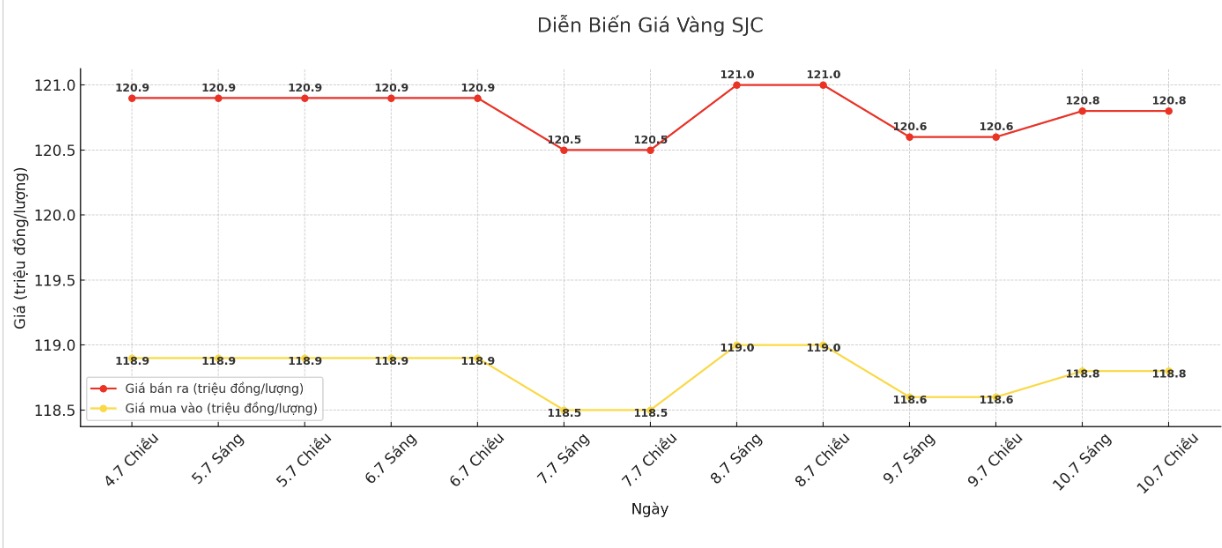

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.8-120.8 million/tael (buy in - sell out); increased by VND 200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.8-120.8 million VND/tael (buy - sell); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.8-120.8 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.1-120.8 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

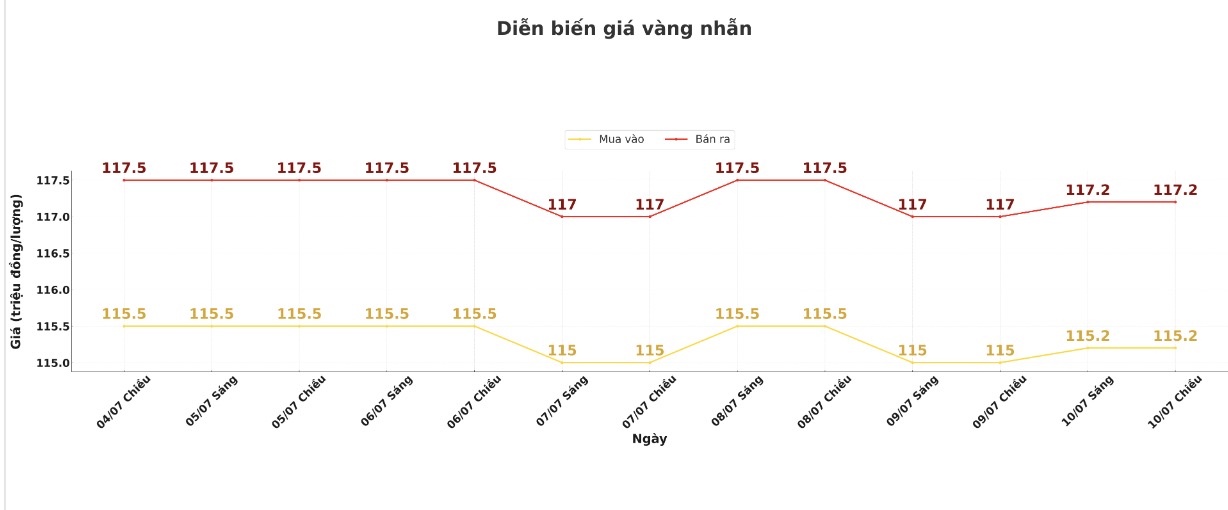

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 115.2-117.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.3-118.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.2-117.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

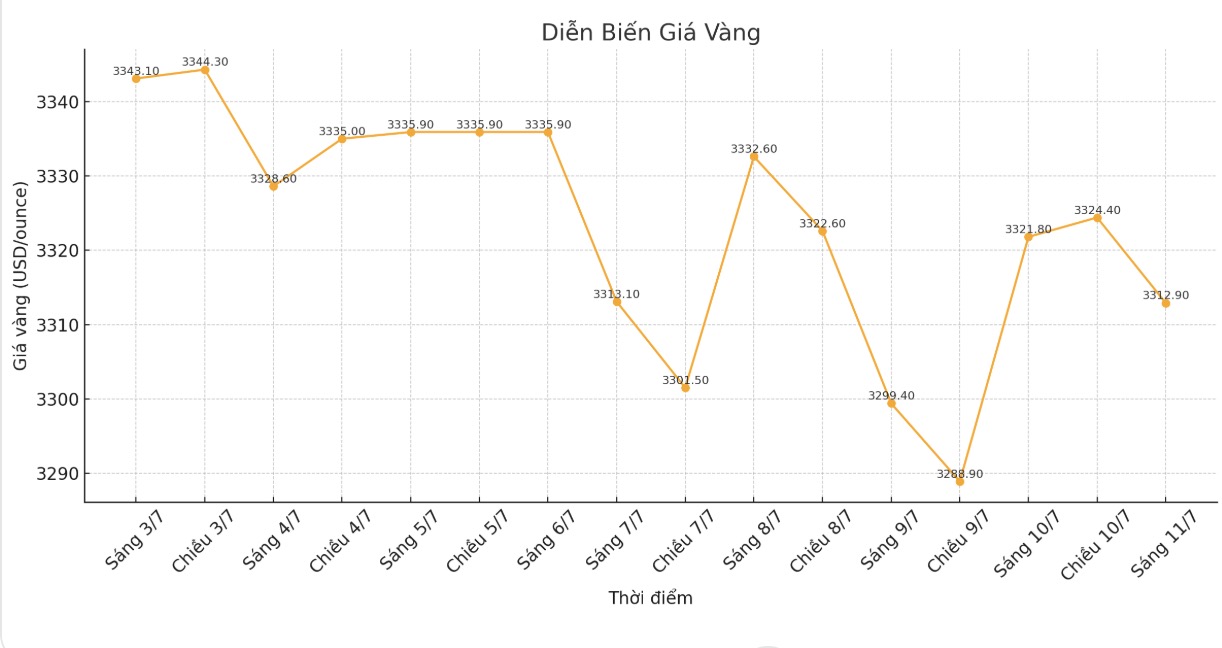

World gold price

Recorded at 0:00, spot gold was listed at 3,312.9 USD/ounce, without much change.

Gold price forecast

The fear of increasing risks in the market is supporting gold prices. US President Donald Trump on Wednesday heightened trade tensions when he announced a 50% tariff on all copper imports, starting from August 1. He also said the US could impose a 50% tariff on imports from Brazil.

Asian and European stock markets moved in opposite directions overnight. US stock indexes are expected to open slightly weakly in today's session in New York.

Technically, speculators who bid for August gold contracts are holding a short-term technical advantage. The next upside target for buyers is to close above the solid resistance level of $3,400/ounce. In contrast, the target for the bears is to push prices below the important technical support level at $3,200/ounce.

The first resistance level was $3,340/ounce, followed by a weekly peak of $3,355.6/ounce. The first support level was an overnight low of $3,321.40 an ounce, followed by $3,300 an ounce.

The gold market continues to maintain its position above $3,300/ounce as the precious metal receives some supportive forces, as the US Federal Reserve (FED) remains cautious in monetary policy even as opinions appear in support of the possibility of a rate cut in July.

According to analysts, the minutes of the Fed's June monetary policy meeting did not bring many surprises, as the agency maintained a neutral stance.

In terms of monetary policy outlook, Fed members generally agree that with the economy and labor market remaining strong, along with the current interest rate being at a moderate level, the Fed can continue to wait for clearer data on inflation and growth before adjusting policy according to the meeting minutes.

Some members said that if the economic data develops as expected, they are ready to consider cutting interest rates at the upcoming meeting, the minutes stated.

Mr. Jeffrey Roach - Chief Economist at LPL Financial - said he did not see any information in the meeting minutes that would change the current neutral stance of the FED.

Despite the obstacles, the economy continues to move forward, giving policymakers time to assess the impact of tariffs. Since last week's jobs report, the market no longer expects the Fed to cut interest rates this month.

inflation data released next week could show a rebound, giving the Fed more reason to keep interest rates high. We do not expect inflation to cool down until the end of the year," he said.

In outside markets, the USD index decreased slightly. Nymex crude oil futures also fell slightly, trading around $68/barrel. The yield on the 10-year US Treasury note is currently at 4.34%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...