The gold market continues to maintain its position above $3,300/ounce as the precious metal receives some supportive forces, as the US Federal Reserve (FED) remains cautious in monetary policy even as opinions appear in support of the possibility of a rate cut in July.

According to analysts, the minutes of the Fed's June monetary policy meeting did not bring many surprises, as the agency maintained a neutral stance.

In terms of monetary policy outlook, Fed members generally agree that with the economy and labor market remaining strong, along with the current interest rate being at a moderate level, the Fed can continue to wait for clearer data on inflation and growth before adjusting policy according to the meeting minutes.

Some members said that if the economic data develops as expected, they are ready to consider cutting interest rates at the upcoming meeting, the minutes stated.

Despite some loose-end opinions, the market is not expecting the Fed to cut interest rates this month. According to CME's FedWatch tool, the possibility of the FED cutting interest rates is set in September.

Adam Button - Senior currency strategist at Forexlive.com, commented: "There is no mystery when mentioning these "a few members" - that is Waller and bowman. But its worth noting that no one else is joining them, and theyre overwhelmed by the majority who dont support the cut. That doesnt mean the market is wrong to expect a 63 basis point cut this year, as officials are often in a hawkish trend until bad news comes out but the market may be overwhelming the impact of Waller/Bowman.

Mr. Jeffrey Roach - Chief Economist at LPL Financial - said he did not see any information in the meeting minutes that would change the current neutral stance of the FED.

Despite the obstacles, the economy continues to move forward, giving policymakers time to assess the impact of tariffs. Since last week's jobs report, the market no longer expects the Fed to cut interest rates this month.

inflation data released next week could show a rebound, giving the Fed more reason to keep interest rates high. We do not expect inflation to cool down until the end of the year," he said.

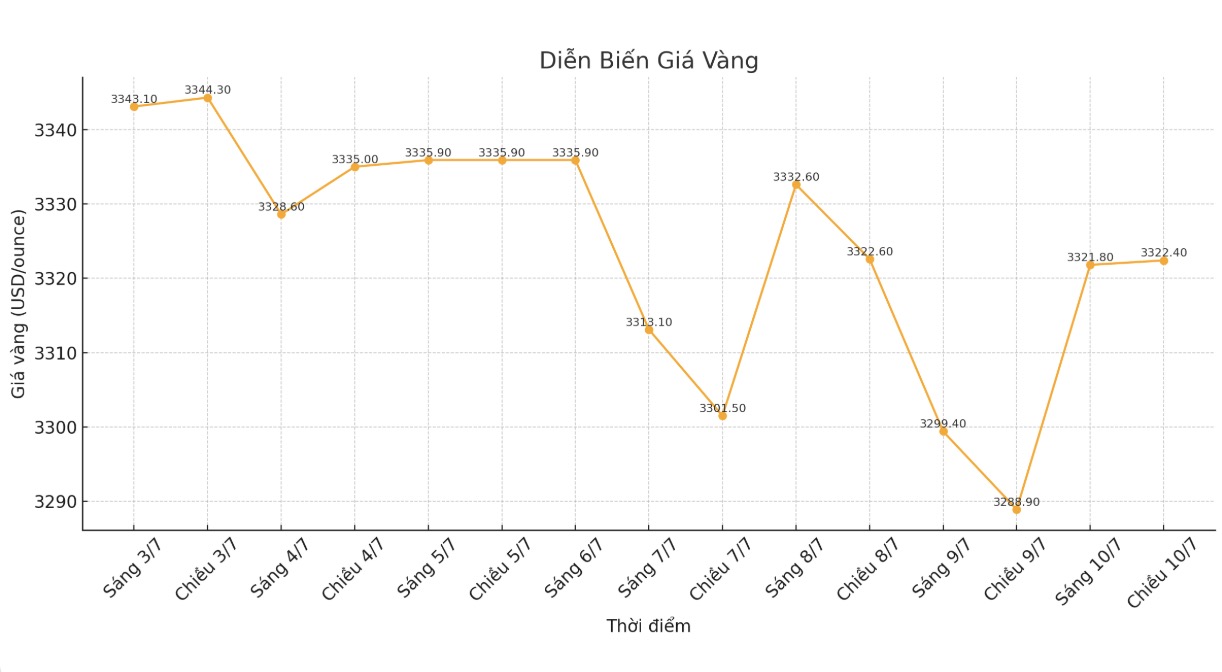

Gold prices have had a slight increase after the minutes were released. End-of-session delivery reached $3,310/ounce, up 0.29% on the day.