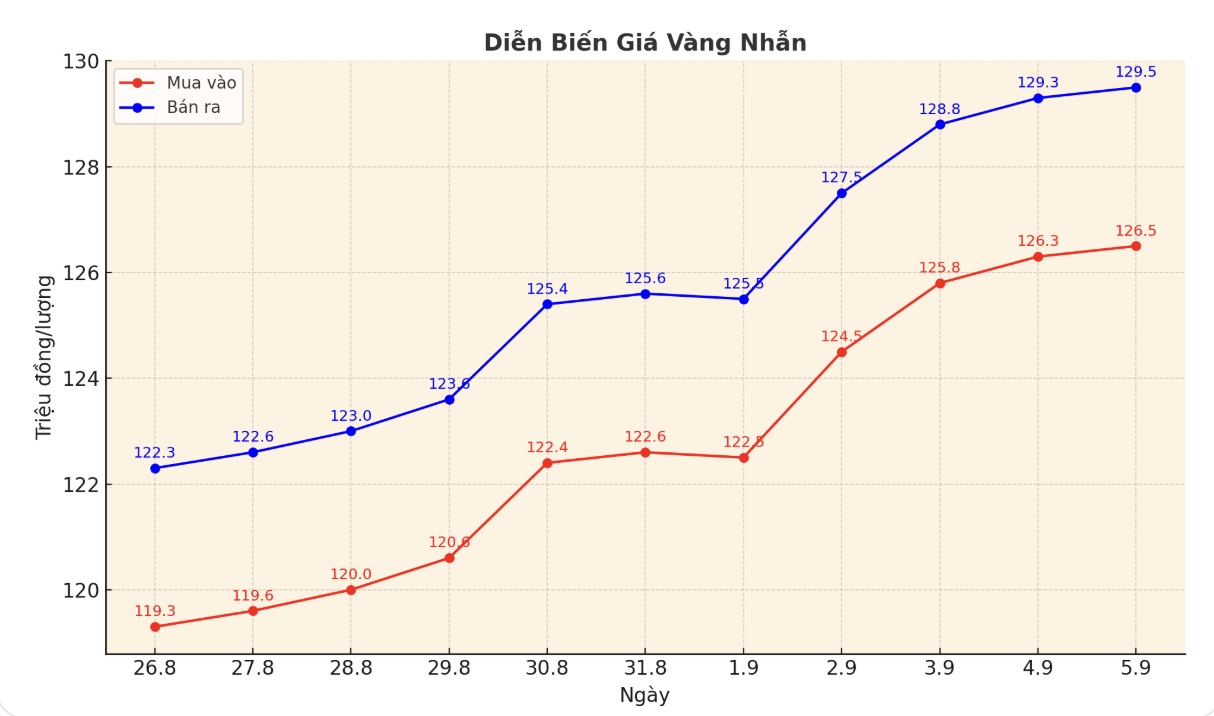

9999 round gold ring price

As of 9:45 a.m., DOJI Group listed the price of gold rings at 126.5-129.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 126.8-129.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.5-129.5 million VND/tael (buy in - sell out), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

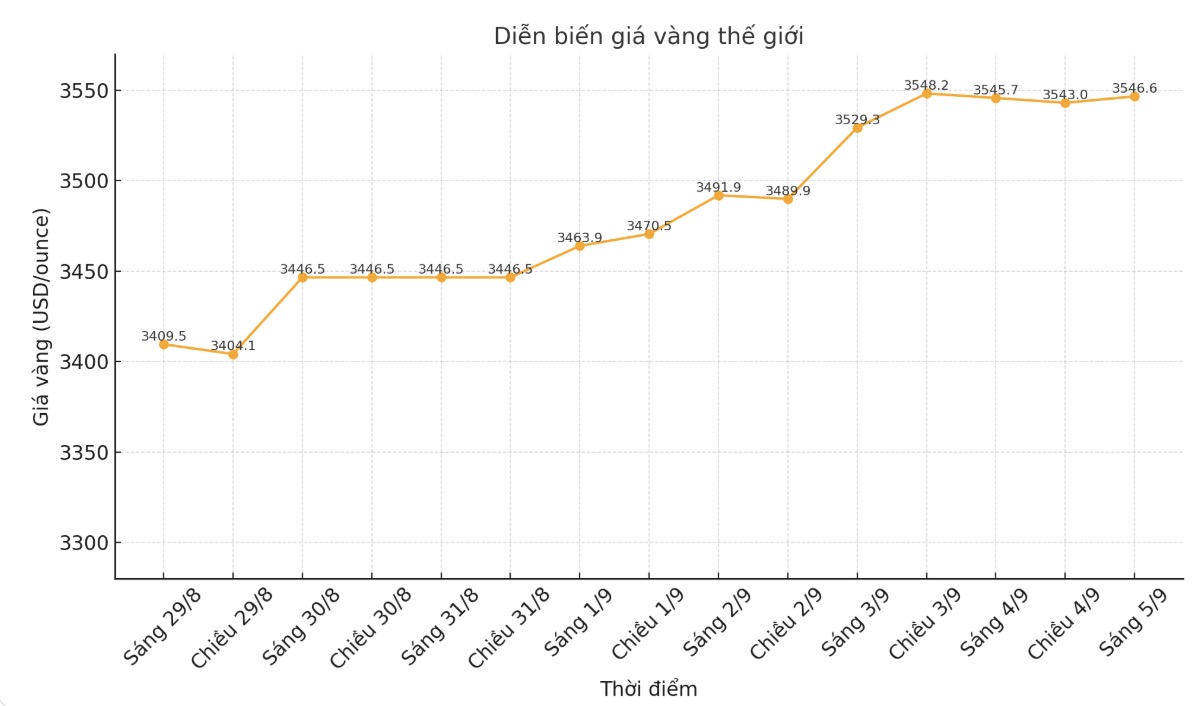

World gold price

At 9:45 a.m., the world gold price was listed around 3,546.6 USD/ounce, up 3.7 USD compared to a day ago.

Gold price forecast

The world gold price increase showed signs of slowing down as short-term futures traders took profits after gold set an all-time record and silver reached a 14-year high on Wednesday.

Mr. Brian Lan - Director of Gold Silver Central - commented: "We are witnessing a profit-taking, but gold is still in an uptrend. Expectations of interest rate cuts and concerns about the independence of the US Federal Reserve (FED) will continue to boost safe-haven demand."

In the case of private investors sharply increasing their diversification into gold, we see the potential for gold prices to surpass the $4,000/ounce base by mid-2026, said Goldman Sachs. Therefore, gold is still our most reliable long-term buying recommendation."

In another development, commodity analysts at TD Securities said on Wednesday that they have closed a strategic gold buying position and made a profit of more than 3 million USD even though gold is still in an uptrend.

TDS opened a buying position in June, considering gold a "low-risk hedge against geopolitical instability". The Canadian bank entered the market at $3,345 an ounce, predicting that a rate cut amid concerns about rising inflation would continue to push gold prices higher. The initial price target for TDS is $3,635/ounce.

Although gold has not yet reached that target, analysts said they are taking profits out of concern for upcoming news risks. The bank also noted that market fluctuations related to global trade issues have cooled down, and buying positions are showing signs of "shoring" again, which could limit the room for increase in the short term.

Looking at the longer term, investors still maintain confidence in sustainable price increase momentum.

Technically, bulls are still in a strong position in the short term with December gold delivery contracts. The next target for buyers is to close above the solid resistance level of 3,700 USD/ounce.

In contrast, the nearest target for the bears is to pull prices below the strong technical support zone at $3,500/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...