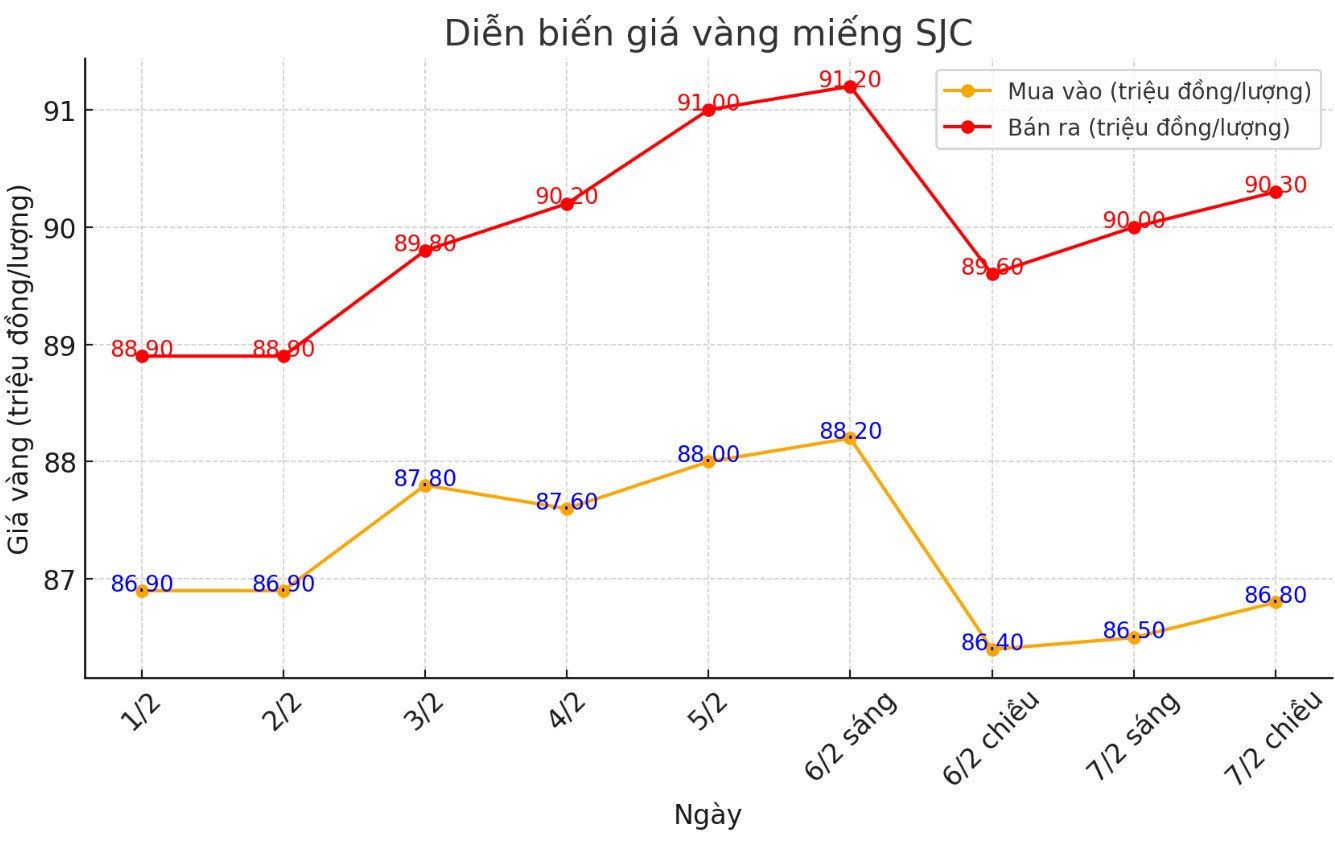

Update SJC gold price

As of 17h15, SJC gold price was listed by Saigon SJC VBD Company at the threshold of 86.8-90.3 million dong/tael (buying - selling); Increasing VND 400,000/tael to buy and up VND 700,000/tael to sell compared to the first session.

SJC gold price difference at Saigon SJC VBD Company at 3.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed SJC gold price at the threshold of 86.8-90.25 million VND/tael (bought - sold). Buying difference - sold at the threshold of 3.45 million VND/tael.

SJC gold price is listed by DOJI Group at the threshold of VND 86.8-90.3 million/tael (bought - sold); Increasing VND 400,000/tael to buy and up VND 700,000/tael to sell compared to the first session.

SJC gold price difference at Doji Group is at 3.5 million VND/tael.

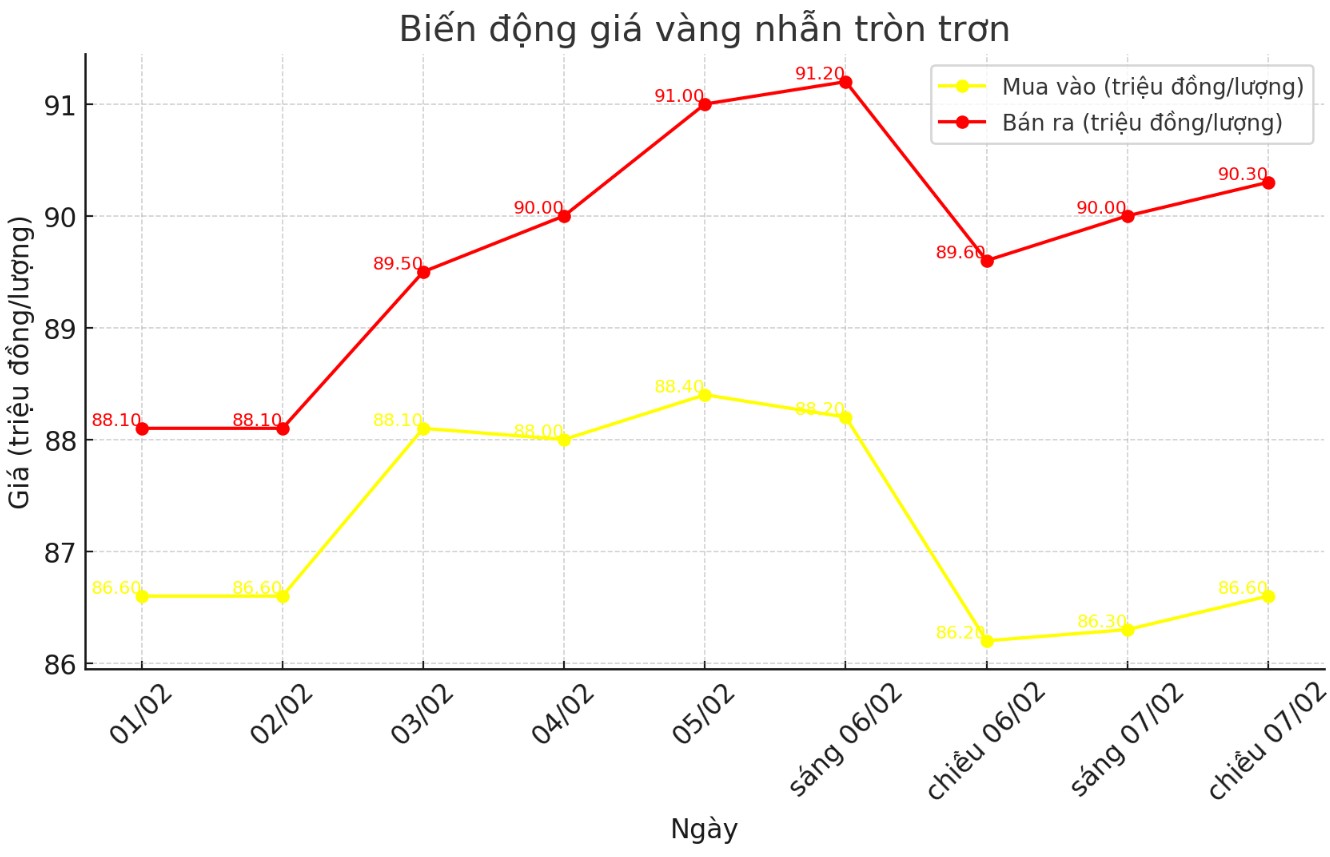

Gold price round 9999

As of 18:00 today, the price of gold ring 9999 prosperity at Doji listed at the threshold of 86.6-90.3 million dong/tael (purchased - sold); Increasing VND 400,000/tael to buy and up 700,000 VND/tael sold compared to the closing session yesterday.

Buying difference - Sell the price of gold round 9999 flourishing in Doji at 3.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 86.8-90.25 million VND/tael (buying - selling), an increase of VND 400,000/tael to buy and an increase of VND 700,000/tael to sell compared to the pin The session yesterday. Buying difference - sold at the threshold of 3.45 million VND/tael.

Recently, domestic gold price fluctuated strongly. Worth mentioning, the difference in buying - selling is increasingly expanded, up to 3.7 million/tael.

The difference in buying and selling prices is too large, creating a huge risk for gold investors. When the difference is pushed up, the price of gold not only needs to increase but must increase sharply to help investors escape losses.

In the context that gold price is adjusting, the purchase at a high difference makes investors heavy losses. As long as the market is gently adjusted, investors have lost a significant amount.

In the context of strong price fluctuations, what makes investors worry is not only a decrease in price but also how gold enterprises adjust the difference, increasing risks when trading. To avoid risks, investors need to observe the market carefully, consider before buying, especially at the time when the difference is pushed up too high.

World gold price

As of 17h15, the world gold price continued to break the record, listed on Kitco at the threshold of 2,866.7 USD/ounce, up 4.9 USD/ounce compared to the same time.

Gold price forecast

The world gold price increased slightly in the context of the USD index tended to decrease. Recognized at 17h15 on 7.2, the US Dollar Index measured the fluctuations of green silver coins with 6 key currencies at the threshold of 107,910 points (up 0.03%).

According to Kitco, the world gold price stopped when investors avoid buying because the US Federal Reserve (Fed) is not clear about cutting interest rates this year.

In a recent interview with Kitco News, Kathy Kriskey - a commodity strategist at Invesco - said that investors should pay attention to a new factor that is dominating gold prices.

Kriskey explained that investors are looking for gold to protect themselves from global and geopolitical economic instability. She pointed out that this mentality is not new, because many older investors have long considered gold as a tool to protect property. However, it is surprising that even young investors are starting to care about gold when market fluctuations increase.

“If you are an investor and something that makes you scared, then you need gold in your portfolio. Gold is a safe and solid shield ” - she said.

In the forecast sent to the London Gold Market Association (LBMA), Bernard Dahdah - a valuable metal analyst at Natixis - said that the demand from the central bank and the return of investors will continue to continue. Push gold price higher in 2025.

"The demand from the central bank will maintain near the 2024 level, with the trend of USD continues to take place in countries that are not friendly to the West (mainly due to concerns about freezing Russian assets after the game. Conflict in Ukraine)

Looking further about the supply and demand of the gold market, Dahdah is quite optimistic about this precious metal, the price is expected to exceed US $ 3,200/ounce and on average about US $ 2,725/ounce this year

See more news related to gold price here ...