SJC gold bar price

As of 6:00 a.m. on October 1, the price of SJC gold bars listed by DOJI Group was at 81.5 - 83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold at 81.5 - 83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at Bao Tin Minh Chau remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

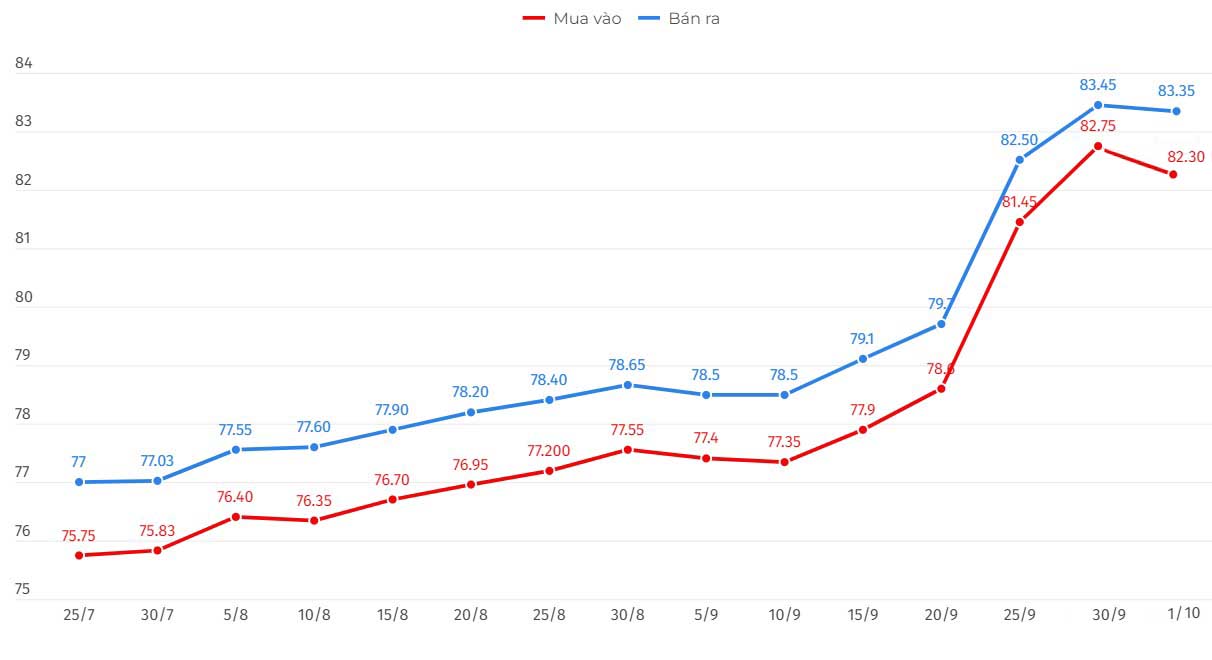

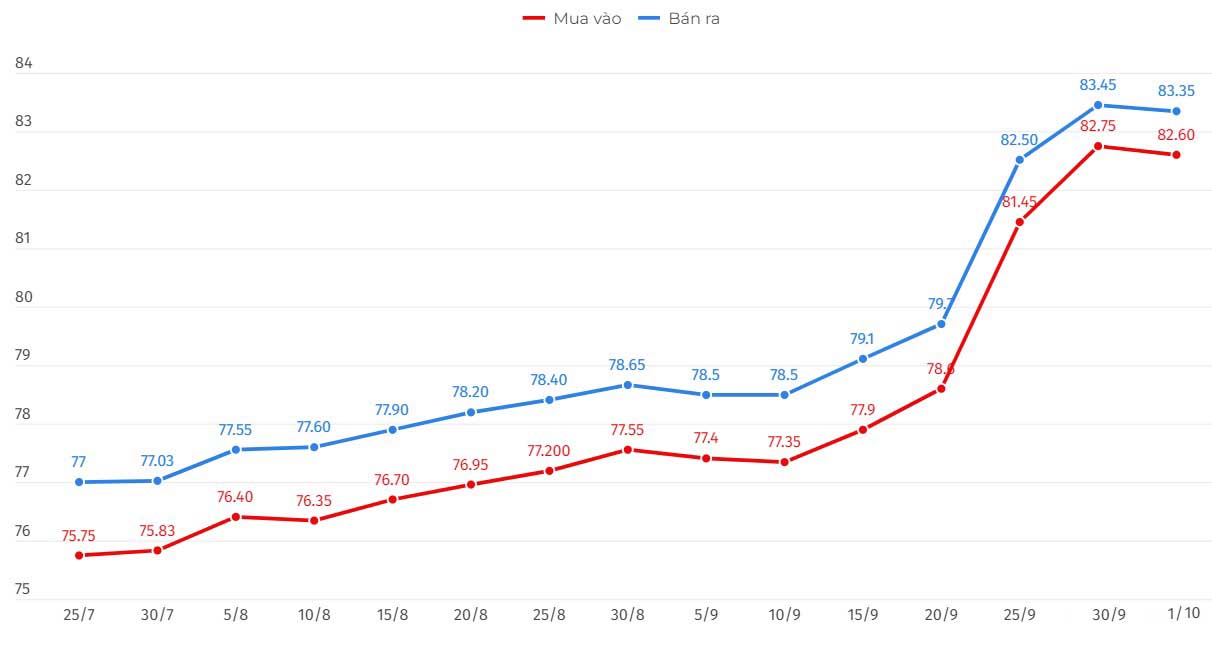

9999 gold ring price

As of 6:00 a.m. on October 1, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 82.30-83.35 million VND/tael (buy - sell), down 450,000 VND/tael for buying and down 100,000 VND/tael for selling.

Bao Tin Minh Chau listed the price of plain round gold rings at 82.54-83.44 million VND/tael (buy - sell), unchanged.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

As of 2:00 a.m. on October 1, the world gold price listed on Kitco was at 2,630.4 USD/ounce, down 28.1 USD/ounce.

Gold Price Forecast

World gold prices plummeted amid a surge in the USD index. Recorded at 2:00 a.m. on October 1, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 100.555 points (up 0.45%).

According to Jim Wyckoff - senior analyst of Kitco, the world gold price fell sharply due to some profit-taking activities from investors. However, he said that the demand for safe haven amid geopolitical concerns is maintaining the floor of the precious metal.

Jim Wyckoff said the market's focus remains on the escalating military conflict between Israel and Hezbollah.

Technically, December gold bulls have the strong overall near-term technical advantage. The bulls’ next upside price target is $2,800/oz.

Gold prices were also pressured as the Fed signaled a moderate pace in its next rate-cutting cycle. At the annual meeting of the National Association for Business Economics (NABE) in Nashville, Tenn., Federal Reserve Chairman Jerome Powell struck a positive tone, noting that “the economy is in solid shape.”

“Looking ahead, if the economy evolves as expected, policy will shift toward a more neutral stance. But we are not on any pre-determined path. The risks are two-fold, and we will continue to make our decisions meeting by meeting,” said Mr. Jerome Powell.

Gold prices will continue to be affected by the Fed's interest rate policy in the coming time. Currently, according to the CME FedWatch tool, traders predict a 53% chance that the Fed will cut interest rates by another 0.5 percentage points at the next meeting. A lower interest rate will reduce the opportunity cost of holding gold, an asset considered a safe haven in times of economic and political uncertainty.

The major outside markets today saw the USD Index move higher. Nymex crude oil prices were firmer, trading around $68.75 a barrel. The benchmark 10-year US Treasury yield is falling, currently around 3.75%.

See more news related to gold prices HERE...