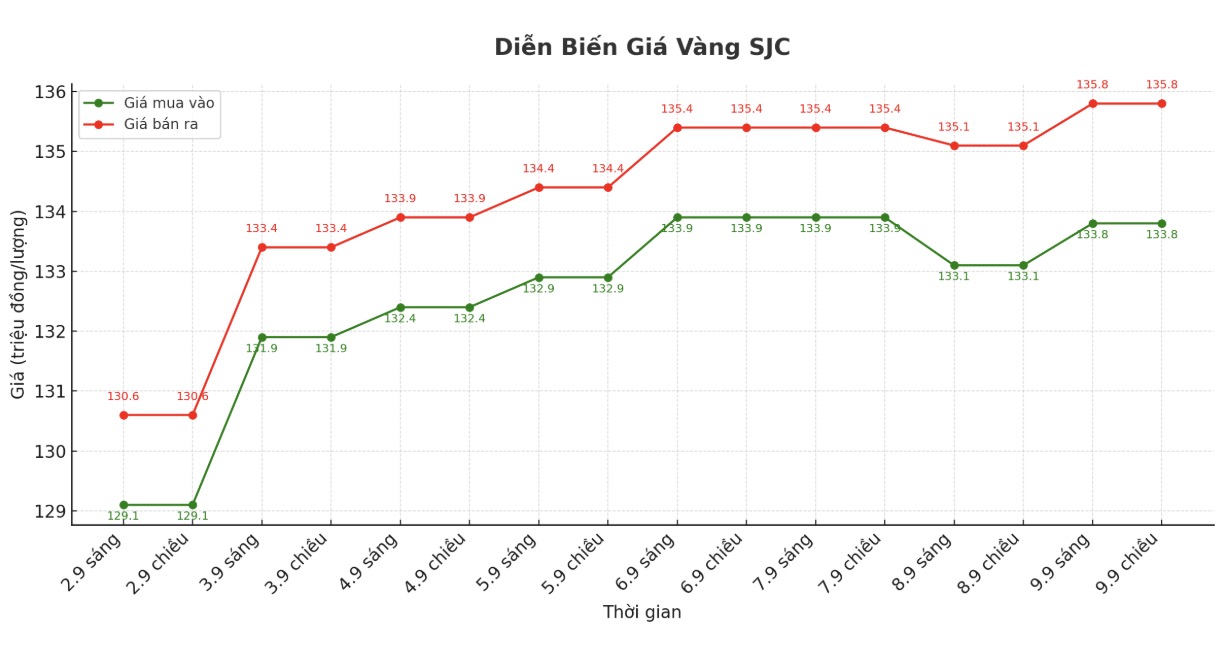

SJC gold bar price

As of 7:15 p.m., DOJI Group listed the price of SJC gold bars at 133.8-135.8 million VND/tael (buy - sell), an increase of 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 133.8-135.8 million VND/tael (buy - sell), an increase of 700,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 133-135.8 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and an increase of 700,000 VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

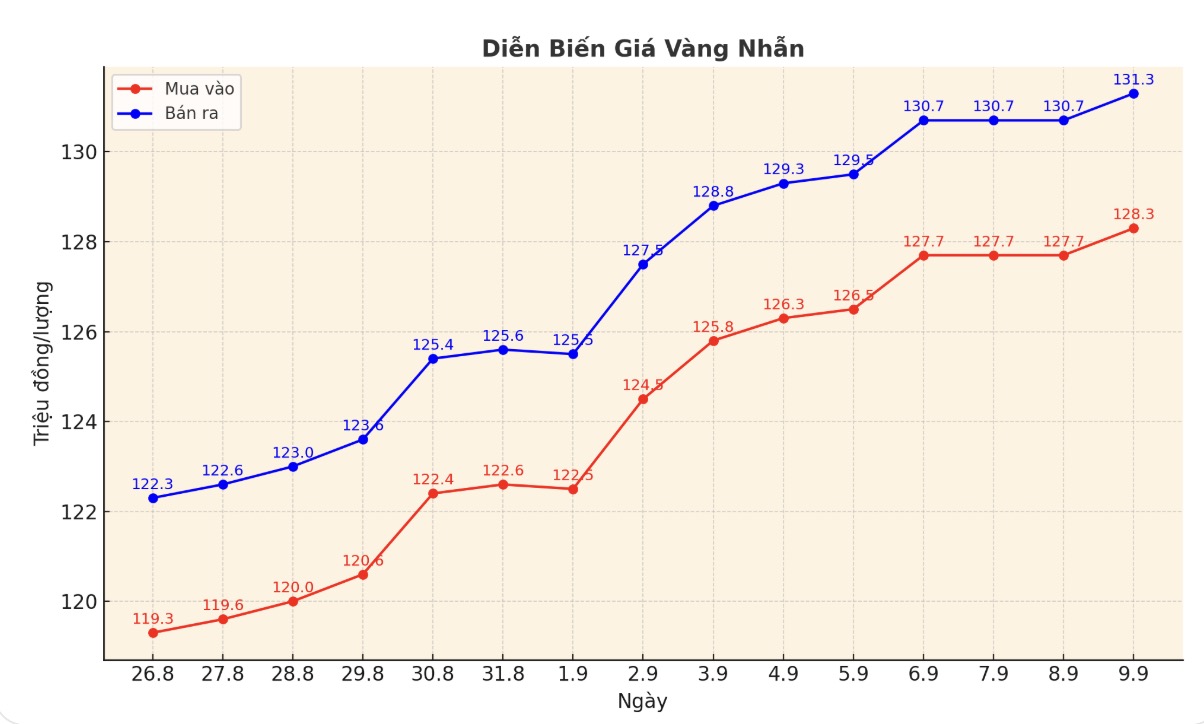

9999 gold ring price

As of 7:15 p.m., DOJI Group listed the price of gold rings at 128.3-131.3 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 128.5-131.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128-131 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

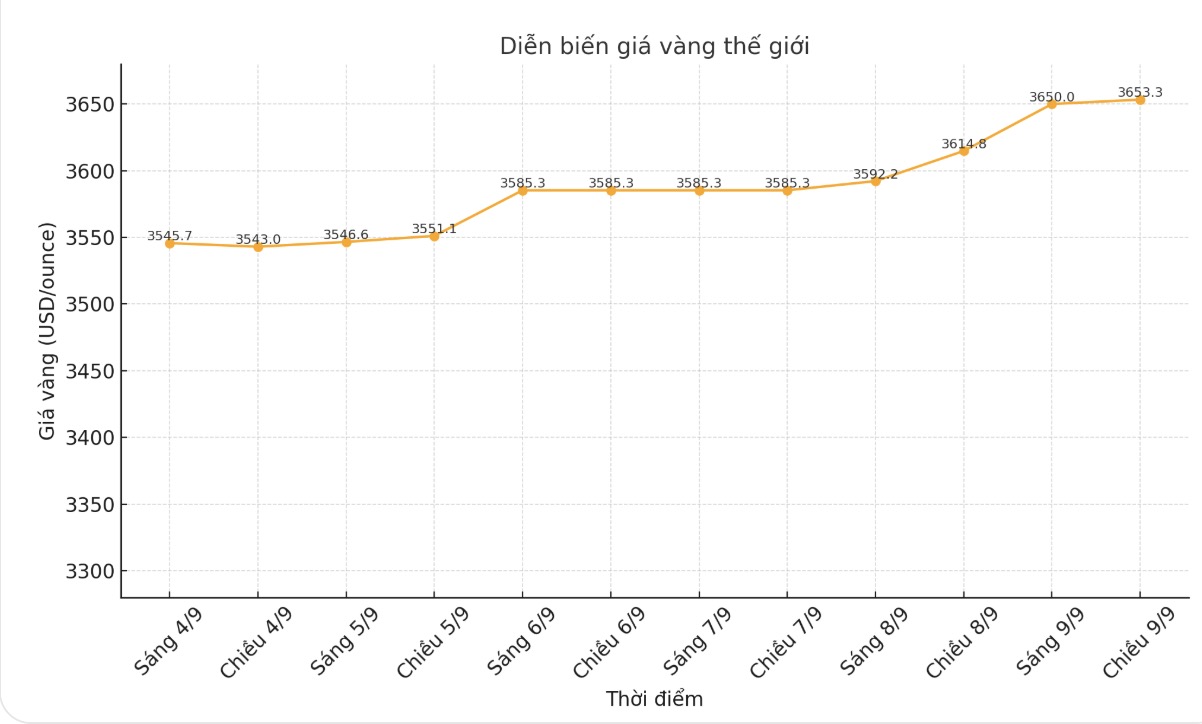

World gold price

The world gold price listed at 7:17 p.m. was at 3,653.3 USD/ounce, up 38.5 USD.

Gold price forecast

World gold prices hit a record high on Tuesday, supported by a weaker US dollar and falling bond yields, as growing expectations of the US Federal Reserve (FED) cutting interest rates this month increased demand for precious metals.

We could see gold continue to rise from here as long as the US central bank acts as the market expects to cut rates several times, said Tim Waterer, chief analyst at KCM Trade.

US job growth weakened significantly in August and the unemployment rate rose to a nearly 4-year high of 4.3%, confirming the weakening labor market and reinforcing the possibility of the Fed cutting interest rates next week.

According to CME Group's FedWatch tool, traders are pricing in an 89.4% chance of a 25 basis point cut at this month's meeting, and a 10.6% chance of a sharp cut of 50 basis points.

Lower interest rates put pressure on the USD and bond yields, thereby increasing the attractiveness of gold - a non-yielding asset.

The USD Index (DXY) has fallen to a nearly seven-week low against other major currencies, making gold more attractive to investors holding other currencies. The benchmark 10-year US Treasury yield fell to a five-month low.

Meanwhile, the European Central Bank (ECB) is expected to keep interest rates unchanged at its meeting on Thursday.

Investors are now waiting for US producer price data released on Wednesday and consumer price data on Thursday for more clues on the Fed's policy.

If US inflation data this week is lower than forecast, the Fed could increase the easing level at the September meeting and that could prompt gold to reach $3,700, Waterer added.

Gold prices have risen 38% since the beginning of the year, after an increase of 27% in 2024, supported by a weak US dollar, strong central bank accumulation, loose monetary policy and rising global uncertainty.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...