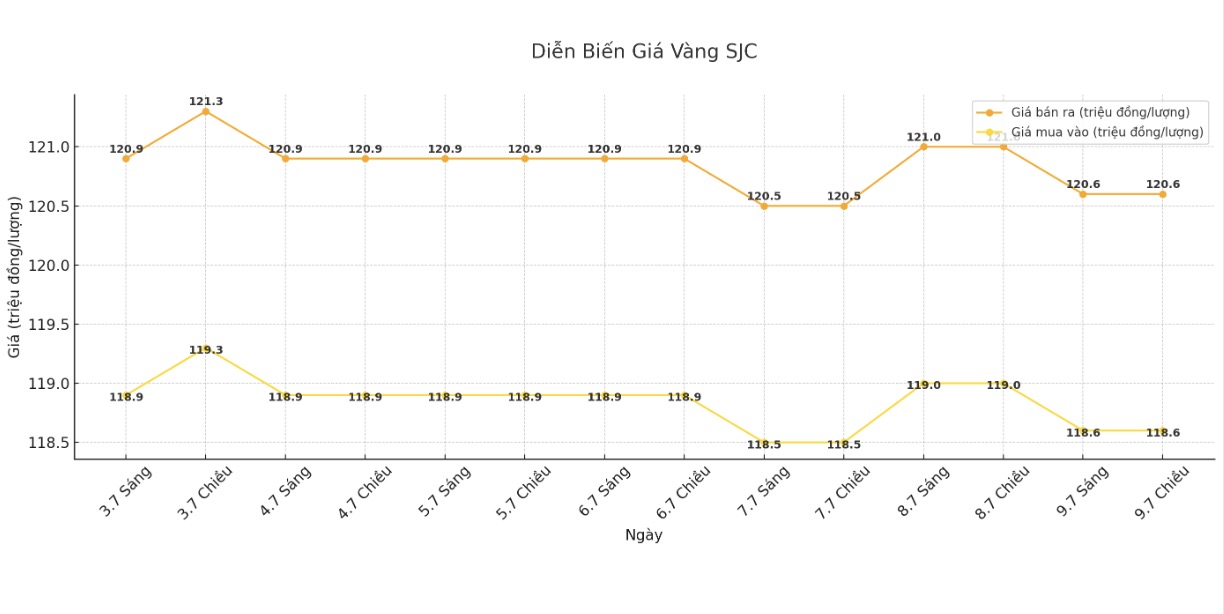

SJC gold bar price

As of 5:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.6-120.6 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.6-120.6 million VND/tael (buy - sell); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.6-120.6 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.9-120.6 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

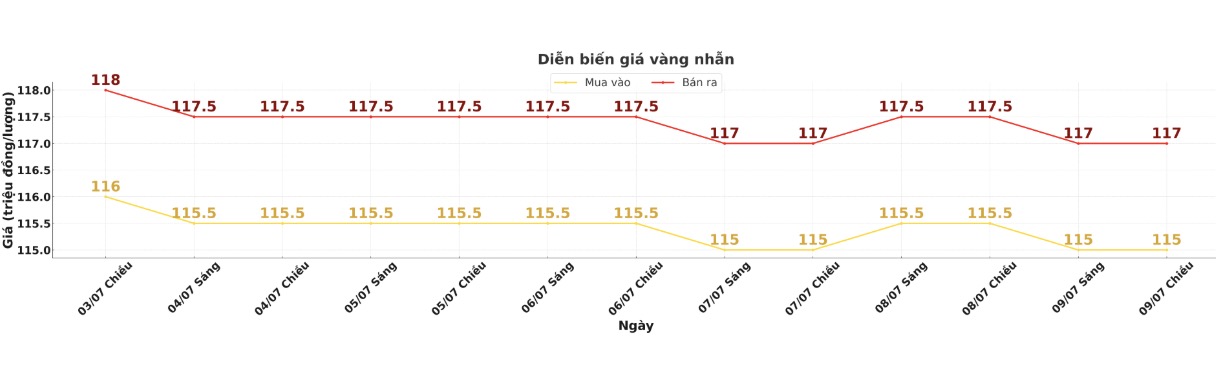

9999 gold ring price

As of 5:20 p.m., DOJI Group listed the price of gold rings at 115-117 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

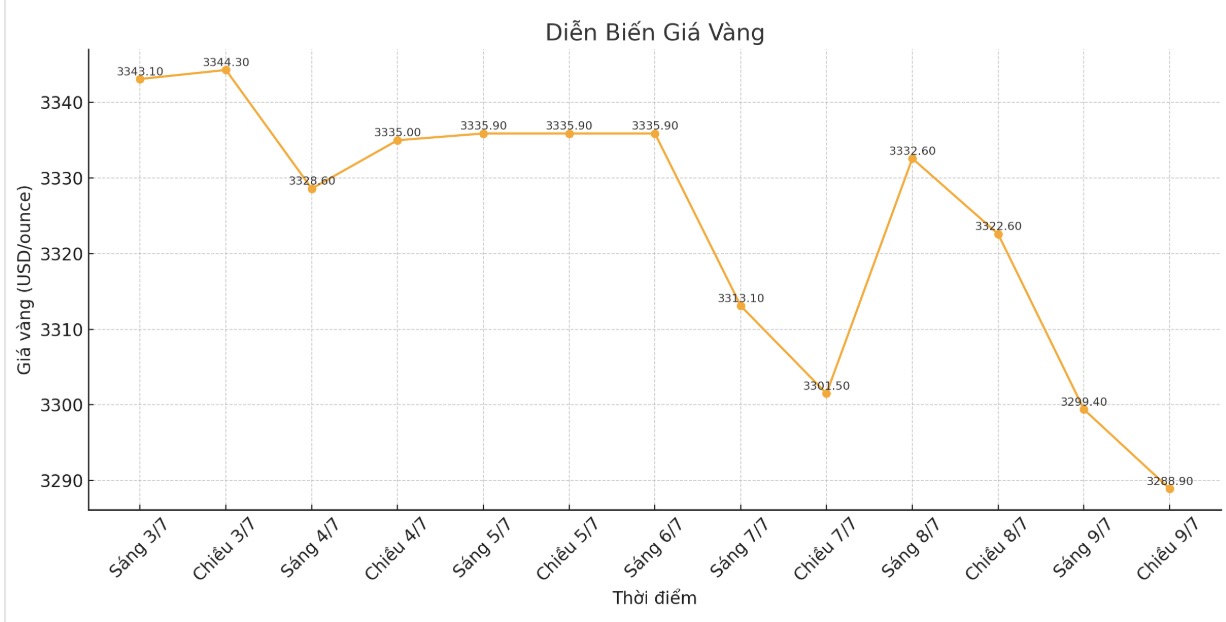

World gold price

The world gold price was listed at 5:20 p.m. at 3,288.9 USD/ounce, down 33.7 USD/ounce compared to 1 day ago.

Gold price forecast

World gold prices fell amid quiet summer trading, the market recorded disbursement from investors holding weak buying positions, mainly short-term futures traders.

bulls in the gold market are currently in need of a fresh boost from the fundamentals to create momentum for the next rally. August gold price is currently down 34.50 USD, down to 3,308.1 USD/ounce. September delivery silver price decreased by 0.299 USD, down to 36.605 USD/ounce.

Risk appetite eased slightly on Tuesday, after US President Donald Trump imposed additional tariffs on Japan and South Korea on Monday. Trump has also sent letters to more than 10 countries, threatening to impose tariffs ranging from 25% to 40%. At the same time, he also postponed the deadline for countries to reach a trade agreement with the US until August 1.

UBS commodity analyst Giovanni Staunovo said: Gold is stuck between two opposite pressures. On the one hand, the US decision to extend the deadline for reaching trade agreements with many partners has put downward pressure on gold prices. On the other hand, US key trading partners in Asia may face higher tariffs in the coming time, which negatively affects economic growth prospects, which is a factor supporting gold prices".

The global geopolitical table is moving towards more risks, pushing up demand for safe-haven assets such as gold. Donald Trump's announcements of a 10% import tax increase targeting BRICS countries have raised concerns about escalating trade tensions. The risk of being retaliated against by China and other partners further highlights the role of gold as a value haven.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...