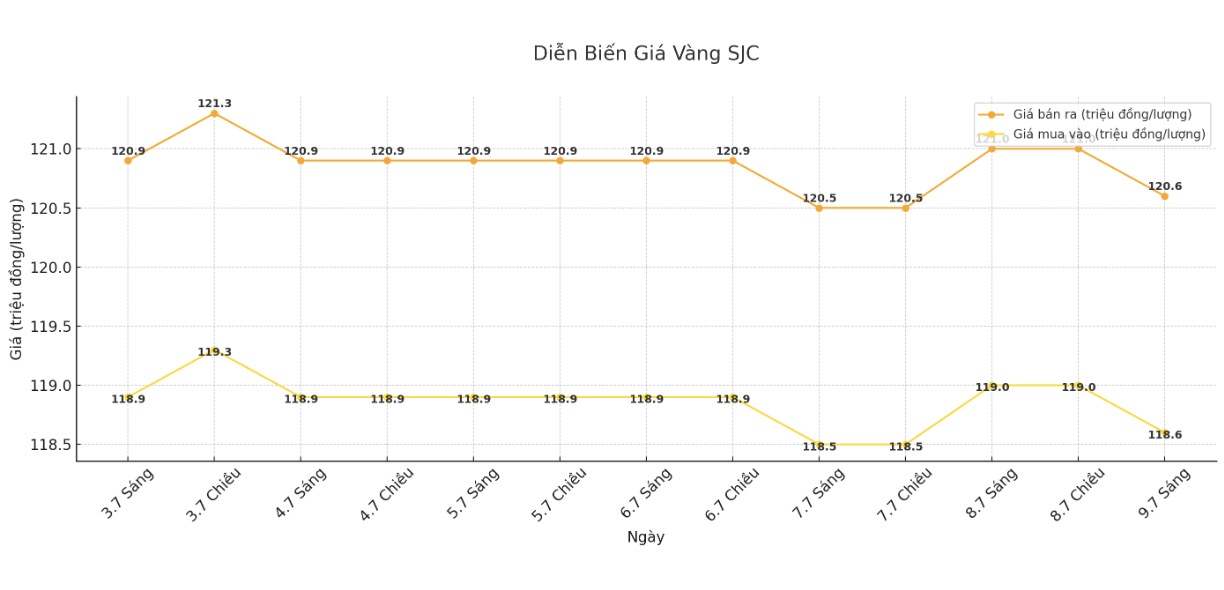

Updated SJC gold price

As of 9:15 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.6-120.6 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed the price of SJC gold bars at 118.6-120.6 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.6-120.6 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.9-120.6 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

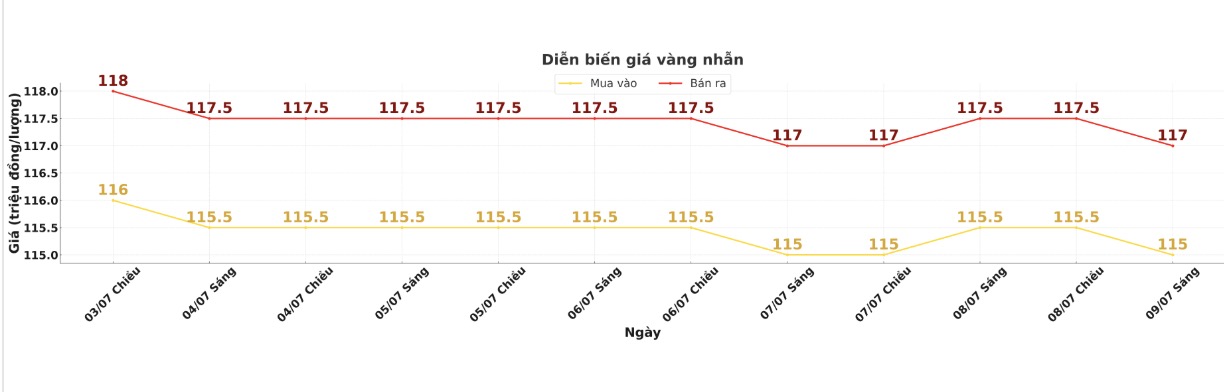

9999 round gold ring price

As of 9:15 a.m., DOJI Group listed the price of gold rings at 115-117 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.2-118.2 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

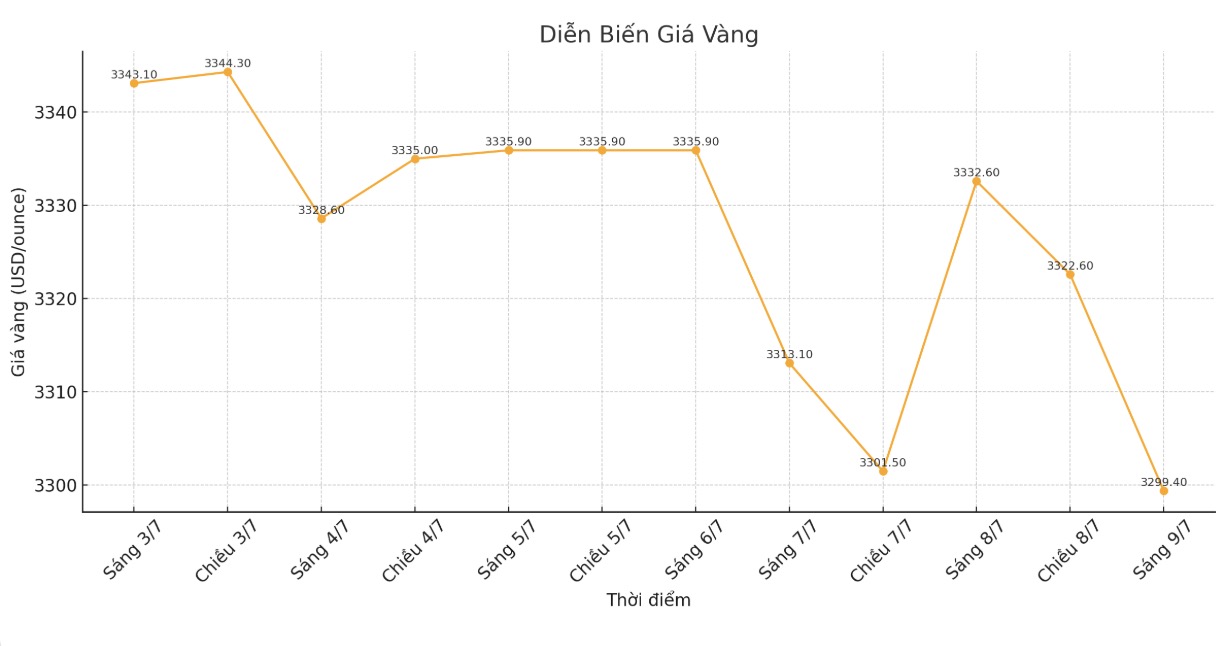

World gold price

At 9:20 a.m., the world gold price was listed around 3,299.4 USD/ounce, down 33.2 USD/ounce compared to 1 day ago.

Gold price forecast

World gold prices fell as the market entered a quiet trading period typically seen in the summer. bulls are in need of a new push from the fundamentals to boost their rally. Otherwise, it is likely that the market will continue to fluctuate within a narrow range in the short term.

Peter Grant - commodity strategist at Zaner Metals - commented: "Investors' interest in trade is increasing, as the deadline of July 9 comes. The Trump administration has also stepped up pressure. However, optimism about trade deals has overwhelmed seeking sanctuary sentiment, causing gold to depreciate.

Meanwhile, central banks' gold purchases continue to be a key pillar supporting the market, helping gold prices stay around $3,300/ounce.

Despite slowing down buying, China still plays a key role in the gold market. According to Krishan Gopaul - an expert of the World Gold Council, People's Bank of China - bought 2 tons of gold in June, bringing the total net purchase from the beginning of the year to 19 tons, with reserves reaching 2,299 tons.

Experts believe that the trend of central banks' gold accumulation will continue, as geopolitical instability and prolonged inflation will make gold return to the role of " silent protection". Ms. Eugenia Mykuliak - CEO of B2PRIME Group - commented that central banks are diversifying assets, not waiting until the crisis to buy gold.

According to Metals Focus, central banks are expected to buy about 1,000 tons of gold this year - the fourth consecutive year exceeding this threshold, accounting for about 21% of global demand, compared to 10% 15 years ago.

In addition to China, Uzbekistan also increased its reserves by 9 tons last month, although it has been a net seller of 18 tons since the beginning of the year. Total reserves are currently at 365 tons.

The market is waiting for the minutes of the latest meeting of the US Federal Reserve (FED), which will be released today, July 9. Some Fed officials are also scheduled to speak this week, giving investors a better understanding of the economy and policies of the agency.

"The risk of prolonged inflation from import taxes is likely to prompt the Fed to continue to postpone interest rate cuts next year. This will put more pressure on gold," said Hamad Hussain, an economist at Capital Economics. Investors now expect the Fed to cut interest rates by a total of 50 basis points (0.5%) this year, starting in October.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...