Gold prices continued to fall to a more than a week low on Wednesday, as investors shifted to the USD after the latest tax declarations by US President Donald Trump, raising concerns about a global trade war.

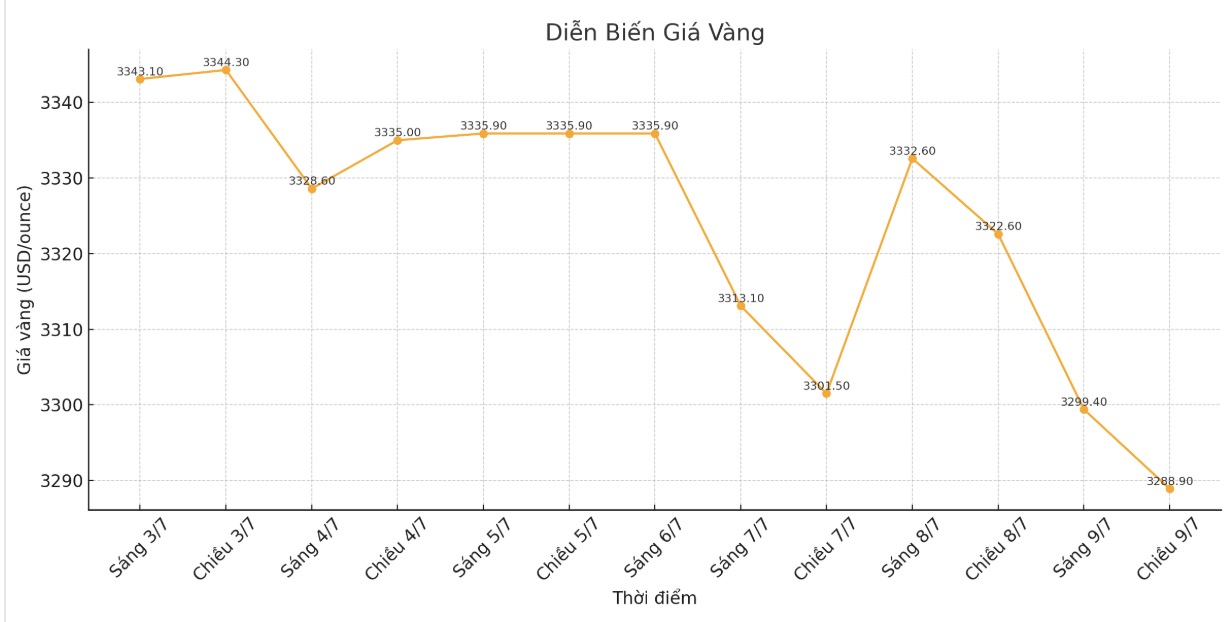

At 5:14 p.m. (Vietnam time), spot gold prices fell 0.3%, down to $3,289.36 an ounce - the lowest level since June 30. US gold futures fell 0.6% to $3,297.1 an ounce.

Fawad Razaqzada, market analyst at City Index and FOREX.com, commented: "The USD has stabilized again, and bond yields have also increased, which reduces the attractiveness of low-yield assets such as the Japanese Yen or gold".

The USD (.DXY) moved sideways after hitting a two-week high in the previous session, while the yield on the 10-year US government bond was near a three-week high, putting pressure on gold and non-interest-bearing assets.

Mr. Donald Trump announced that he would impose a 50% tax on imported copper and impose long-standingly delayed tariffs on semiconductors and pharmaceuticals.

He also reiterated the 10% tariffs on BRICS countries on Tuesday, a day after informing 14 countries, including Japan and South Korea, about the tax increase effective from August 1.

Mr. Trump said that trade negotiations with the European Union and China are going well. However, he also said that he would send a tax letter to the EU in just a few days, a move to continue maintaining tariff pressure.

Razaqzada said that in the short term, gold prices will continue to move sideways, with support around 3,250 USD/ounce and resistance around 3,300 USD/ounce.

Investors are waiting for the minutes of the latest meeting of the US Federal Reserve (FED), scheduled to be released today, to find more signals about the possibility of interest rate cuts in the future.

Mr. Trump has repeatedly criticized Fed Chairman Jerome Powell for not cutting interest rates and hinted at the possibility of appointing a successor soon.

Spot silver prices fell 0.5% to 36.59 USD/ounce; platinum fell 1% to 1,345.64 USD/ounce; palladium lost 2.2%, to 1,086.30 USD/ounce.