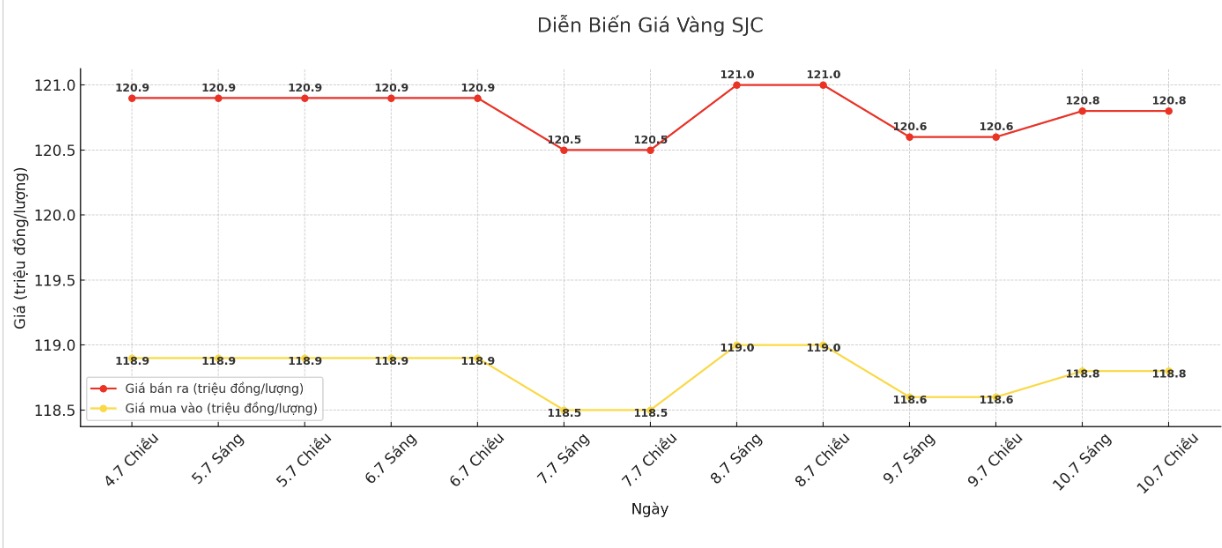

SJC gold bar price

As of 5:10 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.8-120.8 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.8-120.8 million VND/tael (buy - sell); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.8-120.8 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.1-120.8 million VND/tael (buy in - sell out); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

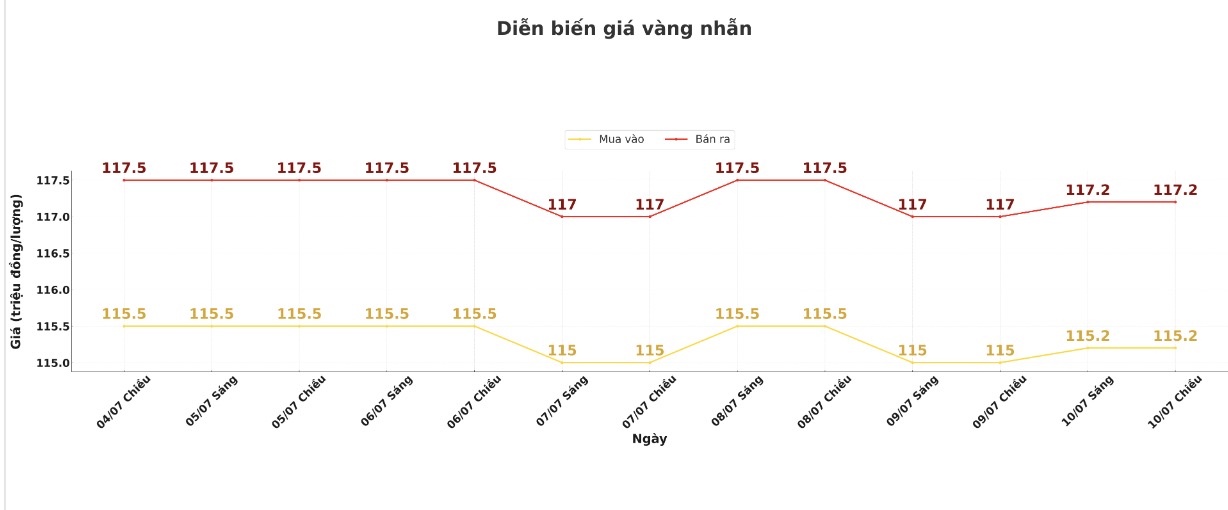

9999 gold ring price

As of 5:10 p.m., DOJI Group listed the price of gold rings at 115.2-117.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.3-118.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.2-117.2 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

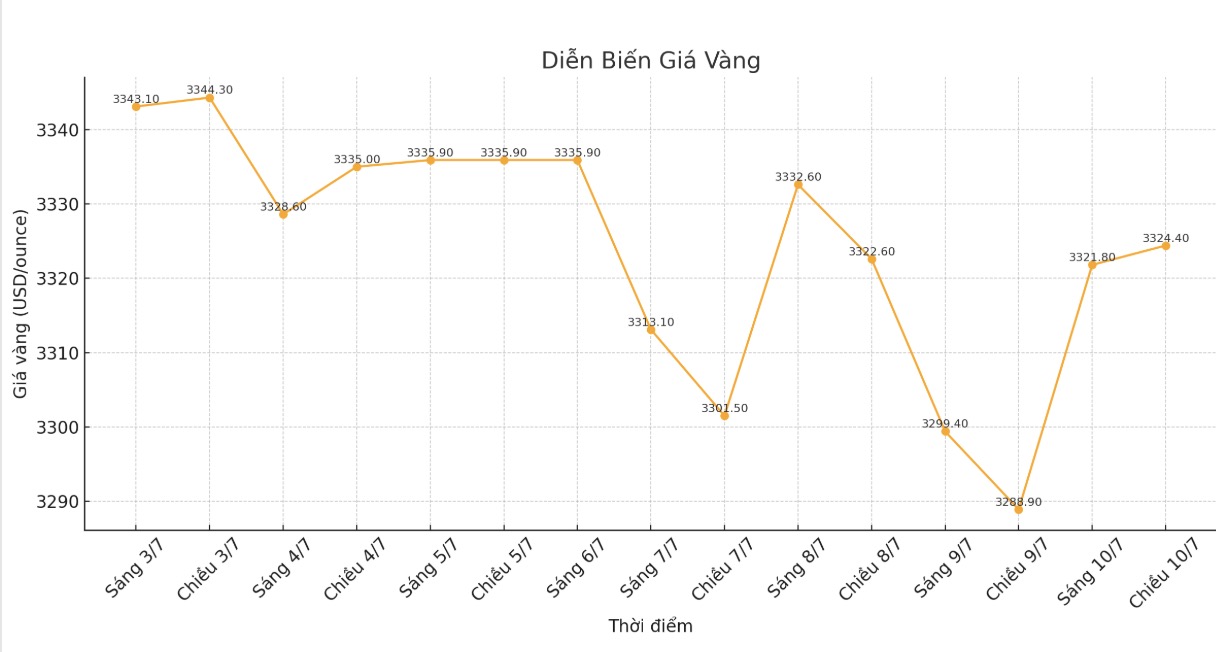

World gold price

The world gold price was listed at 5:10 p.m. at 3,324.4 USD/ounce, up 35.5 USD/ounce compared to 1 day ago.

Gold price forecast

Gold prices increased, supported by a weakening of the US dollar and bond yields, in the context of investors closely following trade negotiations.

Gold has rebounded from technical support levels, while the US dollar has weakened widely, said Nicholas Frappell, global director of organizational markets at ABC Refinery.

US President Donald Trump on Wednesday continued to escalate his tariff campaign, announcing a 50% tax rate on imports into the US and goods from Brazil, expected to take effect from August 1. In addition, he also announced the imposition of tariffs on seven other small trading partners, bringing the total to 21 countries, including a 25% tax on imports from South Korea and Japan, if no agreement is reached before August 1.

"The market impact of tax strikes is decreasing. "Tariff fatigue" has emerged, and traders are waiting for a new factor to reignite volatility," said Matt Simpson, senior analyst at City Index.

The USD (.DXY) fell 0.2%, while the US 10-year Treasury yield fell from a three-week high.

Low bond yields reduce the opportunity cost of holding gold - an unyielding asset, while a weak USD makes gold cheaper for holders of other currencies.

Minutes from the US Federal Reserve's (FED) meeting on June 17-18, showing that only "a few" FED officials believe that interest rates could be cut this month, while the majority are leaning towards a cut at the end of the year, due to inflation concerns related to Mr. Trump's tariff policies.

The Federal Open Market Committee (FOMC) agreed to keep interest rates unchanged at its June meeting. The next policy meeting will take place on July 29-30.

For other precious metals, spot silver rose 0.2% to 36.42 USD/ounce, platinum fell 0.2% to 1,345.06 USD/ounce, while gold rose 0.3% to 1,108.18 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...