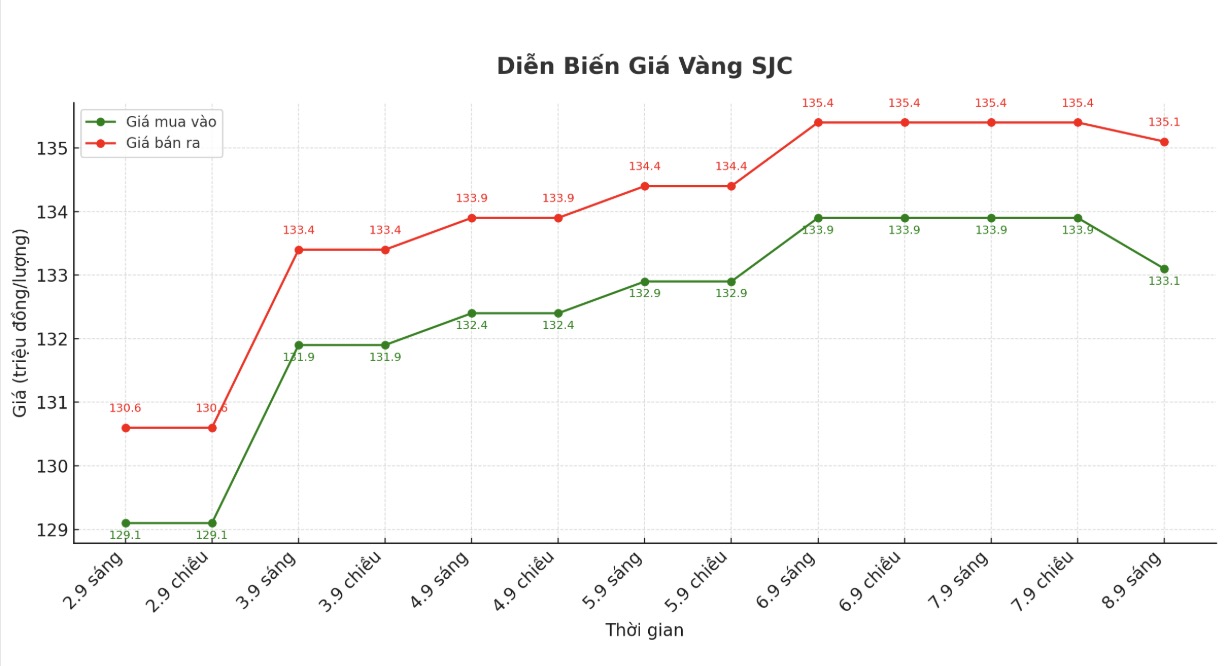

Updated SJC gold price

As of 9:35 a.m., DOJI Group listed the price of SJC gold bars at VND133.1-135.1 million/tael (buy - sell), down VND800,000/tael for buying and down VND300,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133.1-135.1 million VND/tael (buy - sell), down 800,000 VND/tael for buying and down 300,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132.9-135.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

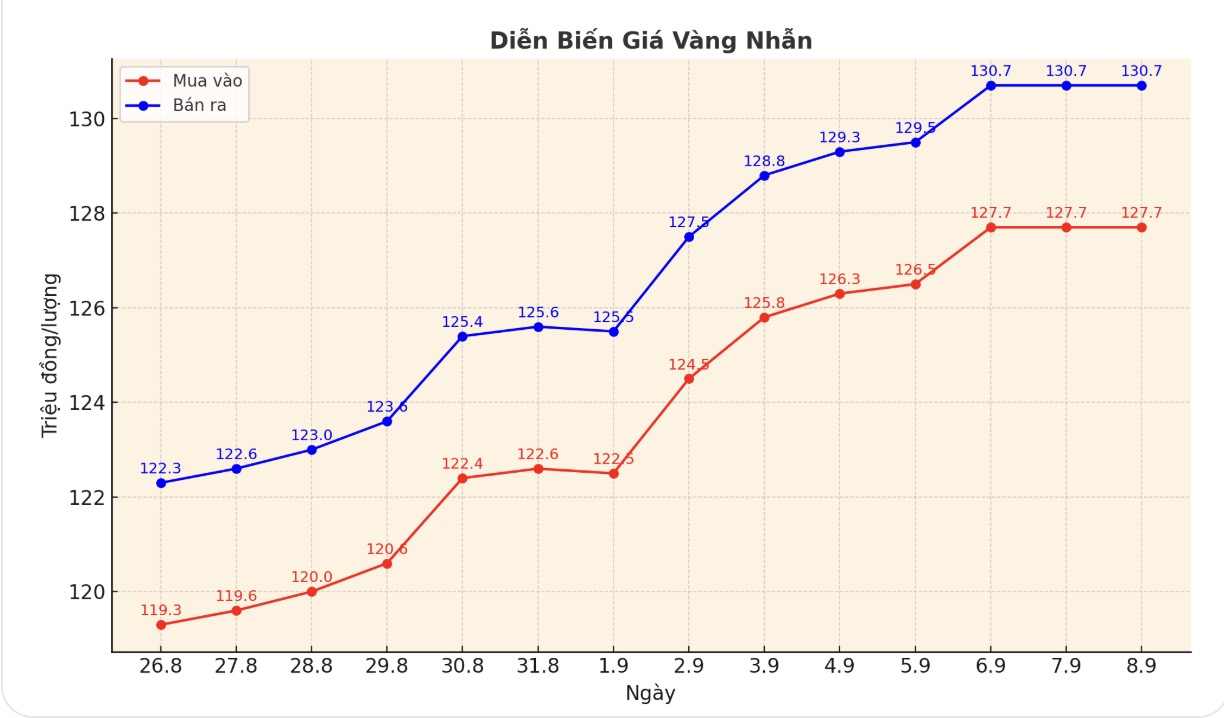

9999 round gold ring price

As of 9:35 a.m., DOJI Group listed the price of gold rings at 127.7/30.7 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 127.8-130.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 127.5-130.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

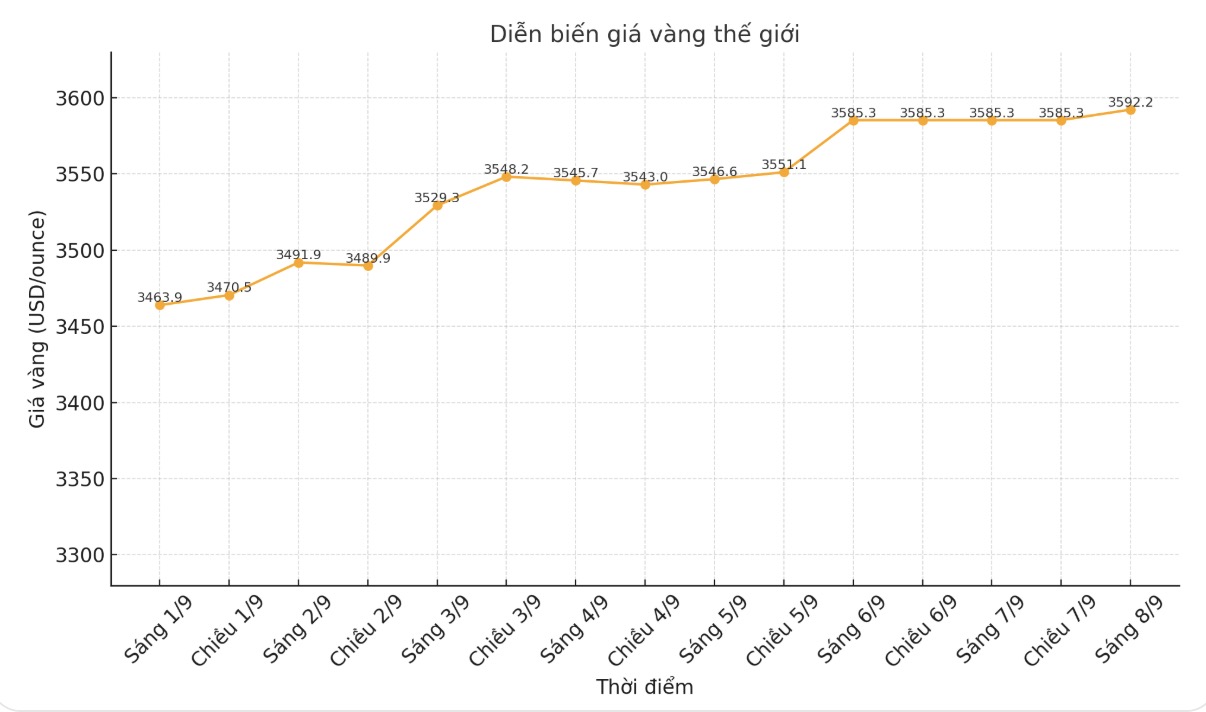

World gold price

At 9:35 a.m., the world gold price was listed around 3,592.2 USD/ounce, up 6.9 USD compared to a day ago.

Gold price forecast

Marc Chandler - CEO of Bannockburn Global Forex - commented that gold prices increased to a record high after reporting weak US employment, a declining USD and falling US bond yields. However, he warned investors to be cautious as prices approach $3,600/ounce, as market sentiment has leaning too much towards expectations of a Fed rate cut, while the CPI released next week could increase again.

Chandler also noted that the use of reverse repo in the US is declining, which could cause strong fluctuations in the bond market. Currently, spot gold prices have surpassed Bollinger Band's upper range, around $3,474/ounce.

Paul Wong - market strategist at Sprott Asset Management - said that the main driver for gold's breakthrough last week came from the massive buying of gold by macro funds and the sale of long-term bonds, bringing prices above the $3,500/ounce mark. He analyzed that for the past four months, gold has been almost flat, with no signs of central bank selling, showing strong accumulation.

According to Paul Wong, this is a super positive technical model: When prices cannot decrease despite a strong increase, it is a sign of the strength of the foundation. Therefore, when there is a breakthrough, prices often bounce very quickly. He predicted the closest target on the chart was $3,900/ounce.

In addition to technical factors, Wong emphasized that the US fundamentals also strongly support gold: higher-than- targets inflation, weak labor market, huge public debt and political pressure on the FED making devaluation of the USD an inevitable trend.

He said another important driver was confidence: When confidence in the financial system, central banks and governments declines, investors will turn to gold as an absolutely safe asset.

Increased, said Michael Moor, founder of Moor Analytics. He analyzed at different time frames that showed that gold has confirmed a strong uptrend.

Sharing the same view, Jim Wyckoff - senior analyst at Kitco, also expects gold to continue to break out: "More gold is thanks to the very positive fundamentals and techniques."

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...