Update SJC gold price

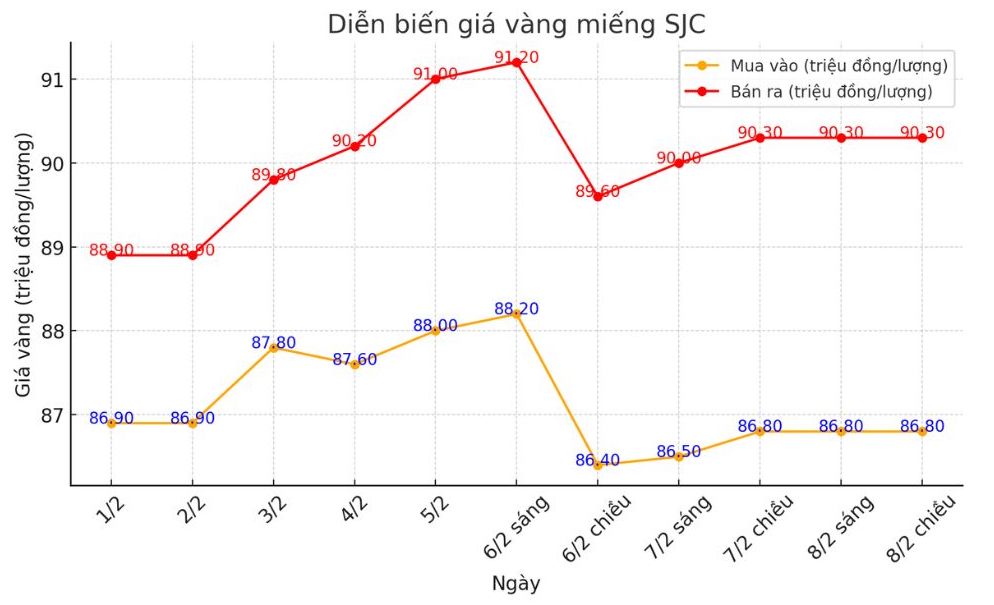

As of 17:15, SJC gold price was listed by SAGA SJC VBD Company at the threshold of 86.8 - 90.3 million VND/tael (buying - selling); Keep both the buying and sell the same direction compared to the previous session.

SJC gold price difference at Saigon SJC VBD Company at 3.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed SJC gold price at 86.8 - 90.3 million dong/tael (bought - sold). Buying difference - sold at the threshold of 3.5 million/tael.

SJC gold price is listed by DOJI Group at the threshold of VND 86.8-90.3 million/tael (bought - sold). SJC gold price difference at Doji Group is at 3.5 million VND/tael.

Gold price round 9999

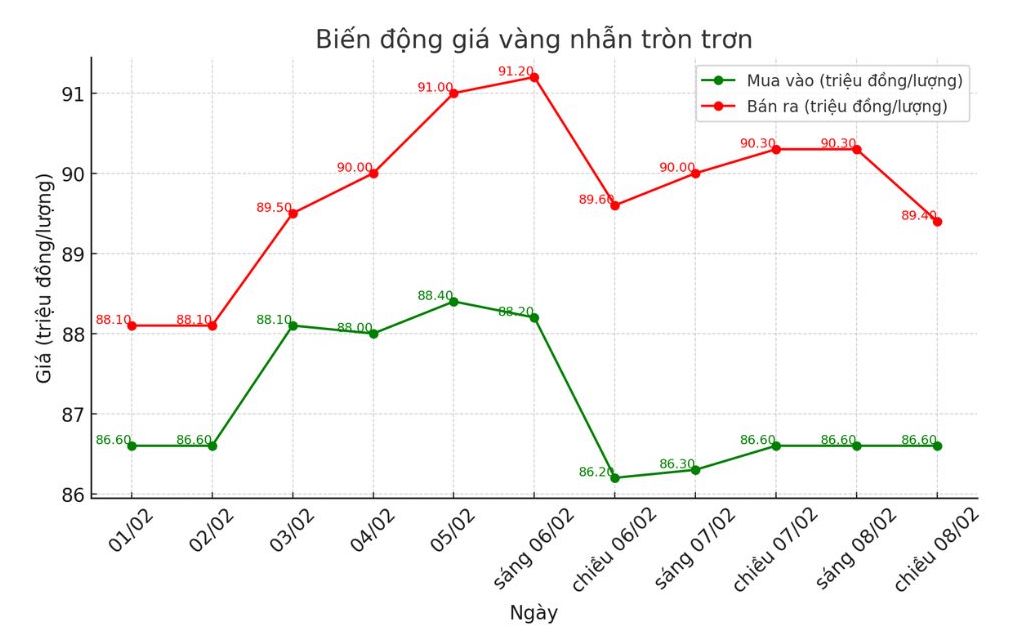

As of 17:30 today, the price of gold ring 9999 prosperity at Doji listed at the threshold of 86.6 - 89.4 million VND/tael (purchased - sold); Maintain in the buying direction and decrease 900,000 VND/tael to sell compared to the closing session yesterday.

Buying difference - Sell the price of gold ring 9999 prosperity in Doji at 2.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 86.8-90.25 million dong/tael (bought - sold), keeping both the buying and selling directions compared to the closing session yesterday. Buying difference - sold at the threshold of 3.45 million VND/tael.

World gold price

As of 17h40, the world gold price listed on Kitco at the threshold of 2,861.25 USD/ounce, up 9.7 USD/ounce compared to the same time.

Gold price forecast

Despite a slight cooling after setting up the historic peak of 2,882 USD/ounce on 5.2, gold price is still expected to go up and soon exceed the threshold of $ 2,900/ounce before reaching $ 3,000 this year.

Investors are concerned that inflation will rise again in many countries around the world when instability increases, the trade war broke out and broken supply chains. Mr. Trump's use of taxes as a measure to bring benefits to the United States can escalate the price of goods, while the energy price has not decreased in time.

In a recent interview with Kitco News, Kathy Kriskey - a commodity strategist at Invesco - said that investors should pay attention to a new factor that is dominating gold prices.

Kriskey explained that investors are looking for gold to protect themselves from global and geopolitical economic instability. She pointed out that this psychology is not new, because many older investors have long considered gold as a tool to protect property. However, the surprise is that even young investors are starting to pay attention to gold when market fluctuations increase.

“If you are an investor and something that makes you scared, then you need gold in your portfolio. Gold is a safe and solid shield ” - she said.

The market is also closely monitoring the possibility that the US Ministry of Finance re -values the national gold reserve, which is much lower than the market price, thereby allowing the supply of a corresponding USD. If so, the need to issue more bonds will decrease, the yield decreases, so that it can push gold price to go up.

Increasing money supply can lead to concerns about inflation, causing investors to look for gold as a value -preserving property.

The need for safe shelter against geopolitical risks, including conflicts in the Middle East, is also a supportive factor for this metal item.

See more news related to gold price here ...